Virtual cards: a seamless way to manage your business expenses

- Experience a different way to pay.

- Make purchases quickly and securely.

- Business payment cards that suit your day-to-day needs.

Manage team spending with virtual cards

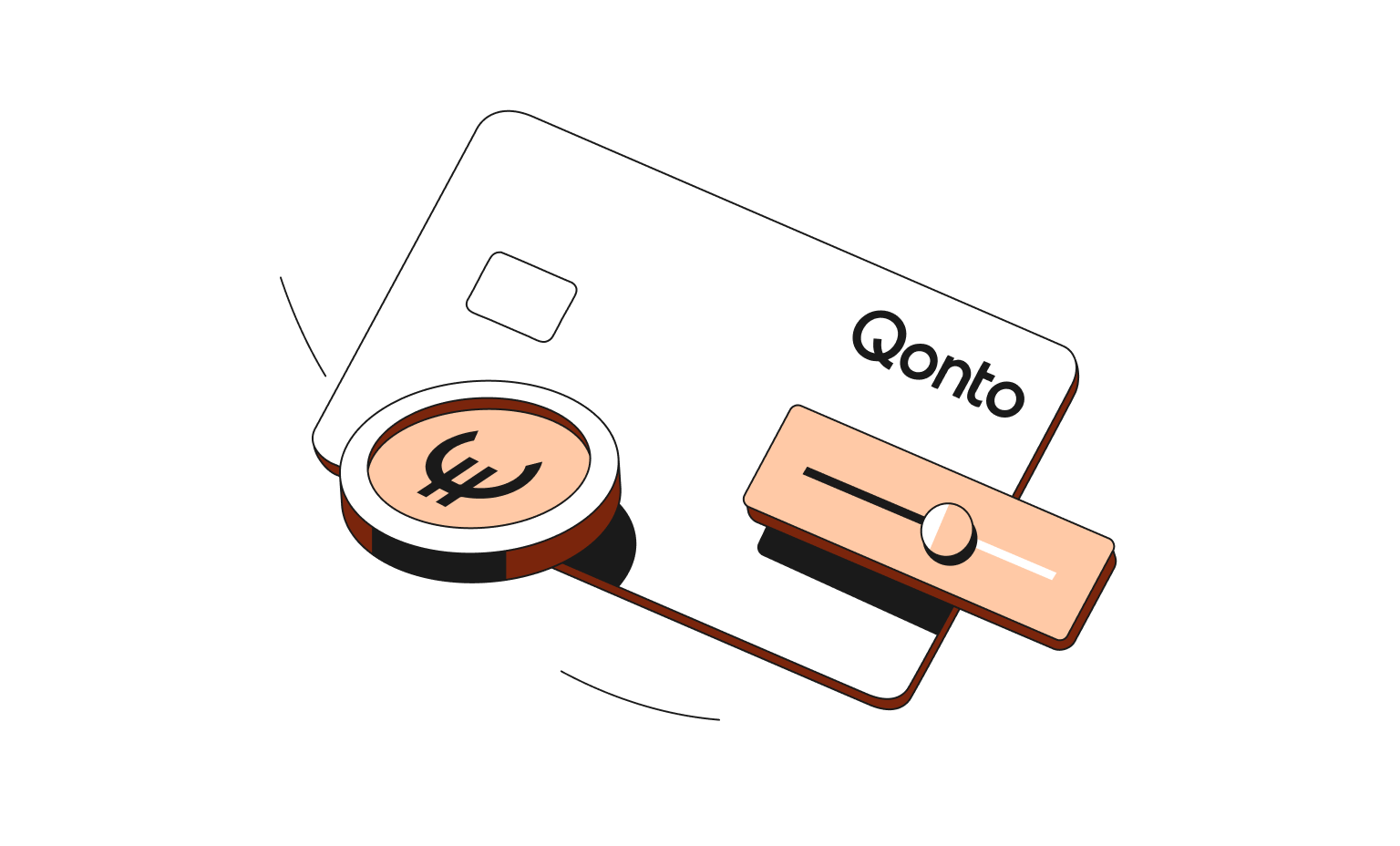

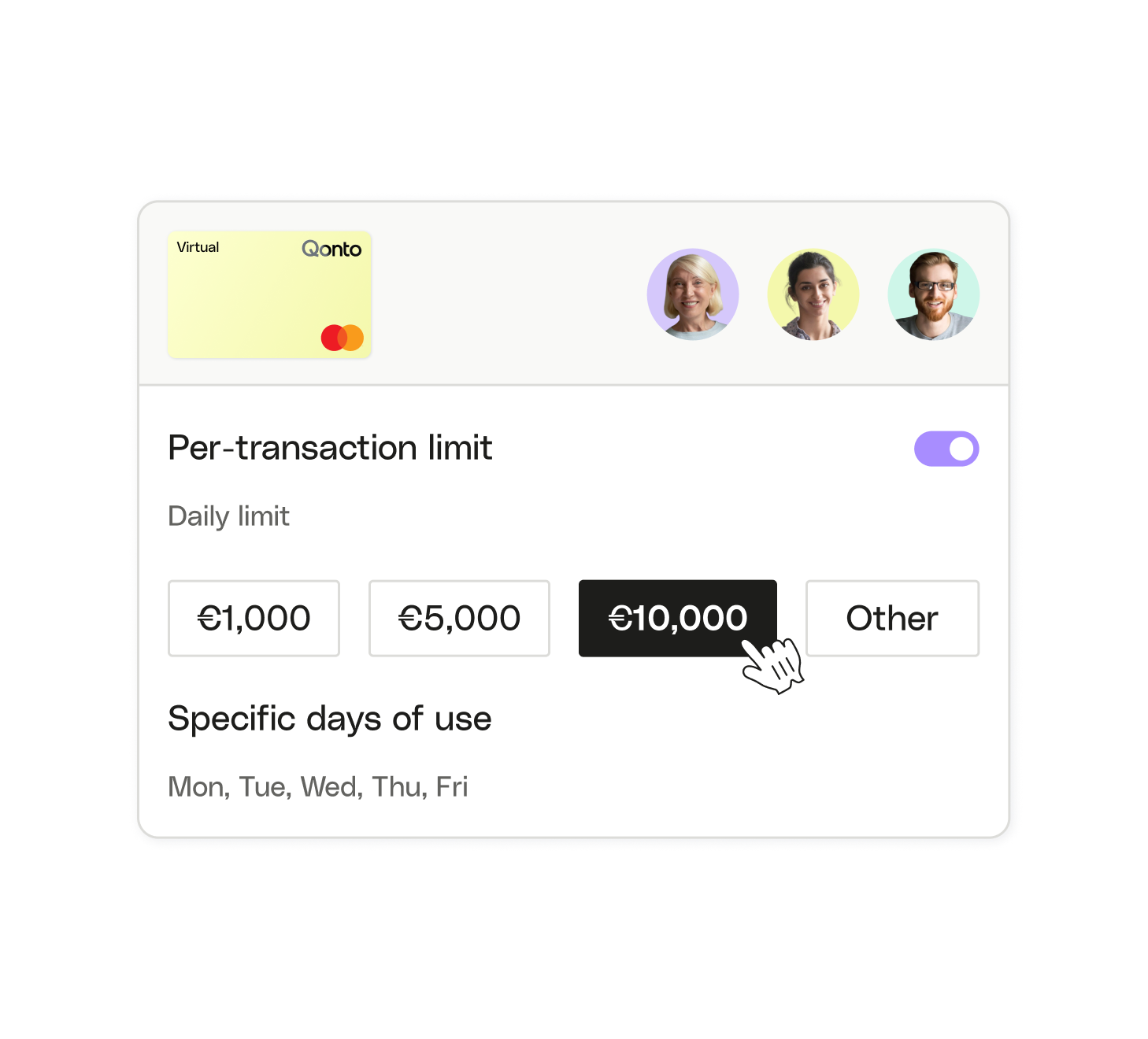

Give your teams autonomy all while staying in control of your expenses by ordering virtual cards instantly. You can even change the card limits in real-time. Virtual Qonto cards can be used online or in-store with Apple Pay and Google Pay.

Manage your expenses with ease

Simple

Secure

Effective

Make secure payments with virtual cards

A card to boost your campaigns

- High payment limits to ensure your campaigns never get blocked

- Unlimited cards to manage your campaigns with full flexibility

- Designed to work exclusively with top ad platforms - delegate with complete control

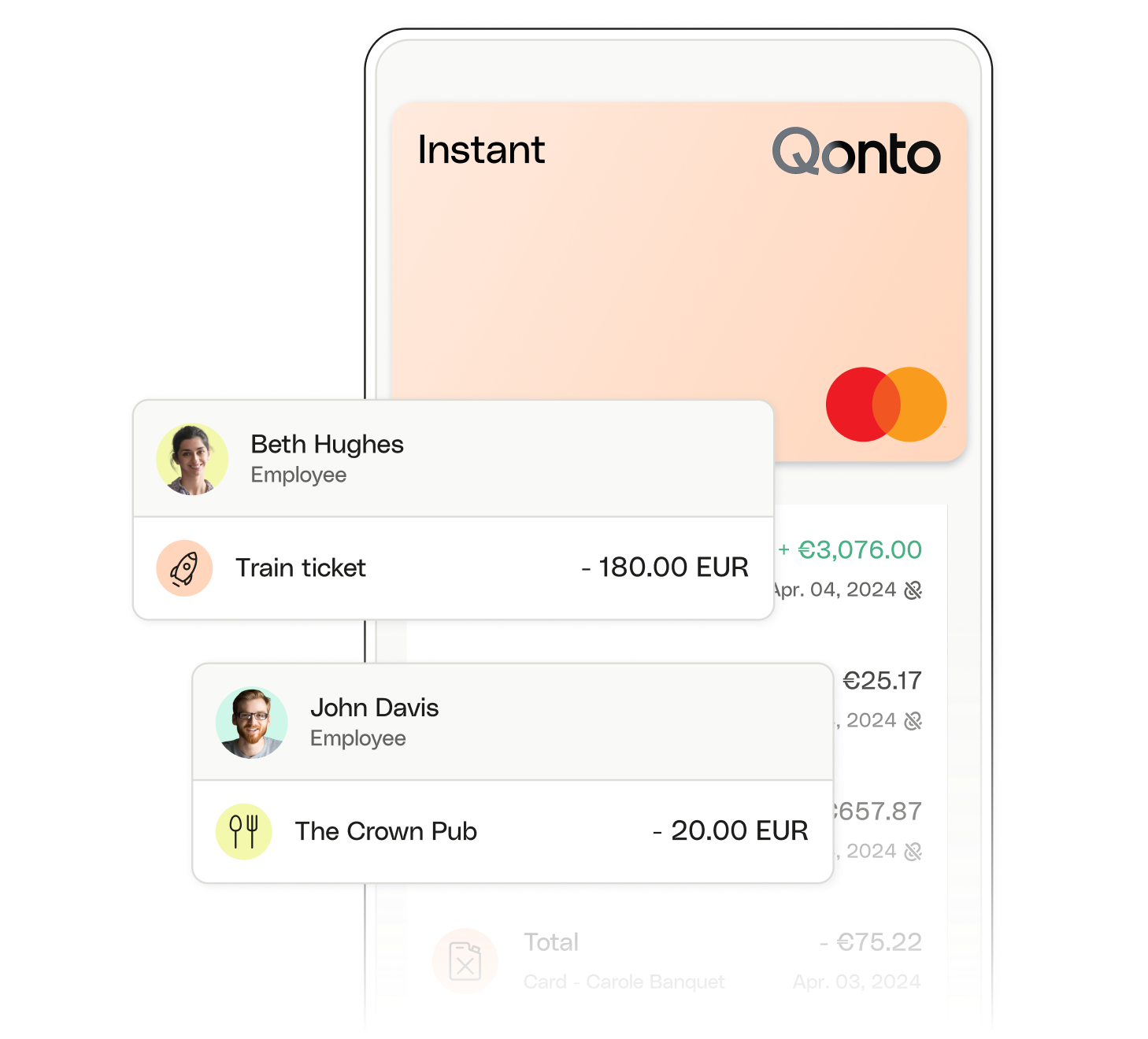

Instant cards for one-off expenses

An employee needs to buy office supplies or is going on a business trip? Empower them by allocating a specific budget with an Instant card. Employees feel autonomous while you stay in control.

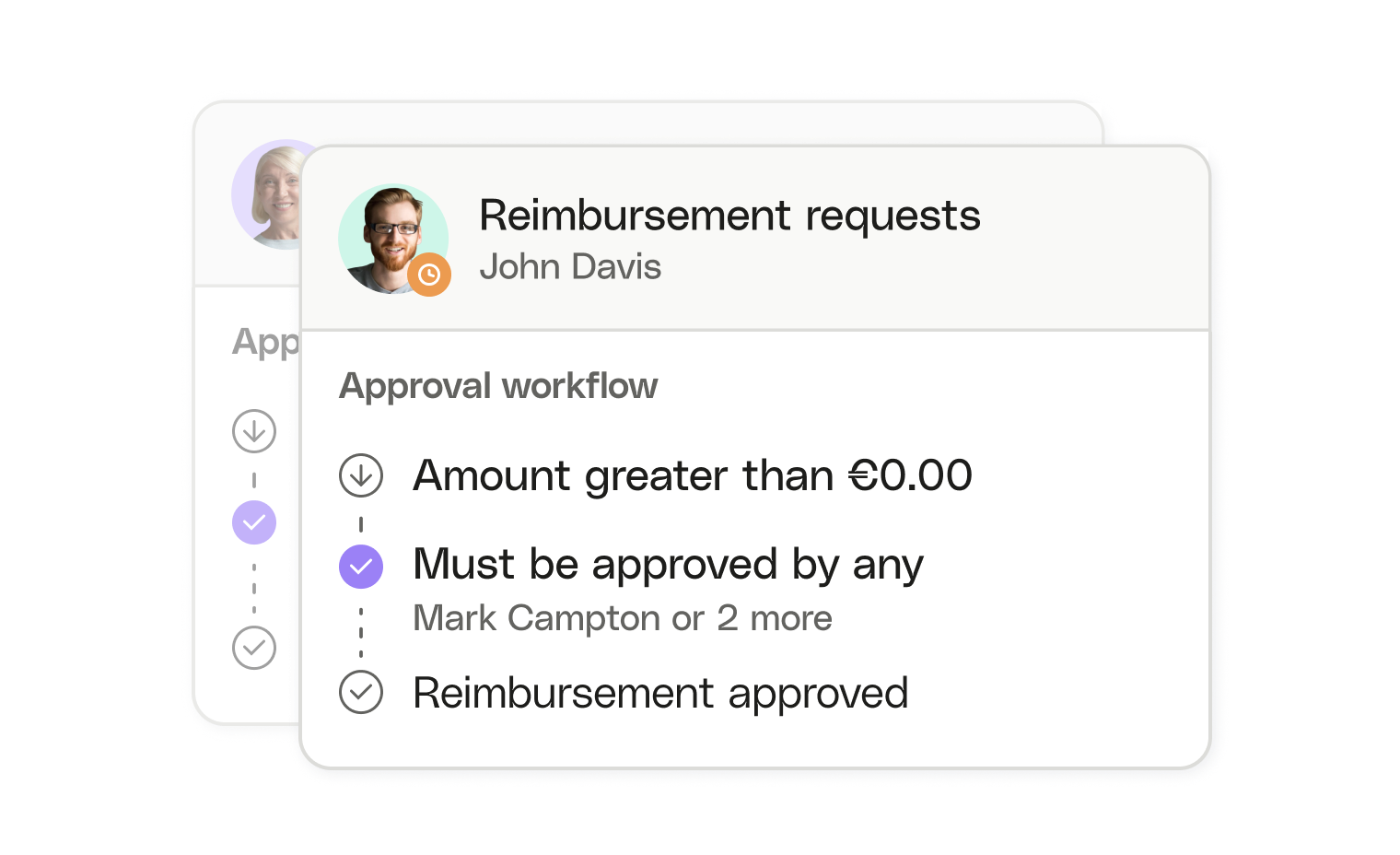

Scale your spending, stress-free

Let your team buy what they need while you keep ultimate control, with custom expense approval rules, budgets, and role-specific access. Tailored spending limits and permissions = more autonomy for your team.

Physical or virtual cards to suit all needs

Plans

Included in all plans

Included in the Business and Enterprise Plans

Payment limit

€20,000

€20,000

Exchange rate fees for payments outside the euro zone

2%

2%

Monthly payment limit

-

Daily limit

-

Specific days of use

Determine the days on which your employees can pay with the virtual cards

-

Limited usage period

Determine the usage time for your Instant card, which can range from one day to one year.

-

Plans

Included in all plans

Included in the Business and Enterprise Plans

Free

Payment limit

€20,000

€20,000

€200,000

Exchange rate fees for payments outside the euro zone

2%

2%

2%

Monthly payment limit

-

Daily limit

-

Determine the days on which your employees can pay with the virtual cards

-

-

Determine the usage time for your Instant card, which can range from one day to one year.

-

-

Business meets design

- Assign colors to virtual cards to identify specific projects, teams, or spend types.

- Choose from four limited‑edition designs by French artist Lucas Beaufort.

- Make your virtual cards easy to spot in Apple Pay and Google Pay.

How to create a virtual card

Customize your card

Set the spend limits and days of use for each card.

Validate your card

Enter the validation code you’ll receive by text.

Your card is ready

You can make purchases online or in-store (using Apple Pay or Google Pay) right away.

Customize your card

Set the spend limits and days of use for each card.

Validate your card

Enter the validation code you’ll receive by text.

Your card is ready

You can make purchases online or in-store (using Apple Pay or Google Pay) right away.

Customize your card

Set the spend limits and days of use for each card.

Validate your card

Enter the validation code you’ll receive by text.

Your card is ready

You can make purchases online or in-store (using Apple Pay or Google Pay) right away.