Instant transfers: from account to account in 10 seconds

Instant transfers help you avoid late payment fees and blocked orders. The money you send arrives at its destination instantly, and so does the money others send you. At no additional cost. Whenever you want, wherever you are.

Enjoy a new era of bank transfers

- Collect bills & pay suppliers in under 10 seconds

- Make immediate transfers whenever you want, 24/7

- Higher limits: transfer up to €100,000 at no extra cost

- Transfer across the SEPA zone on any device

You’re in good hands

Safe

Available

Reliable

3 reasons to switch to instant transfers

Save time

No more figuring out when to send a transfer so the payment arrives on time. No more sending proof.

Strengthen trust with your partners

Your money transfers completed in 10 seconds. Perfect for building trust with your business partners.

You can focus on your business

You’re notified instantly that the money you sent has been received. Job done; you can move on to whatever’s next.

Save time

No more figuring out when to send a transfer so the payment arrives on time. No more sending proof.

Strengthen trust with your partners

Your money transfers completed in 10 seconds. Perfect for building trust with your business partners.

You can focus on your business

You’re notified instantly that the money you sent has been received. Job done; you can move on to whatever’s next.

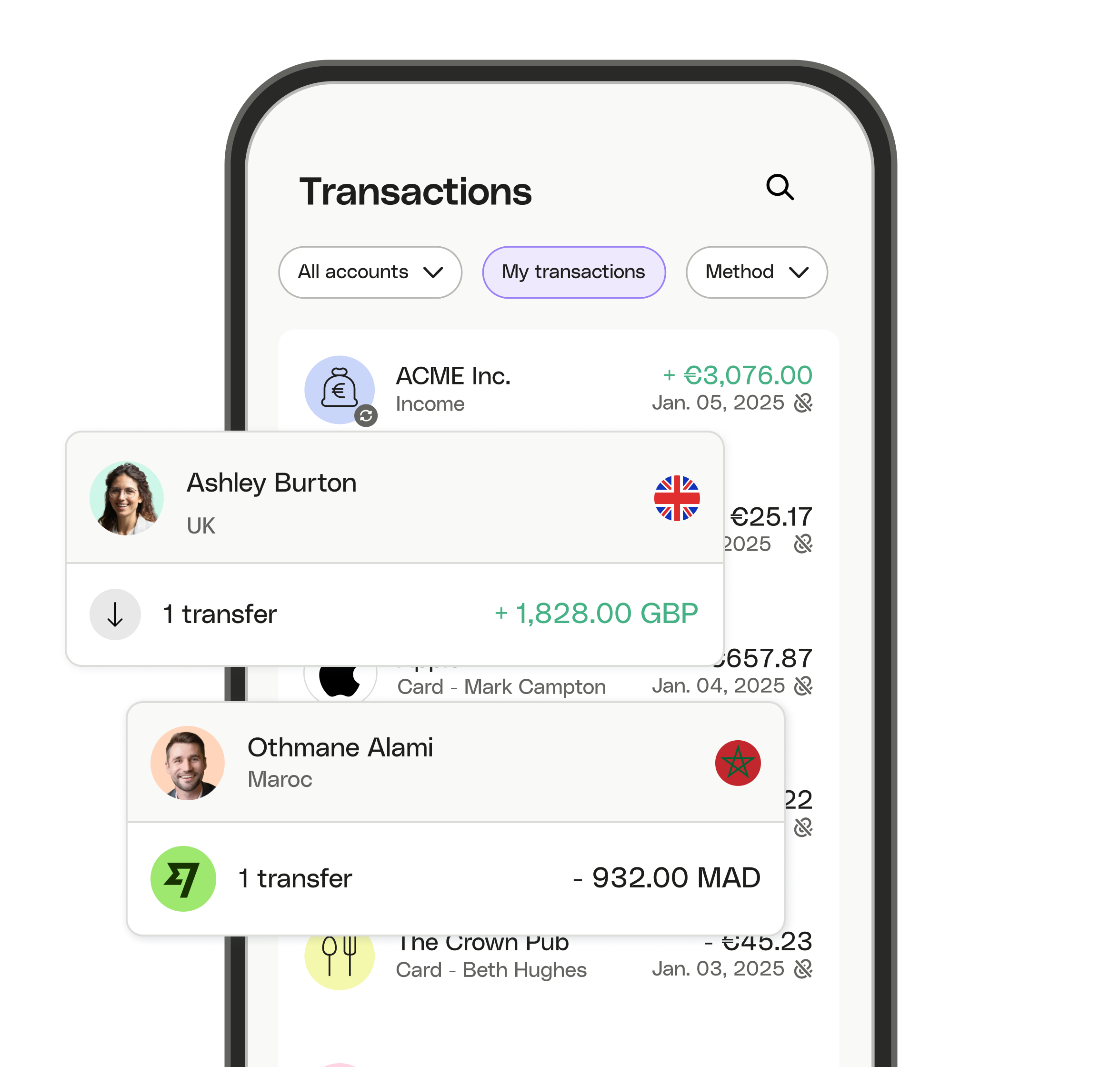

How to make an instant SEPA transfer with Qonto

Log in to your account

From desktop or your mobile app, go to the Transfers tab, click on Make a transfer then select External transfer in euros.

Enter the payment details

Enter the beneficiary's details, transfer amount & reference number. Or just upload the payable invoice to your Supplier Invoices section and this data is pre-filled for you.

Check your SEPA transfer details

Instant transfers are irreversible. Always double check the bank details and the transfer amount before approving the transaction.

Log in to your account

From desktop or your mobile app, go to the Transfers tab, click on Make a transfer then select External transfer in euros.

Enter the payment details

Enter the beneficiary's details, transfer amount & reference number. Or just upload the payable invoice to your Supplier Invoices section and this data is pre-filled for you.

Check your SEPA transfer details

Instant transfers are irreversible. Always double check the bank details and the transfer amount before approving the transaction.

Log in to your account

From desktop or your mobile app, go to the Transfers tab, click on Make a transfer then select External transfer in euros.

Enter the payment details

Enter the beneficiary's details, transfer amount & reference number. Or just upload the payable invoice to your Supplier Invoices section and this data is pre-filled for you.

Check your SEPA transfer details

Instant transfers are irreversible. Always double check the bank details and the transfer amount before approving the transaction.

Send money abroad faster

Need to pay your suppliers in a foreign currency? With Qonto, make international transfers via Wise to 150+ countries and in over 30 currencies, in less than 24h*.

*for 94% of transactions.

All the payment methods your business needs

Business Mastercards

Compatible with Apple Pay and Google Pay, pick the right card for your business: physical, virtual or temporary Flash cards.

Compare cards

Mobile payment terminal

Taking payment by card? Order a smart mobile payment terminal that offers low commissions per transaction.

Get equipped

SEPA direct debits

Master your cash flow: make your payments at the right moment thanks to automatic SEPA direct debits.

Discover SEPA direct debits

Check deposit

A customer wants to pay by check? No need to bring it all the way to the bank. Simply send by post.

Learn more