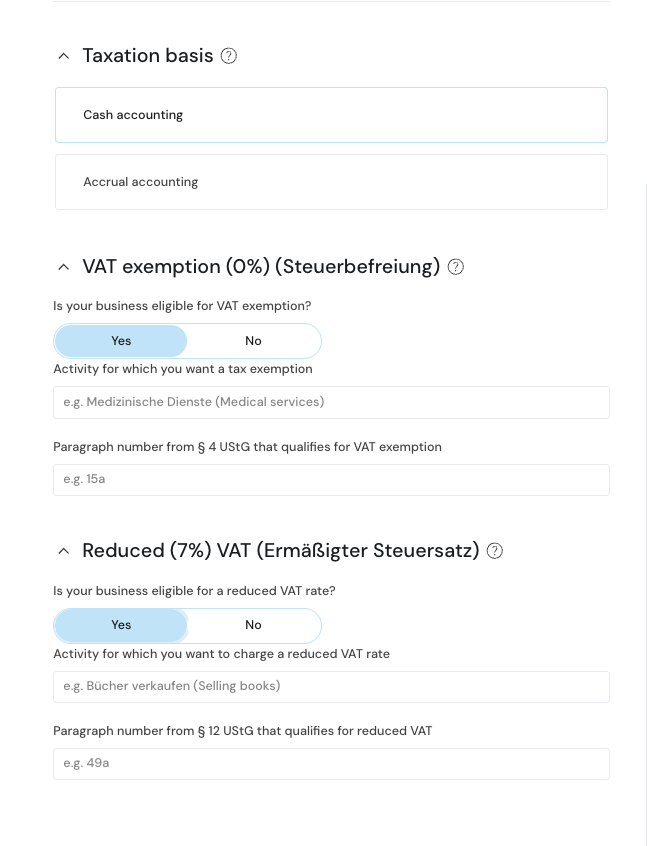

Then, there’s a question on VAT exemption; so find out if your activity makes you exempt from VAT (for instance some education, healthcare and financial services). To do that, you should consult Section 4 of the German VAT Act (§4 UStG, link in German). If it does apply to you, enter a short description of the activity in German and enter the relevant paragraph number from Section 4 of the VAT Act.

Similarly, some professions qualify for a reduced VAT rate of 7% instead of 19% (for example selling groceries, cultural tickets, hotel accommodation); to find out if you’re in that category, check out Section 12 of the German VAT Act (§12 UStG, link in German). If it does apply, you must enter a short description of the activity in German and enter the relevant paragraph number from Section 12 of the VAT Act.

The most common self-employed professions don’t typically qualify for VAT exemptions and reductions, but it is worth checking the criteria in the VAT Act, or seeking advice from a tax advisor. If either case does apply to you, you will need to include a mention of the exemption/reduction on each invoice you send.