What’s a SCHUFA? A frequently asked question in Germany, and for good reason. Most responses you’ll get if you ask will go like this: ‘Something very important’ and ‘Your creditworthiness?’ While not wrong, these answers don’t quite get to the heart of it.

What is SCHUFA? Everything you need to know

What is a SCHUFA report?

Companies, banks and landlords conduct credit checks on prospective customers to find out if they’re risking their business by taking that customer on. The resulting check determines your ability to pay bills and rent on time, loan instalments and even keep up with mobile phone plans. At the end of the check, credit agencies compile your score in a report.

What does SCHUFA mean?

In German, ‘SCHUFA’ stands for the Schutzgemeinschaft für Allgemeine Kreditsicherung. Loosely translated, it’s ‘Organisation for general credit safety protection’.

- Banks and savings banks

- Credit card organisations

- Companies in the stationary or online trade

- Telecommunications companies

- Energy providers

- Collection companies

How does the credit check work?

Put simply, the credit check is an investigation into your legal, personal, and financial circumstances. Both positive and negative results of these aspects are taken into account, so if you’ve always made your payments on time, obeyed the law and juggled several large payment plans with ease, you’re on your way to a good (maybe perfect!) SCHUFA score. The results under consideration include:

- Current and previous addresses including the date of collection (for private individuals)

- Information about account openings, current contracts and loans

- Information on dunning or collection procedures

- Affidavits or insolvencies

- Open as well as already settled claims

- Macroeconomic and industry-specific conditions (for companies)

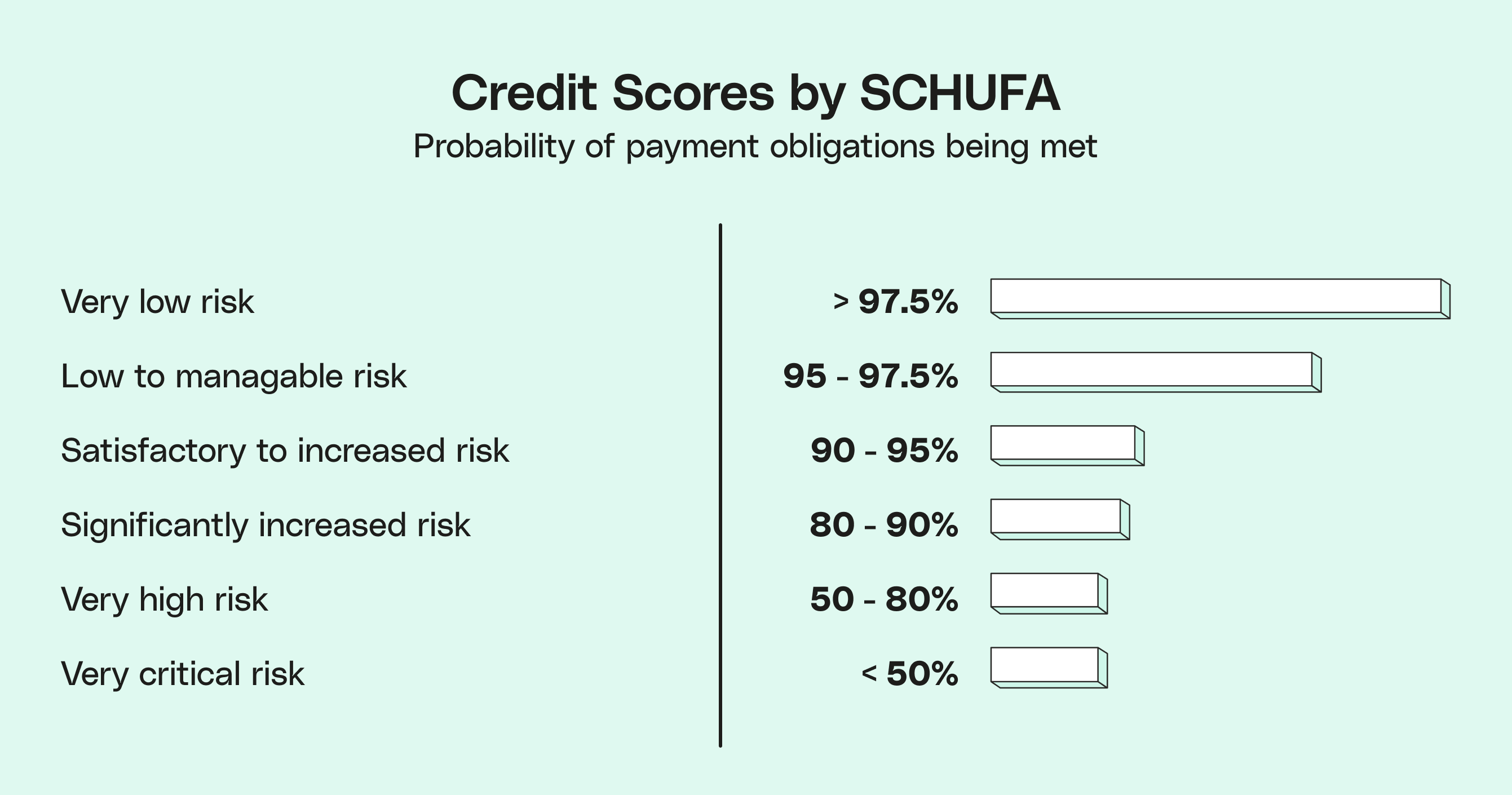

How do you understand your entry

Your SCHUFA entry is the assessment based on the above results checks, culminating in a percentage that indicates your creditworthiness. Your landlord or whomever has requested the entry will then assess you based on this percentage.

Who can request your SCHUFA report?

Any person or company who can prove their legally legitimate interest in your creditworthiness is entitled to a SCHUFA report. If there is potential risk for the person or company in the contract, they are then legally entitled to request the report. Typical scenarios include:

- The opening of a private current account or a business account

- Credit applications

- The purchase on account for large sums

- The conclusion of a rental agreement

- The conclusion of contracts with a long term (Internet or cell phone contracts)

Viewing Your Own SCHUFA

What role does the SCHUFA play in granting you credit?

Your SCHUFA entry is the deciding factor in all the scenarios discussed above. The results fluctuate depending on the kind of institution you’re dealing with and with the size of the investment or purchase being made. Banks, for example, will pay very close attention to your results if you’re taking out a loan, because it is a particularly high risk for them. If they determine you to be a high risk client, the bank will increase their interest rates.

How can you improve your own SCHUFA entry?

Consistency, punctuality, and reliability are what you should keep in mind if you wish to maintain a high or perfect SCHUFA score. This means that, on the flip side, frequent rental contract changes, a bad reputation with payment plans, multiple maxed out credit cards, and an account regularly dipping into overdraft payments will all contribute to a bad score and limit your financial freedom in Germany.

- SCHUFA is a company in charge of generating creditworthiness reports for individuals in Germany

- A credit check is a an examination of your legal, financial, and personal circumstances

- Your report can determine your eligibility for rental properties and other large purchases

- You will be rated in terms of risk: very low to critical