Business financing, simplified

Request financing in just a few clicks and receive funds directly in your Qonto account. Say goodbye to paperwork, hidden fees, and weeks of waiting for an answer.

4.8

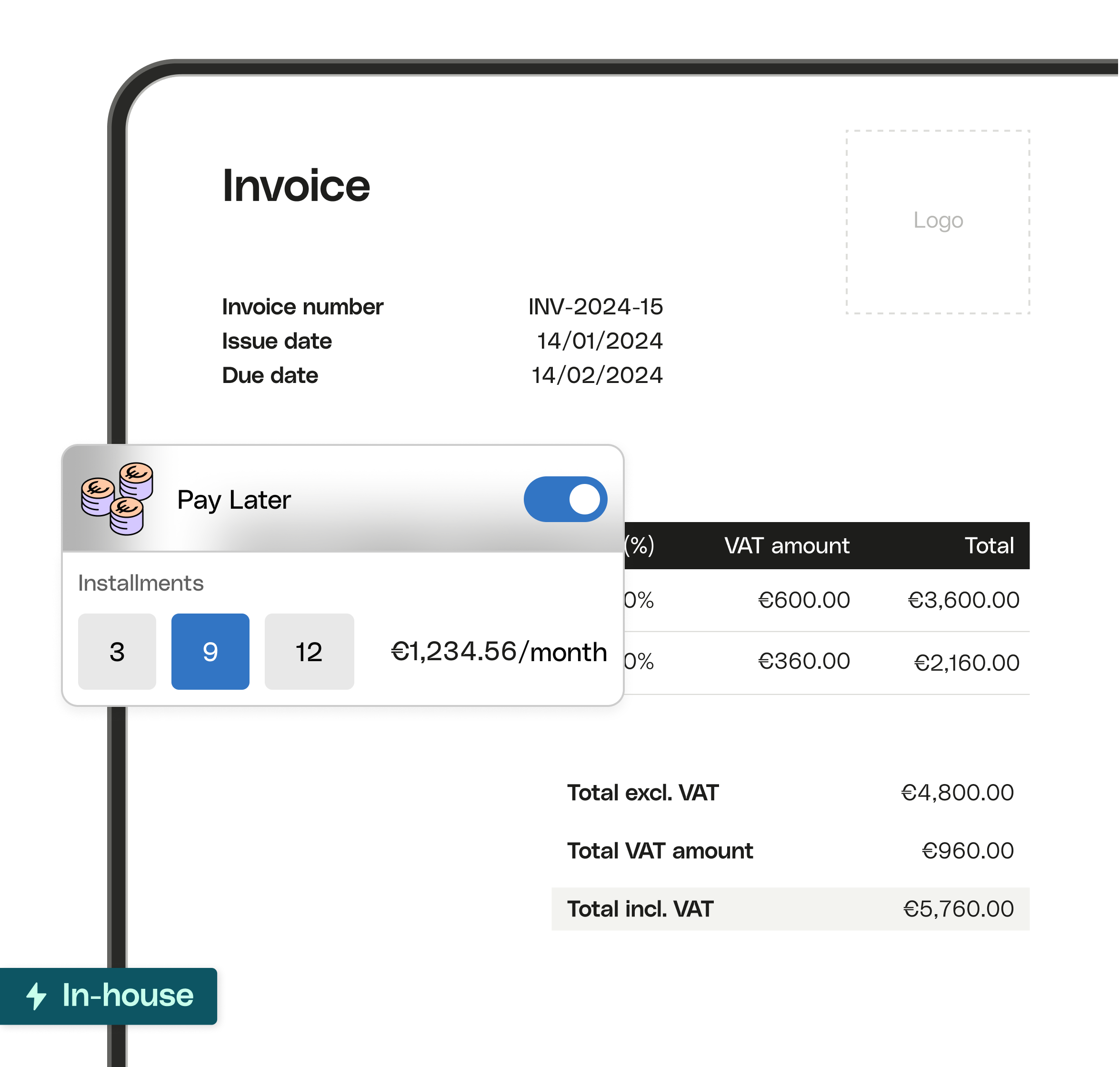

Pay later with Qonto

We pay your supplier invoices today. You pay us back later, in 3, 9 or 12 installments.

- Spread equipment payments with staggered installments

- Invest in growth without impacting your budget

Up to €50,000

Available instantly in your account to pay supplier invoices.

3, 9 or 12 installments

Pay in 3, 9 or 12 installments and track repayments plus remaining available credit directly in Qonto.

From 0.62%

From 0.62% monthly interest, calculated over your business financing period.

“I can finance my business whenever I want with Qonto, with just one click. It gives me peace of mind, especially if I have any problems with my equipment.”

100% online financing

To access our financing offers, you need to have been a Qonto customer for at least 6 months. You can then request financing in just a few clicks, directly from the Qonto web and mobile app.

Partner financing offers

Get a loan to finance your growth

Fund your long-term projects for amounts up to €10M. Automate your applications and receive funds directly in your Qonto account.

Eligibility criteria vary. Get more details on our partners page.

Variable eligibility criteria.

The business account you need

The business account you need

Make smart financial decisions

Forecast future cash flow, automate payment tracking, and use interactive dashboards to stay in control of your financial flows.

Qonto, your all-in-one solution

Qonto's business account gives you financing services, invoice management, pre-accounting and much more, all in one app.

30-day free trial