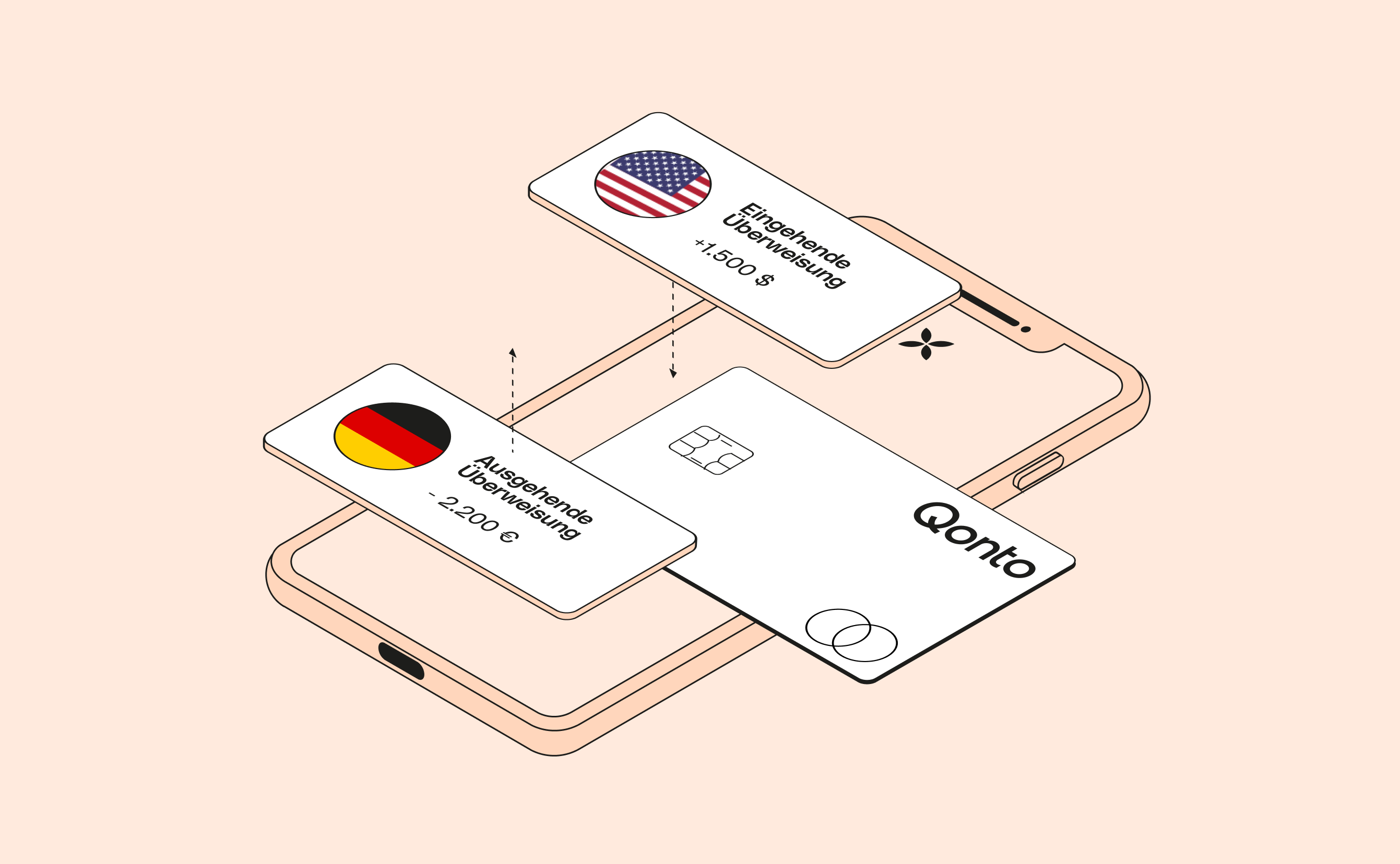

How would you feel about opening a new current account?

Now, you can create up to five current accounts with dedicated IBANs to manage your company’s cash flow as you see fit. And perhaps best of all, you can do all this in just two clicks (really!).

Just created a new current account? You can rename it, add funds to it, order new cards, download and share your new IBAN, send transfers (almost) instantly between your different Qonto accounts... basically you can ensure that your new account meets your needs.

Your multiple current accounts will have all have the same functions and features you already know and love.

Multi-accounts, multi-uses

Multi-accounts, multi-uses

What can multi-accounts do for you? Here are three ways you can handle your cash flow like a pro by opening multiple accounts.

1. Divide to save more

Just as you would fill your piggy bank every birthday, multi-accounts can help you separate between your expenditures and save some money. No more nasty surprises during tax season or when you have to return a deposit.

Time to pay? Not a problem - you have other options now. Set up a direct debit, send a transfer or make a withdrawal, and much more, all directly from your account.

2. Separate your activities

Does your company engage in various types of business activity? Assign an account to each activity. This is the key to complete control over your finances.

3. Allocate budgets to your teams

Nothing beats team work - in fact it’s one of the foundations of our work ethic here at Qonto. And now with multi-accounts, you can share the management of your finances without losing control.

How? By creating a dedicated account for the expenses of each of your teams. You can then provide them with cards to help them manage their budget, all while keeping an eye on everything from your application. Win-win: more transparency for you, and more autonomy for your teams.

👉 Want to know more? Have a look right here.

A new interface for new accounts

A new interface for new accounts

To reflect these changes, we gave our app a fresh new look! New sections, new icons, new shortcuts... Our teams left nothing to chance. We redesigned your interface for even simpler and faster navigation.

Each of your accounts has its own “ID” card: name, bank details, balance. We’ve put all the pertinent information in one place so you can verify your cash flow situation in the blink of an eye.

Check your transactions, bank cards, transfers, direct debits...in just a few clicks. Need a clearer picture? Feel free to tinker with the filters and select only the elements that matter to you.

This new feature is available starting from the Premium plan. The new interface, however, is available to everyone.

ABOUT THE AUTHOR

Our Product Marketing Managers have one simple goal: to help our customers get the most out of Qonto’s many tools and features.

Recommended articles

Subscribe to our newsletter

Enter your contact details to get the latest news and trends to help boost your business.

Ready? Let's go.

Whether it's to examine the specific needs of your business, or to go over the benefits of Qonto's tools and features, we're here for you.

Qonto

4.7

(32,7K)