The number 1 online business account in Europe

- Open a business account in 5 minutes.

- Up to 4% reward* on your total balance

- Physical and virtual Mastercard debit and credit cards.

- Instant SEPA transfers and international transfers.

- Unlimited transaction history and real-time notifications.

- Customer service available 7 days a week.

A business account for every budget

Basic

Starting from

€5

/per month

1 physical Mastercard card + 30 transfers & debits.

1-month free trial

Smart

Starting from

€15

/per month

2 physical Mastercard cards + 100 transfers & debits.

1-month free trial

Premium

Starting from

€25

/per month

2 physical Mastercard cards + 200 transfers & debits.

1-month free trial

Open a business account with rewards

- Payment methods: Pay with Mastercard debit or credit cards, the premium metal X-card, SEPA and SWIFT transfers, Google Pay, Apple Pay, and more.

- Receipt management: Store your receipts and invoices centrally, compliant with Dutch tax regulations and manage them easily.

- Invoicing software: Create and send quotes and invoices directly from your Qonto account.

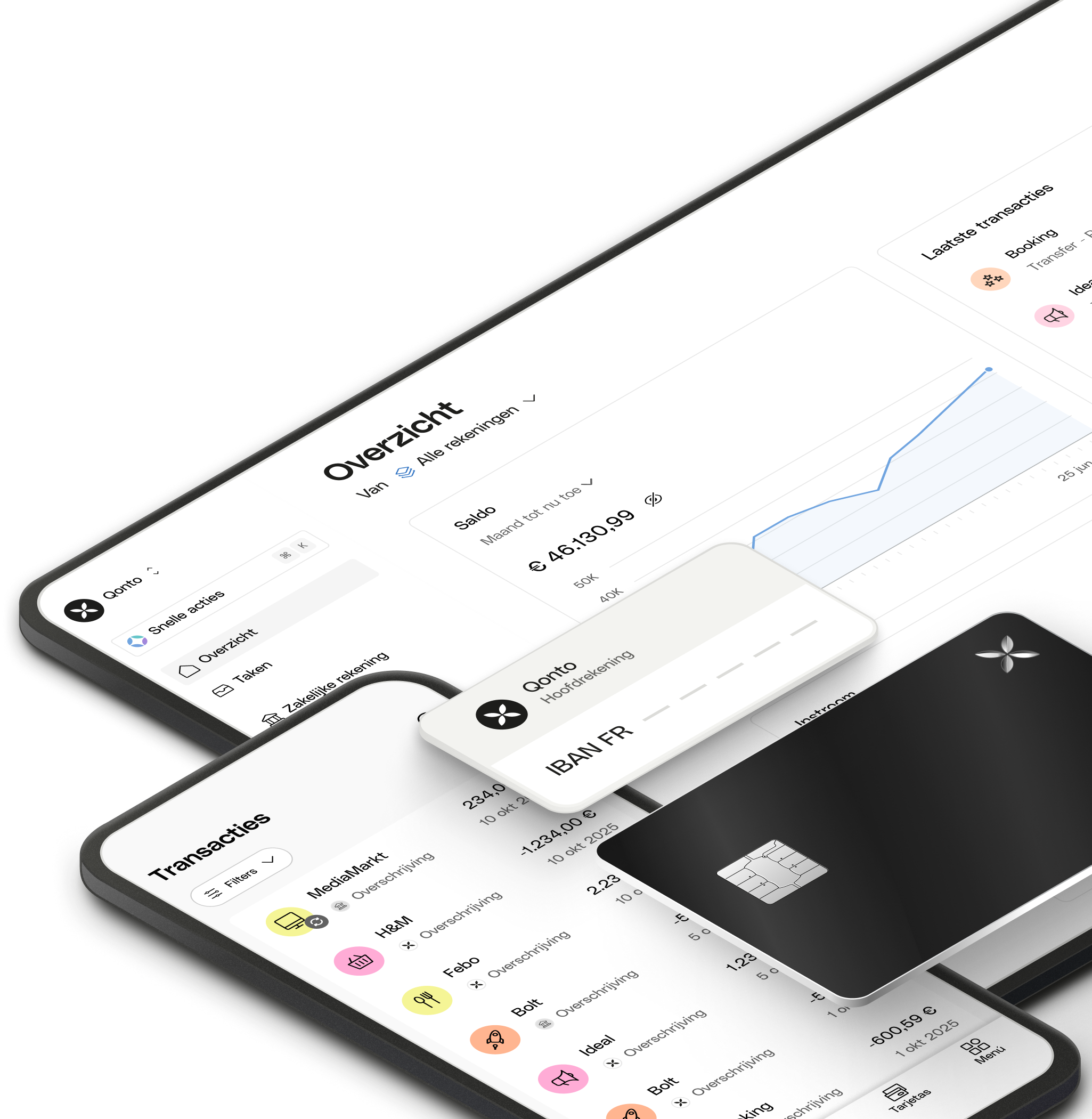

- Real-time financial overview: Manage your finances via the browser, app, and clear dashboards.

- Business account rewards: Receive up to 4% rewards per year on your balance, simply by using your Qonto account.

Opening a business account: everything you need to know

How can you open a business account?

No appointment needed. Open a business account online for your company and receive an IBAN in an average of 10 minutes.

Enter your details

Fill in the details of each partner and your company.

We verify your identity

Submit a valid ID and confirm that it’s you.

Your business account is open!

Your IBAN is available, you can order your payment cards and enjoy your business account. Also, take advantage of an exclusive service to help you switch to your new account.

Enter your details

Fill in the details of each partner and your company.

We verify your identity

Submit a valid ID and confirm that it’s you.

Your business account is open!

Your IBAN is available, you can order your payment cards and enjoy your business account. Also, take advantage of an exclusive service to help you switch to your new account.

Enter your details

Fill in the details of each partner and your company.

We verify your identity

Submit a valid ID and confirm that it’s you.

Your business account is open!

Your IBAN is available, you can order your payment cards and enjoy your business account. Also, take advantage of an exclusive service to help you switch to your new account.

The ideal payment method for your business account

Multiple payment cards for your team

Benefit from the Mastercards included in your plan.

So much more than a business account!

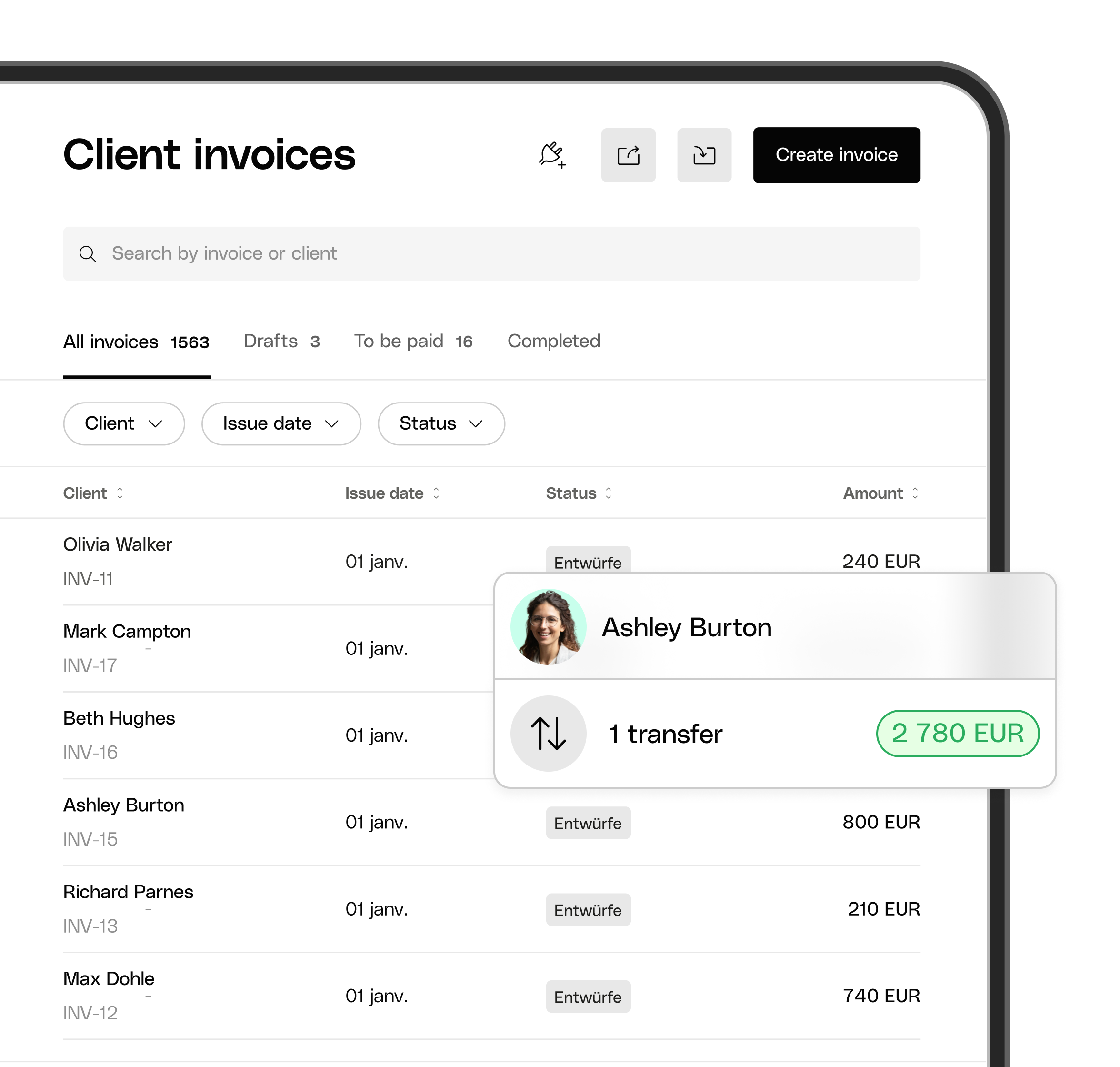

Invoicing

Create, send, and manage all your invoices easily from one clear platform.

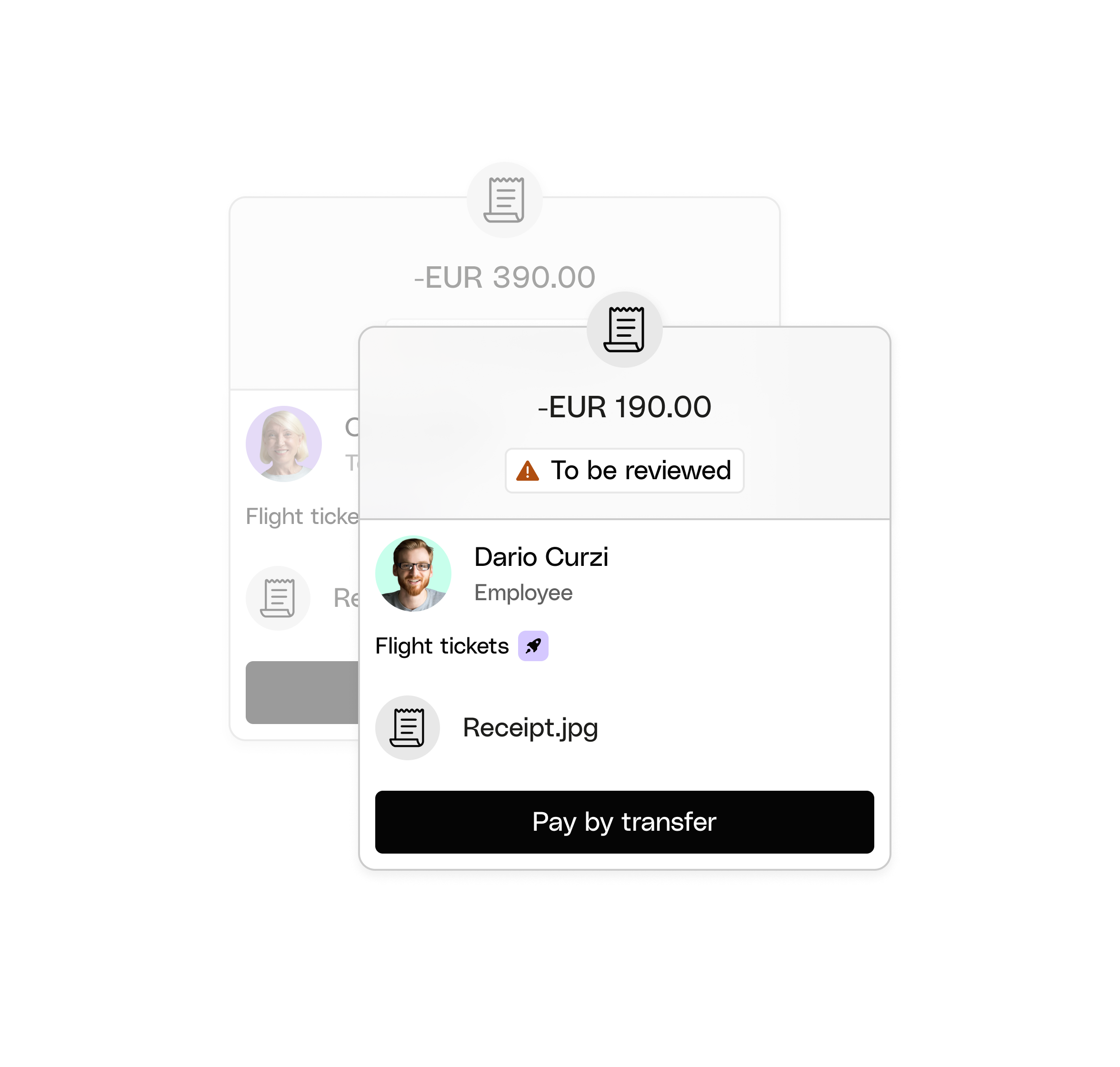

Expense Management

Manage your expenses and track your budgets wherever you are, thanks to your clear dashboard.

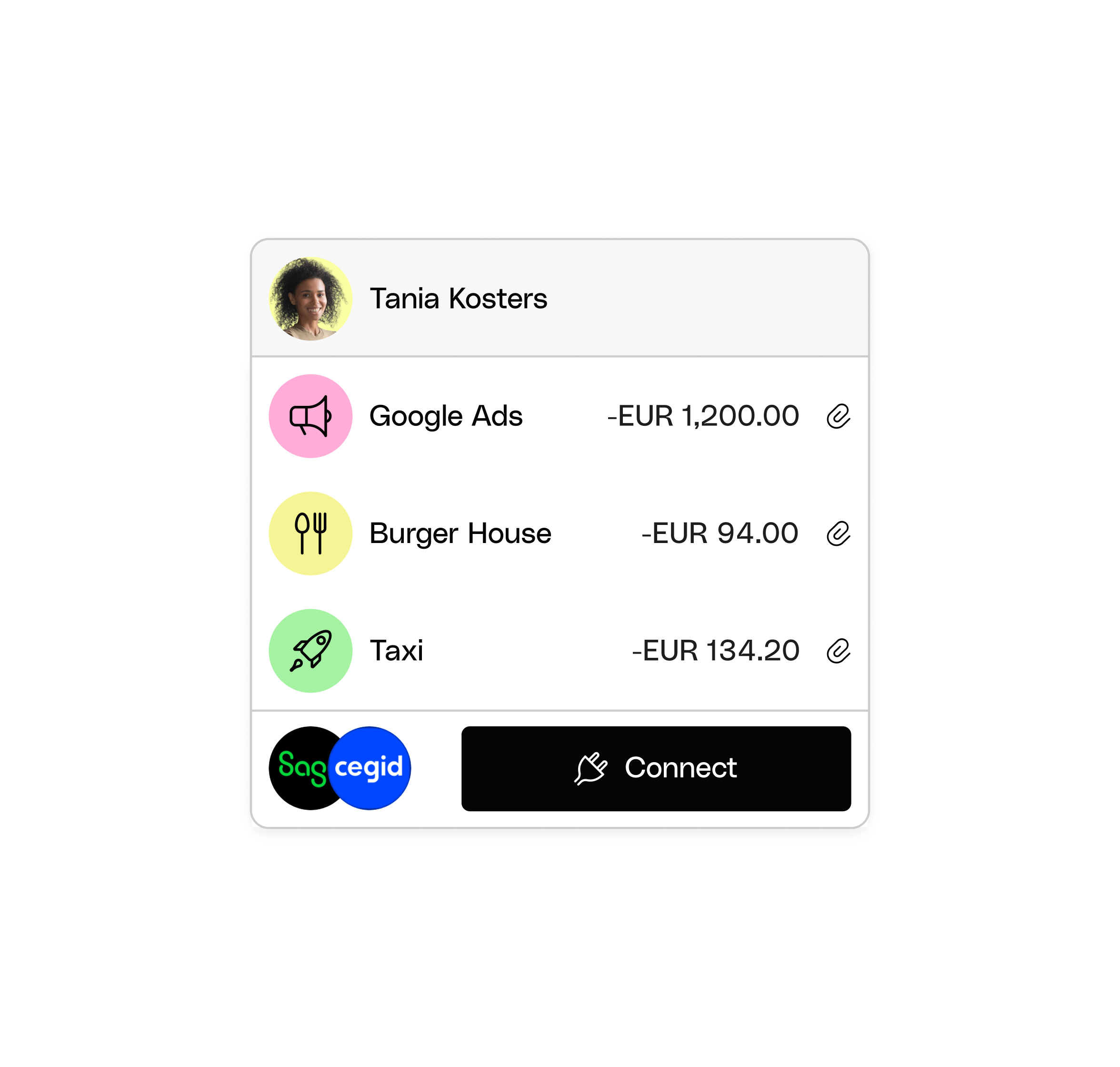

Simple accounting

Save time on your accounting with advanced tools and securely link your bank accounts to Qonto.

Track your cash flow

Gain the financial insight you need to make strategic decisions at the right time.

Your business account is in good hands.

Protected data

100% secure

Deposit guarantee

Licensed institution

What they think of our business account

What they think of our business account

Your questions about the Qonto business account

*Account fee subject to General Terms and Conditions. Annual fee of 4% during the first two months for new customers; thereafter, the fee percentage varies depending on the chosen subscription. A minimum of five (5) valid payment transactions per month is required. The fee is limited and subject to the general terms and conditions.

*This is not a banking or investment product. Annual fee of 4% during the first two months for new customers; thereafter, the fee percentage varies depending on the chosen subscription. A minimum of five valid payment transactions per month is required. The fee is limited and subject to the terms and conditions.