To determine a company’s financial health, we need to think in terms of net treasury, or net cash, rather than available treasury.

Net treasury is the total value of available funds in a company’s accounts once short-term costs and expenses have been settled. It can be calculated with the following equation:

Net treasury = Available funds - short-term debt

If these terms seem complex, don’t worry. All will be explained!

A company’s available funds are the sum total of all the financial resources that it can access or mobilise to maintain its activity. In other words, it’s a company’s treasury: cash held in savings or current accounts as well as the marketable securities mentioned above.

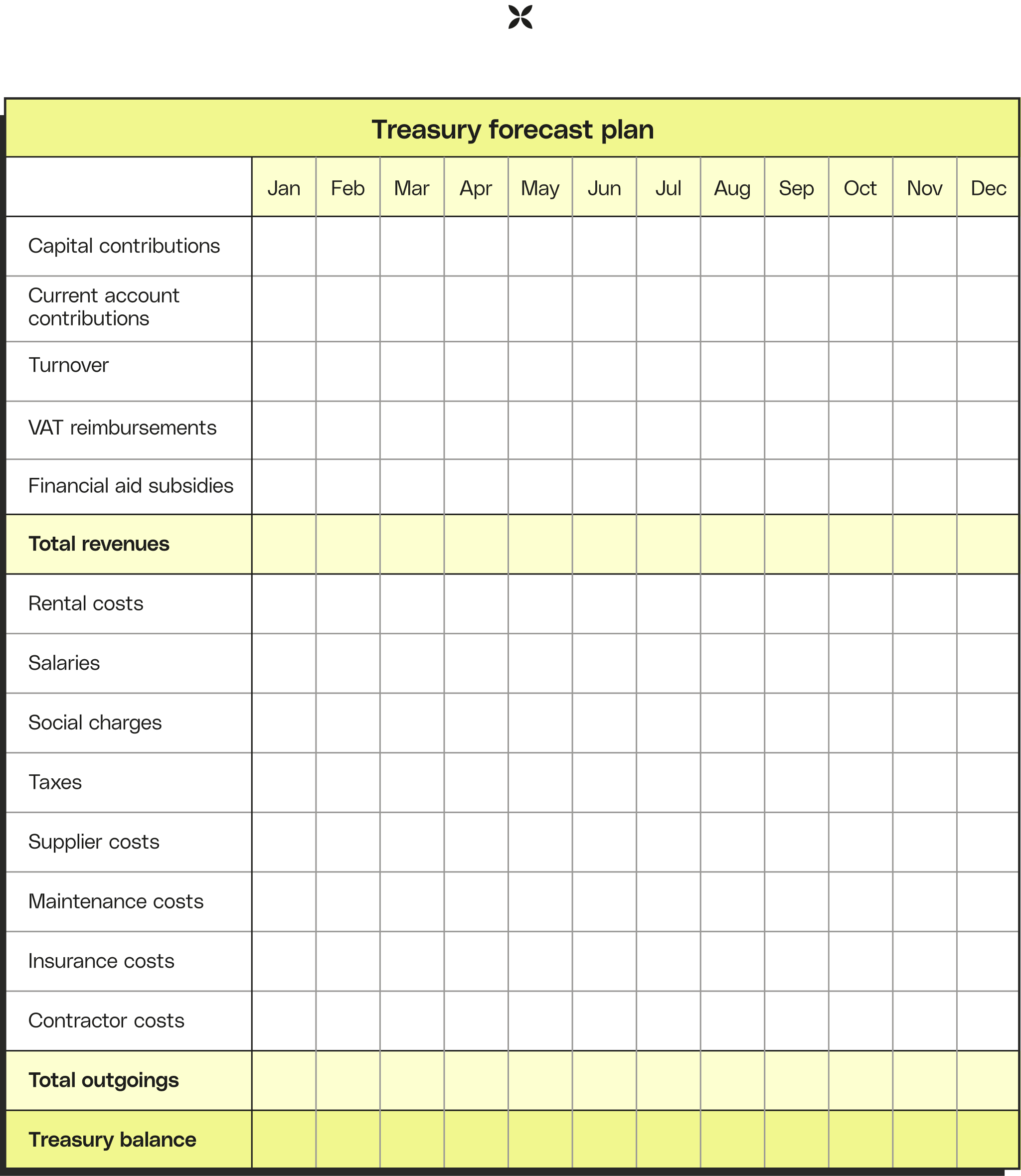

Short-term debt is the sum total of all the payments a company needs to make in order to finance its continued activity. They include:

- Staff salaries

- Purchases ordered from suppliers

- Rental costs

- Social costs and taxes (VAT, income or corporate taxes, real-estate contributions etc.)

- All other short-term costs needed to keep business running (maintenance costs, raw material costs, software, hardware, stationary etc.)

There are three possible scenarios when it comes to net treasury:

- When the funds available to a company are greater than the short-term debt, the net treasury is positive. It has a positive cash flow and is ‘in the black’; its financial situation is, on the face of it, healthy. It is able to pay all its costs without having to resort to financial assistance from elsewhere.

- When the funds available to a company are equal to the short-term debt, the net treasury is zero. Its financial situation is said to be balanced. It doesn’t require any external financial assistance but it remains vulnerable and will be unable to pay any unforeseen or ‘extraordinary’ costs.

- When the funds available to a company amount to less than the short-term debt, the net treasury is negative. It is in deficit or ‘in the red’. The company lacks financial resources and will need outside financial support to be able to continue to operate.

To better understand, let’s take a concrete example:

Max owns a business specializing in car rentals. His company’s treasury, or the cash available to it (in bank accounts and in marketable securities), amounts to 100,000 Euros.

His short-term debts include social charges and tax, employee salaries and vehicle maintenance and they all add up to 50,000 Euros.

To calculate his net treasury, Max makes the following calculation:

Available funds - short-term debt = Net treasury

100,000 - 50,000 = 50,000

His small car rental business has a net treasury of 50,000 Euros. His treasury is positive. Max’s company is ‘in the black’ and ready for business.