Europe’s no. 1 online business account

A business account with a local IBAN - open in 10 minutes

Up to 4% annual rate* remuneration on your total balance

- Customer support 24/7

- Physical and virtual Mastercards

- SEPA instant and international transfers

Get rewarded for using Qonto

Make five or more eligible payments per month to receive up to 4% AER* on your total balance across all of your Qonto accounts, calculated daily. Access your cash whenever you need it.

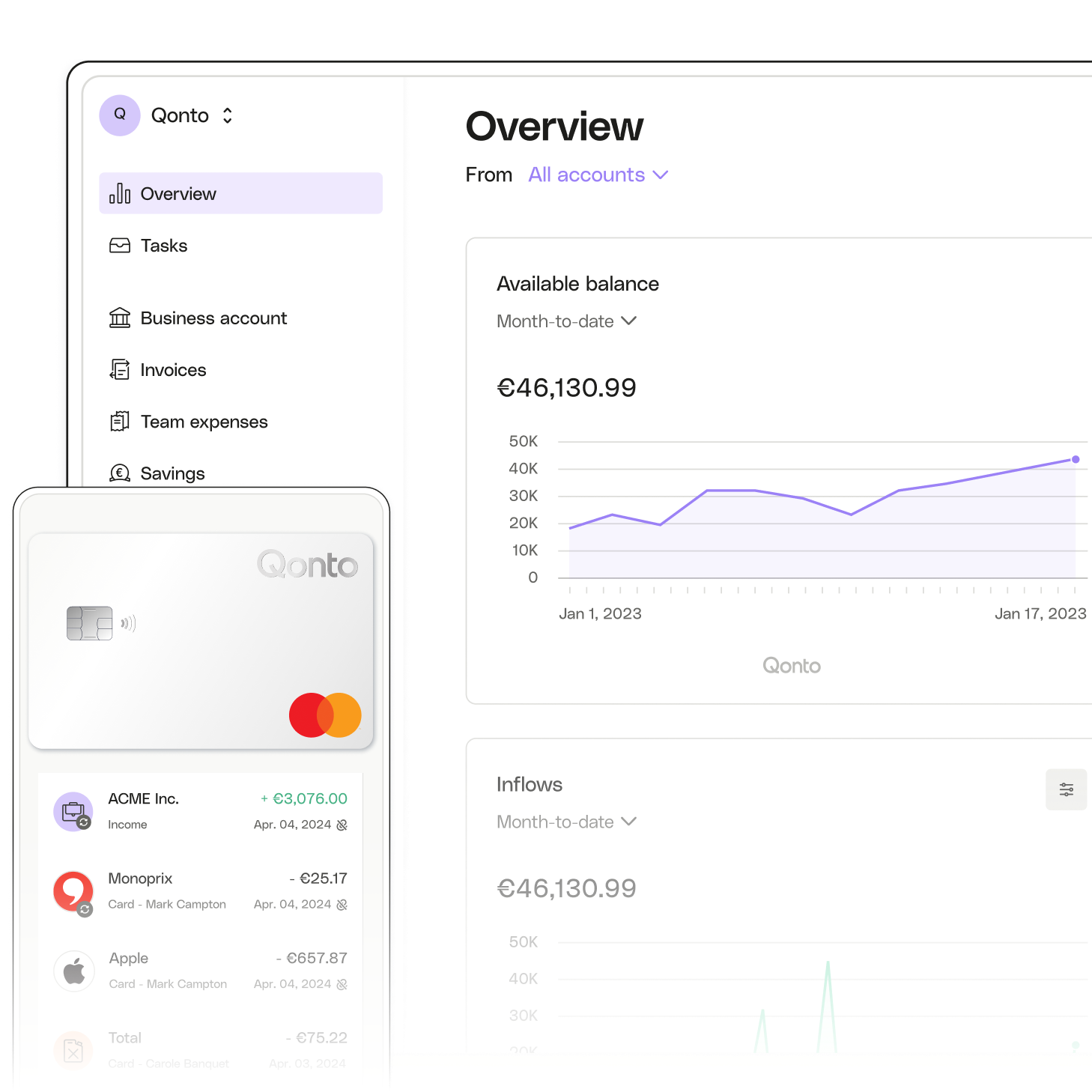

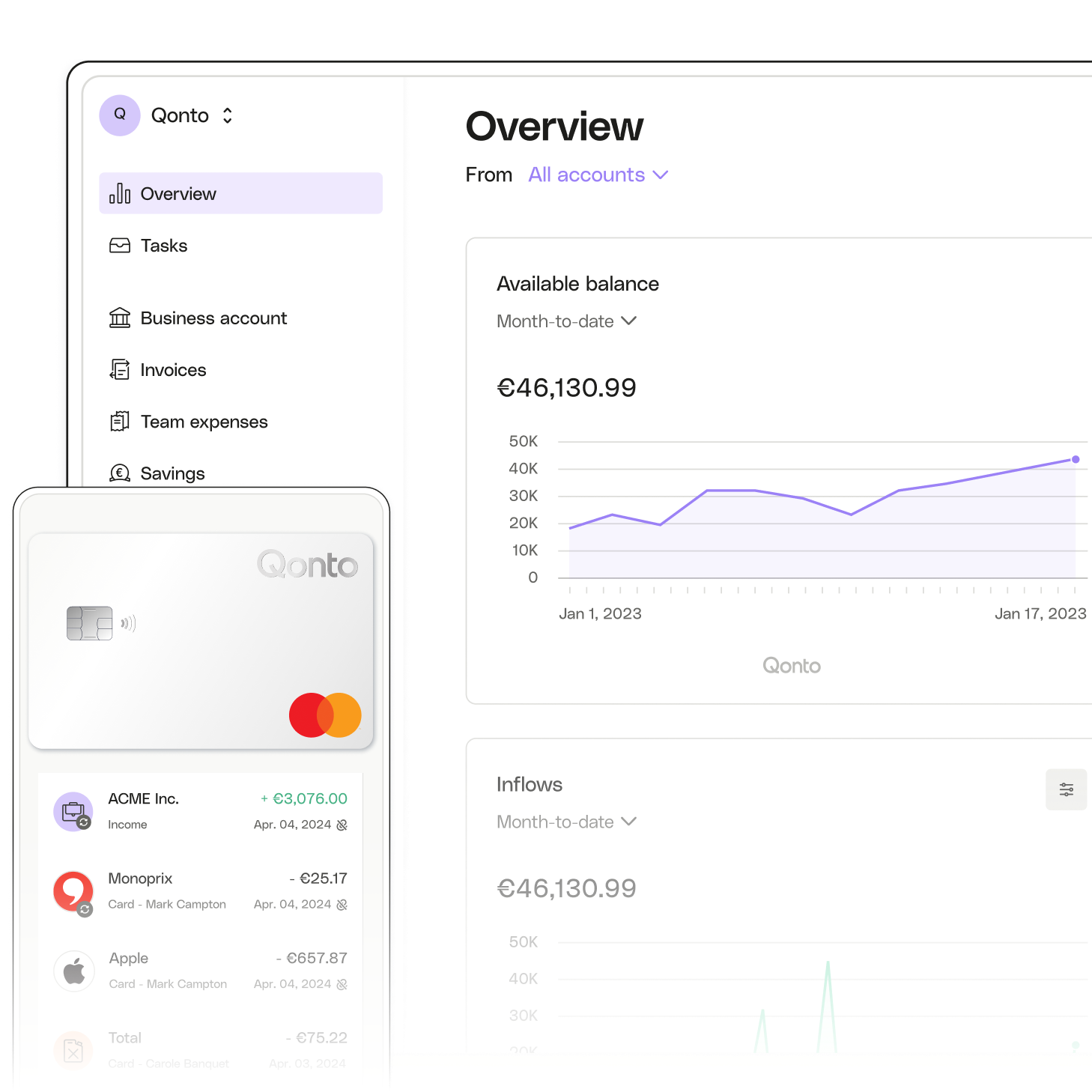

Payment cards to support your business

Cards for every need

Pay online, in-store, and abroad with physical and virtual cards, with no hidden costs.

The Metal X Card

Spend up to €200,000 per month and pay in foreign currencies, commission-free, with deferred debit option.

Payment methods that get the job done

International transfers

Make international transfers to 150+ countries and in over 30 currencies. Powered by Wise.

Discover international transfers

Check deposit

Cash a check in just a few clicks through your Qonto app, then simply send it to us by post.

Discover check deposit

Payment terminals

Receive card payments on the go, with a handy mobile payment terminal.

Discover payment terminalsUp to 4% AER* in rewards. You do the math.

Financing to fuel your business

- Get instant funds to finance your invoice payments with Qonto’s own Pay later solution.

- Find longer-term, larger sum financing offers through our network of specialist partners.

- Enjoy a fast-tracked process: no red tape, no paperwork, no waiting weeks for an answer.

Much more than a business account

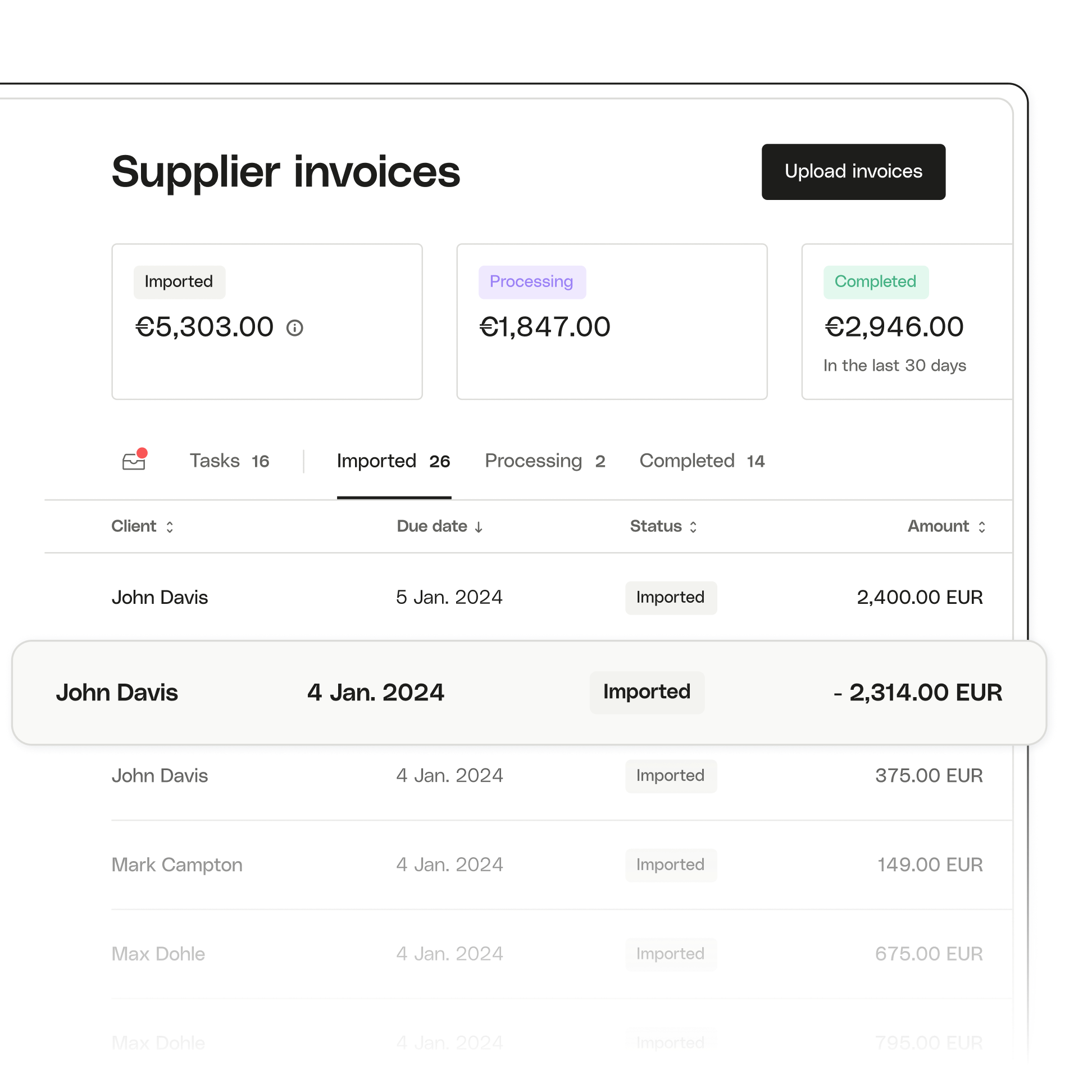

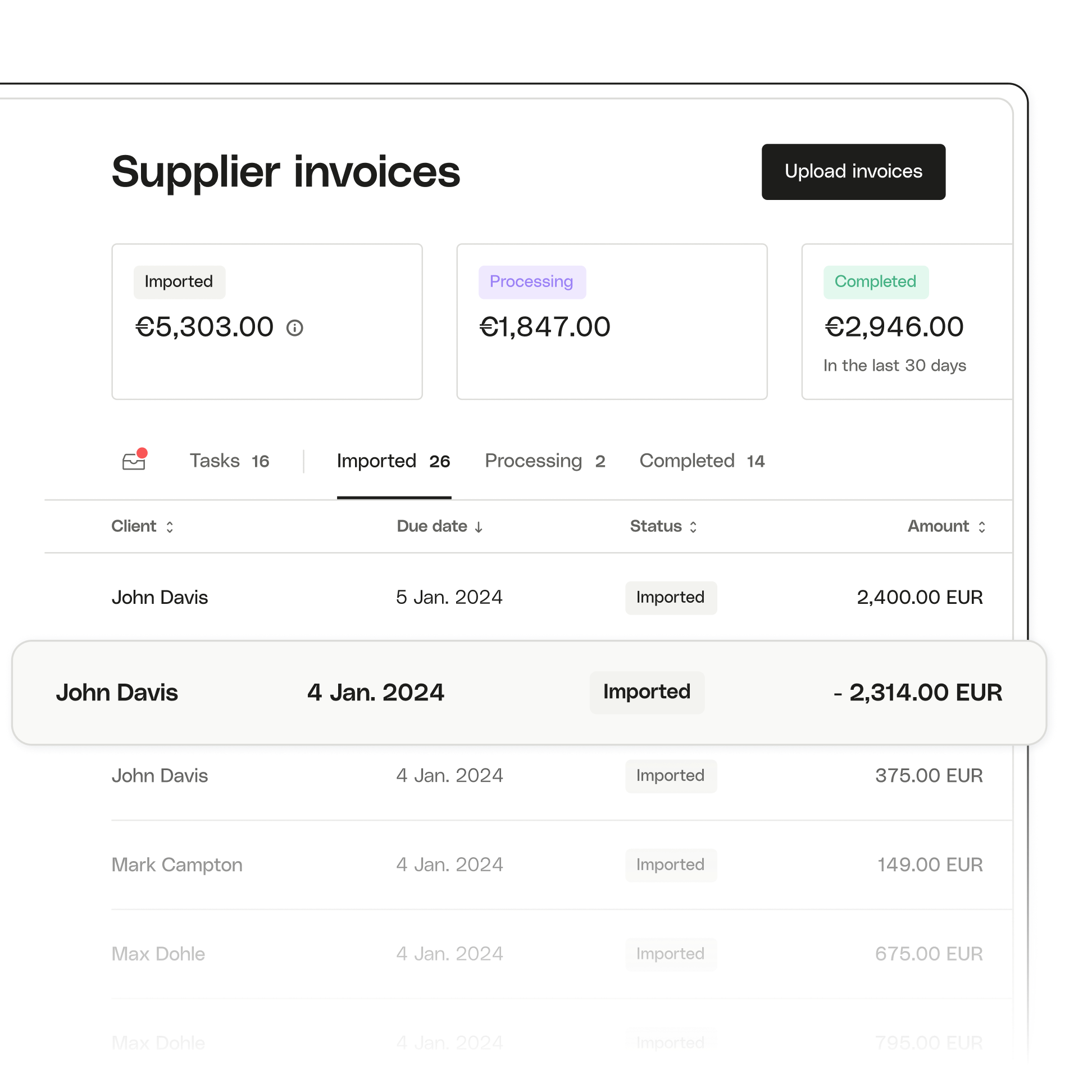

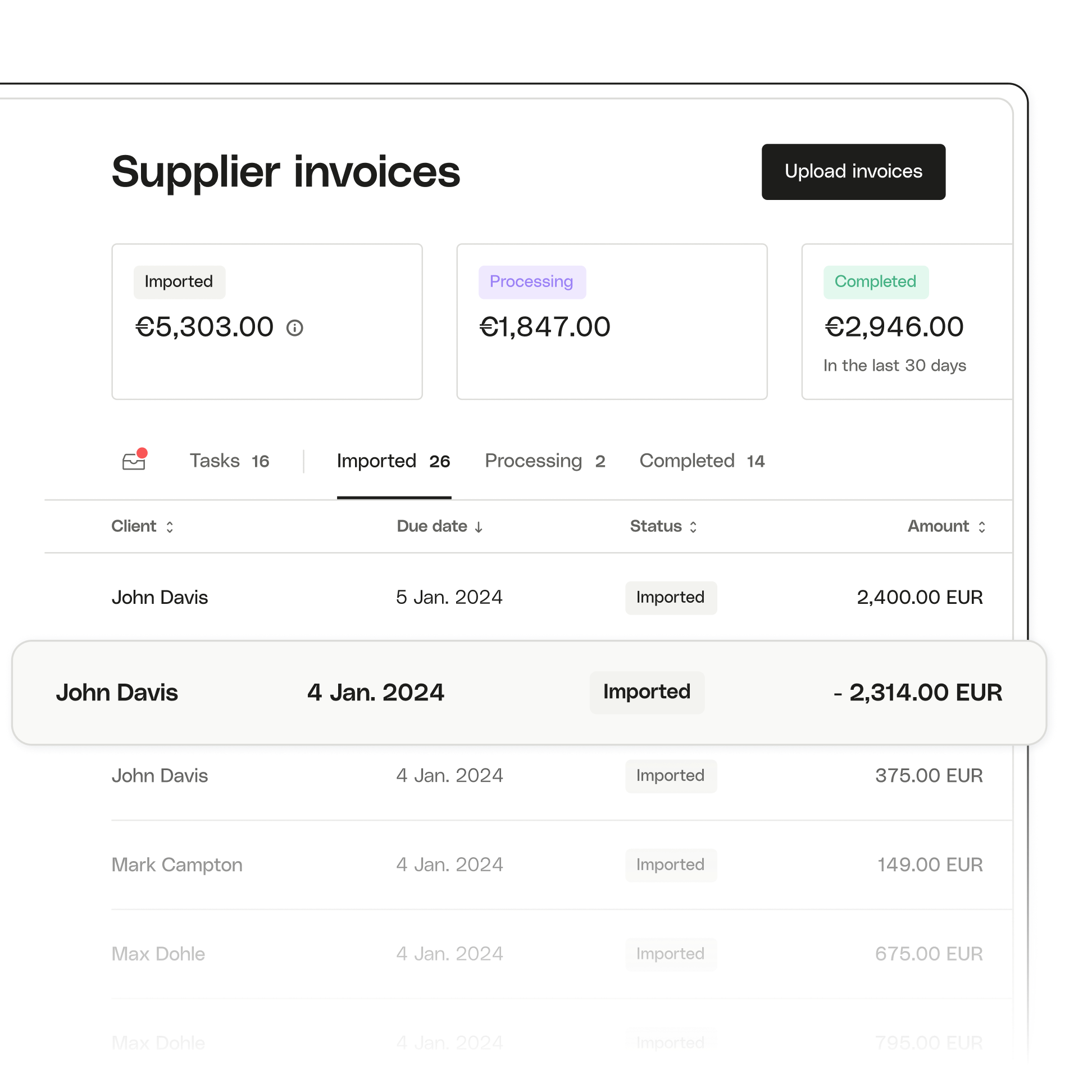

Invoice management

Manage your supplier invoices, get ready for e-invoicing, and issue quotes and customer invoices, all in one place.

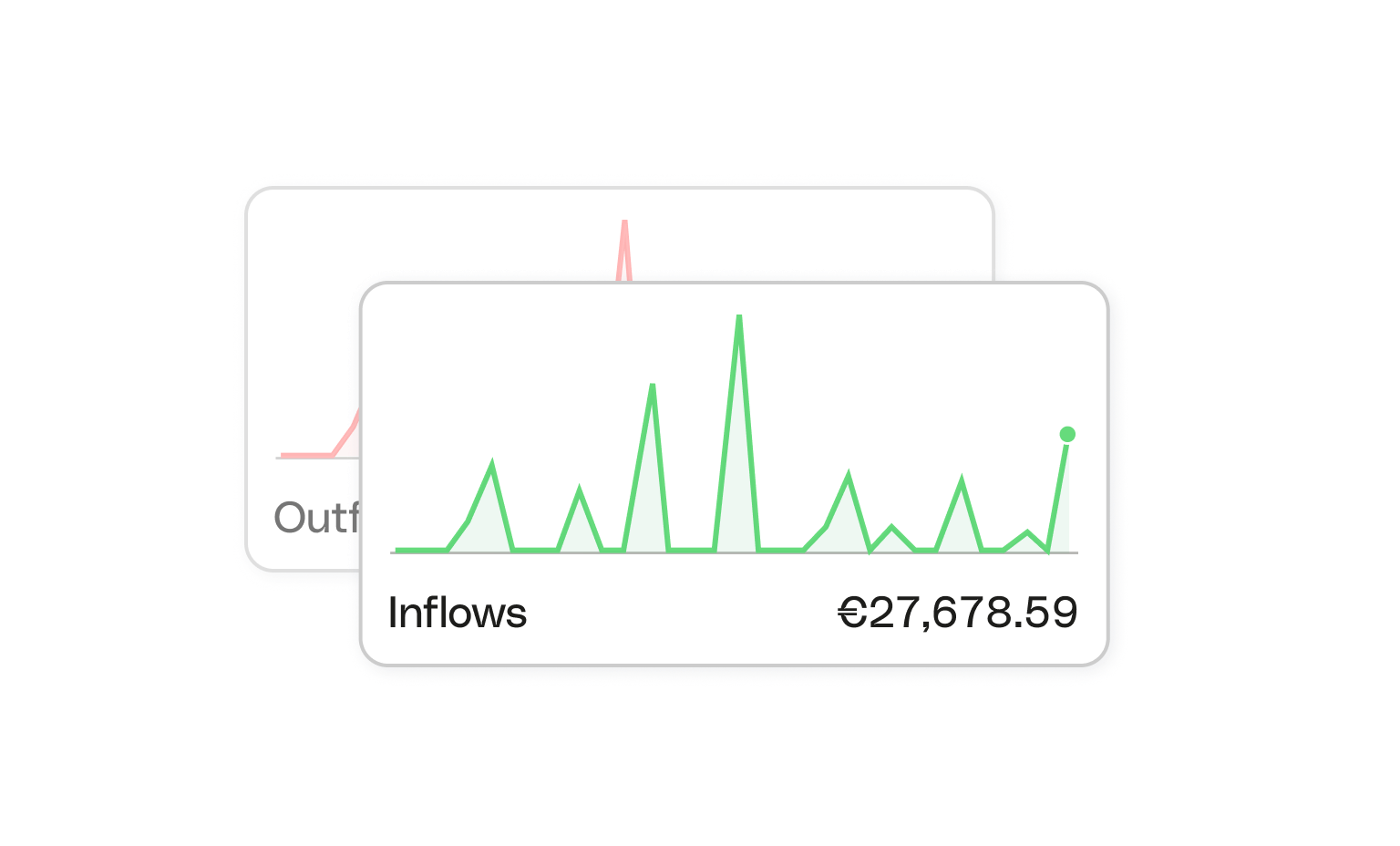

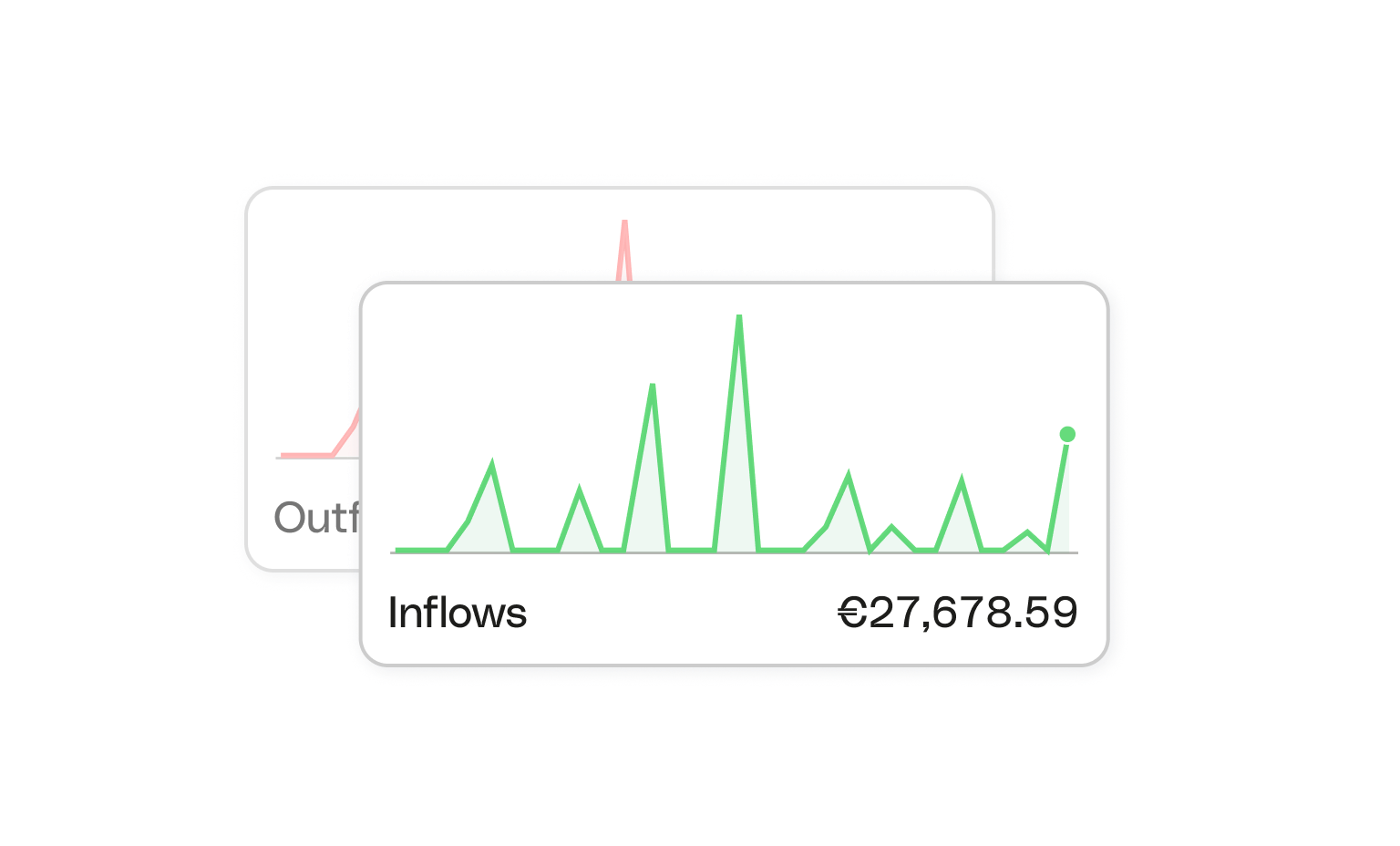

Expense management

Keep control over your expenses and track your budgets wherever you are, using your personalized dashboard.

Bookkeeping

Win back valuable time on preparing your accounts, with smart tools and centralized external account management.

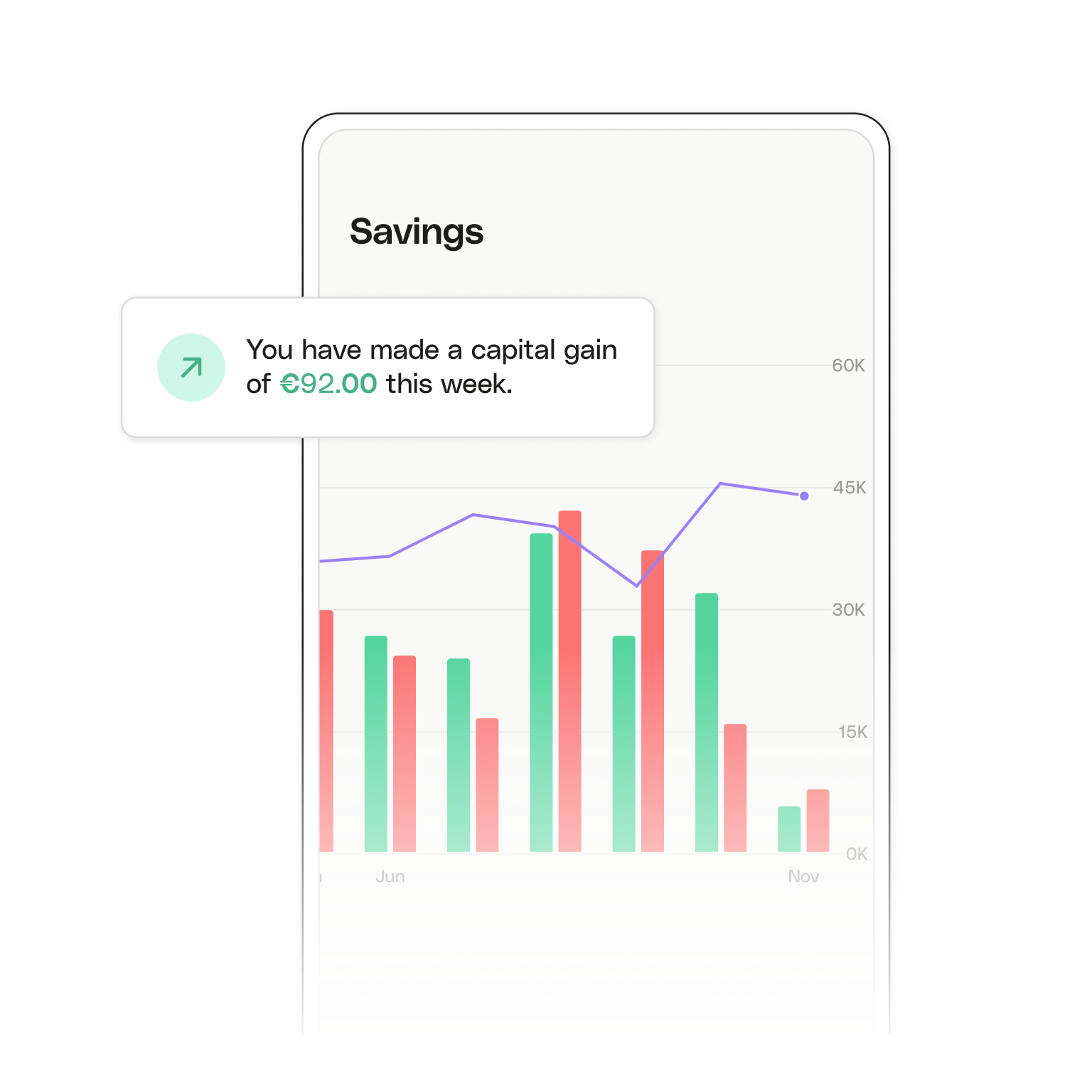

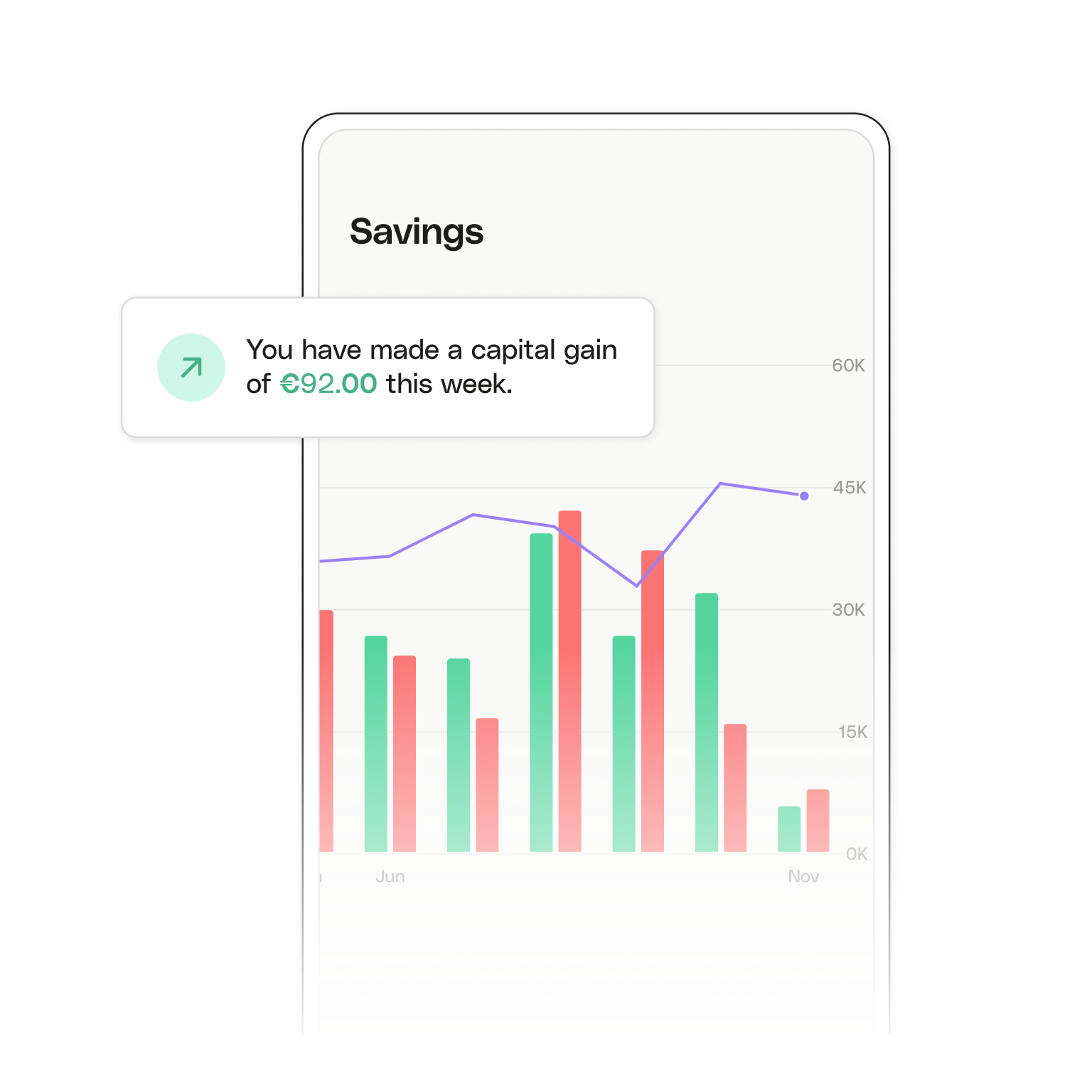

Flexible investments

Make your money work harder, with flexible investments through your online Qonto account.

Invoice management

Manage your supplier invoices, get ready for e-invoicing, and issue quotes and customer invoices, all in one place.

Expense management

Keep control over your expenses and track your budgets wherever you are, using your personalized dashboard.

Bookkeeping

Win back valuable time on preparing your accounts, with smart tools and centralized external account management.

Flexible investments

Make your money work harder, with flexible investments through your online Qonto account.

The Total Economic Impact™ of Qonto

Small businesses are seeing big benefits with Qonto. Read more in this 2025 commissioned study conducted by Forrester Consulting.

€

51,000

in benefits over 3 years

%

faster day-to-day finance admin

<6

months

for the net benefits to match the initial investment

Whatever your size, sector, or stage of growth

Micro-businesses

Build solid foundations, with an account that gets your finances and bookkeeping in order.

See our plans

Self-employed

Freelance with freedom, with this account made for paying and getting paid daily.

See our plans

Company Creators

Open a business account and deposit share capital. All at once, all online.

See our plans

Creating your own business?

Access our expert support, with everything from registering your business to depositing share capital.

How to open a business account

No need for an appointment. Open your company’s business account online and get your IBAN in around 10 minutes.

Enter your details

Fill out some information on your company and its partners.

We verify your identity

Upload a valid ID online and we’ll perform the necessary checks.

And that’s it - your account’s set up

With your IBAN created, you can order cards and enjoy everything your business account has to offer.

Enter your details

Fill out some information on your company and its partners.

We verify your identity

Upload a valid ID online and we’ll perform the necessary checks.

And that’s it - your account’s set up

With your IBAN created, you can order cards and enjoy everything your business account has to offer.

Enter your details

Fill out some information on your company and its partners.

We verify your identity

Upload a valid ID online and we’ll perform the necessary checks.

And that’s it - your account’s set up

With your IBAN created, you can order cards and enjoy everything your business account has to offer.

You’re in safe hands

Safely stored data

Secure transactions

Deposit protection

Licensed institution

Our customers say it best.

Our customers say it best.

More practical information on opening a business checking account

*Not a banking or investment product. 4% annual rate for the first 2 months for new clients, then the rates will vary according to the subscribed plan. Minimum of 5 eligible payment transactions per month required. Remuneration is capped and subject to T&C.