Business Mastercards - get the job done, fast

Spend up to €200,000/month and enjoy customer support 7 days a week. Our range of free and premium corporate cards has got you covered.

1-month free trial. Until 31/07, get 3 months free on the Basic plan.

Do more. Worry less. Cards you can rely on.

A Mastercard accepted everywhere.

Cards that keep you in control

Block and unblock your cards in a flash, whenever you need. Set your own payment limits and track your spending in real time.

Optimize your cash flow with a credit card

Use our business credit card and make your cash flow more flexible and predictable. Eligibility criteria apply.

A Mastercard accepted everywhere.

Cards that keep you in control

Block and unblock your cards in a flash, whenever you need. Set your own payment limits and track your spending in real time.

Optimize your cash flow with a credit card

Use our business credit card and make your cash flow more flexible and predictable. Eligibility criteria apply.

Bad day? Our insurance has got you covered

Flight delays? Lost luggage? Scammers after your money? Our payment cards also give you insurance against risks to your business. So that when bad things happen, we’ve got your back.

Customized corporate cards available with every plan.

Card type

Recycled Plastic

Recycled Plastic

Price

Free

€8 excl. VAT

NEW

Credit card available

Eligibility applies

-

Payment limit

per calendar month

€20,000

€40,000

Cash withdrawal limit

per calendar month

€1,000

€2,000

Number of free cash withdrawals

then €2 excl. tax for each extra withdrawal

0

5

Foreign exchange commission

outside the Euro zone

2%

1%

Customizations

-

Choice of colors and styles

Insurance

All our physical Qonto cards provide you with insurance and assistance. The level of coverage varies according to the type of card you have (One, Plus or X Card).

Fraudulent payment

Advanced coverage

Compatible with Apple Pay/Google Pay

Card type

Recycled Plastic

Recycled Plastic

Metal

Price

Free

€8 excl. VAT

€20 excl. VAT

NEW

Eligibility applies

-

Payment limit

€20,000

€40,000

€200,000

Cash withdrawal limit

€1,000

€2,000

€5,000

Number of free cash withdrawals

0

5

Unlimited

Foreign exchange commission

2%

1%

Free

Customizations

-

Choice of colors and styles

Choice of colors

All our physical Qonto cards provide you with insurance and assistance. The level of coverage varies according to the type of card you have (One, Plus or X Card).

Fraudulent payment

Advanced coverage

Premium coverage

Compatible with Apple Pay/Google Pay

Metal X Card: a premium experience you can touch

- Spend up to €200,000 per month

- 0 foreign transaction fees

- A sleek, 17-gram metal card with a unique design

- Travel secure with premium insurance

- Concierge service and lounge access included

“The X Card lets me make international payments for travel, software, suppliers... all with no added fees. The payment limits are very high and I can pay in foreign currency with zero commission.”

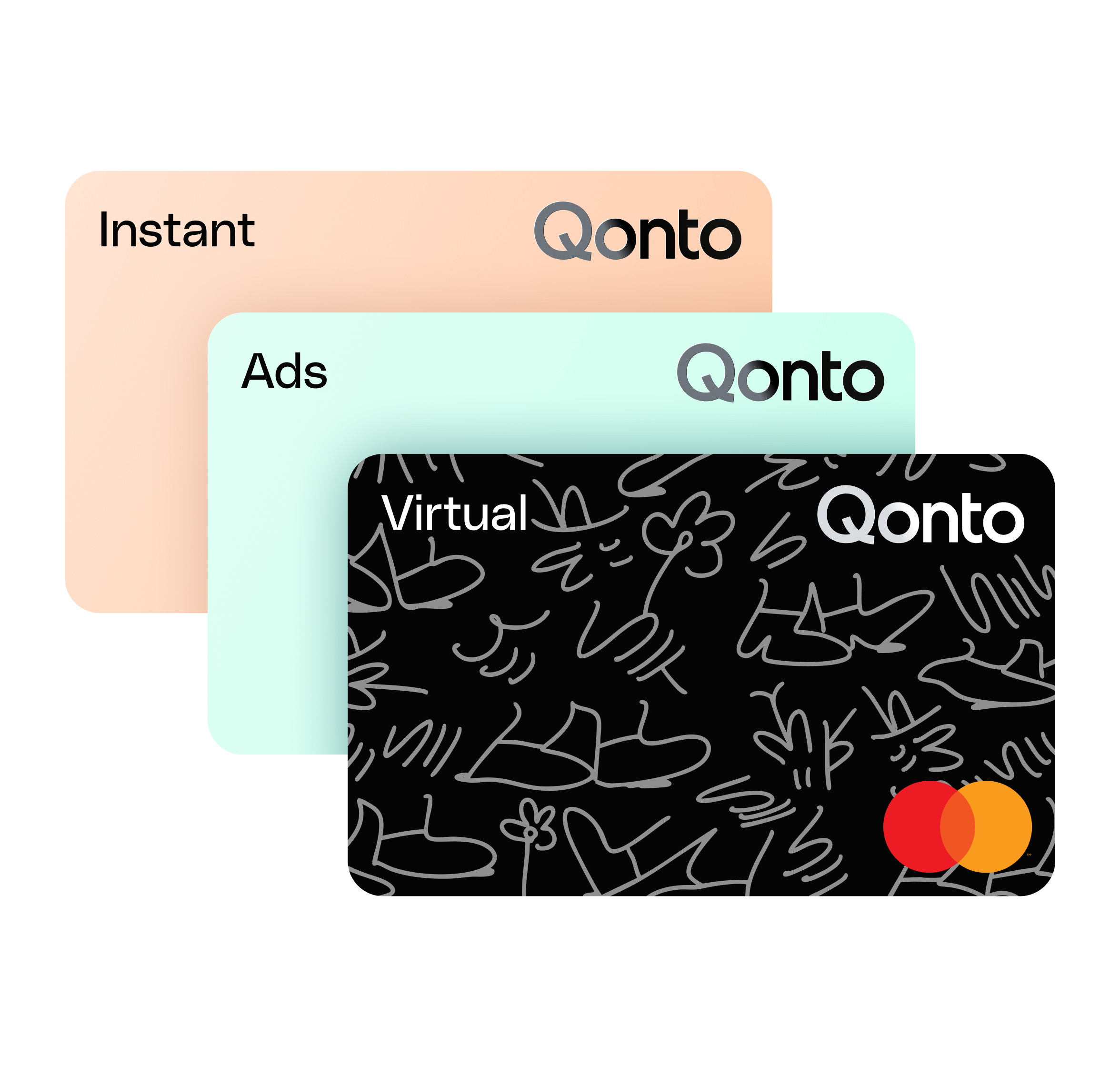

Virtual Cards: Stay on budget, stress-free.

- Create a virtual card in seconds. Pay online or in‑store with Apple Pay or Google Pay.

- Control spend with customizable limits, instant lock/unlock, and real‑time alerts.

- Assign colors to tag cards by project, team, or spend type for instant recognition.

First class offer at clear prices

Basic

Starting from

€9

/month (excl. VAT)

1 physical Mastercard card + 30 transfers & debits.

1-month free trial

Smart

Starting from

€19

/month (excl. VAT)

1 physical Mastercard card + 60 transfers & debits.

1-month free trial

Premium

Starting from

€39

/month (excl. VAT)

1 physical Mastercard card + 100 transfers & debits.

1-month free trial

Essential

Starting from

€49

/month (excl. VAT)

The essentials for managing your finances.

1-month free trial

Business

Starting from

€99

/month (excl. VAT)

1 physical Mastercard card + 60 transfers & debits.

1-month free trial

Enterprise

Starting from

€199

/month (excl. VAT)

1 physical Mastercard card + 100 transfers & debits.

1-month free trial

Business

Starting from

€99

/month (excl. VAT)

10 physical Mastercard cards + 500 transfers & debits.

1-month free trial

Enterprise

Starting from

€199

/month (excl. VAT)

30 physical Mastercard cards + 1,000 transfers & debits.

1-month free trial

Personalized plan

Custom price

Tell us what you need to manage your company finances. We’ll make it happen.

Free trial available

Add-ons

Customize your plan with Add-ons

Get the most from advanced features and enjoy a business account tailored to your business needs.

Save time. For yourself and for your team.

Ready? Create your account in 10 minutes.

Open your business account online today and order your first company payment card.