In this second article of our fundraising series, our VP of Legal Alexia Delahousse has outlined 5 key legal tips for a successful fundraising round. Be sure to check out the first article outlining our fundraising strategy by Qonto’s co-founder and CEO Alex Prot.

The legal side of fundraising at Qonto

1) Choose your lawyer wisely

My first piece of advice would definitely be to surround yourself with the right people when fundraising. It’s best if you settle on representation before you even sign your first term sheet (a letter of intention to invest) with an investor.

At Qonto, we’ve partnered with Solferino & Associates, as they’ve been providing counsel for our co-founders since their very first entrepreneurial project. They’ve been with us since our first fundraising round in 2016, through Series A, B, C, and now, most recently, Series D. Working with a firm that has known you from inception provides a unique advantage: they tend to be more responsive and can better anticipate the needs of investors.

Your lawyer will support you during negotiations and help polish the wording of your legal documentation (e.g. your term sheet, investment agreement, or shareholder’s agreement) to ensure that when you sign, the conditions meet your expectations. And when it comes to your first meetings with investors, don’t take suggestions of ‘market practices’ too close to heart: be a firm negotiator! The documents you sign during your first fundraising round act as a launching point for negotiating the following rounds.

2) Negotiate your term sheet well

A term sheet is a letter of commitment that you sign with an investor. It is non-binding, meaning there is no firm obligation to abide by its terms; however the more you define the conditions from the outset, the quicker and easier it becomes to draft a long-form version of the legal documents (i.e. investment agreement, shareholders agreement).

Ideally, your term sheet should cover the following legal and financial aspects:

- the amount of invested capital;

- the pre-money value of the company (i.e. before the first funding round);

- the valuation of the new BSPCE/BSA/Stock option pool (buy-in options that the company intends to give out to employees, independent governance members, or partners);

- the timelines for signing (the investment agreement) and closing (performing the funding transaction, i.e. the date of the general assembly and signing of the shareholders agreement);

- preferential liquidation (a clause guaranteeing investors a minimum return);

- a breakdown of lawyer fees;

- whether or not someone is nominated as a member of the board;

- precedent conditions for closing: legal and fiscal due diligence (a.k.a. everything investors will check before the transaction), MAC (Material Adverse Change, which outlines the conditions under which an investor is entitled to walk away from the deal should events occur that hurt the company), the finalization of the contractual documents based off of the paperwork from the first fundraising rounds;

- the term sheet’s expiration date.

You can find some examples of Series A term sheets on the Galion Project website.

3) Get your legal paperwork in order

Organize your legal paperwork well and keep it stored in a safe place. Having well-structured, comprehensive documentation that’s easy for your investors (and their lawyers) to access, particularly during fundraising, will very much reduce the time it takes to perform your fiscal and legal due diligence. This will pare down the usual back-and-forth with your investors’ lawyers, and therefore limit the legal insecurity that tends to weigh down talks when the deal isn’t yet finalized.

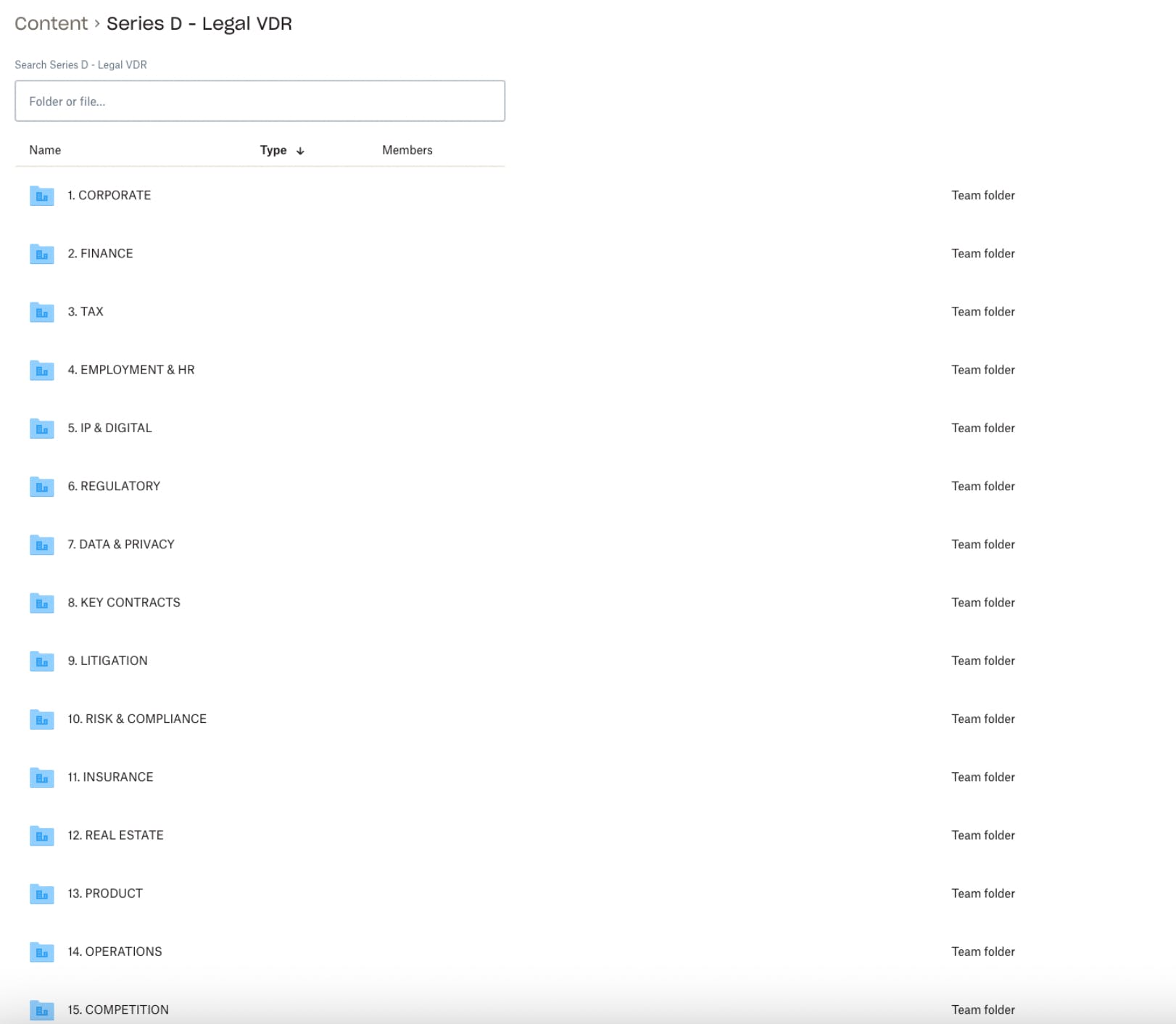

One effective way to organize and display your legal documents right from the start is to use a virtual ‘Data Room’: it’s an online space where you can store, share and edit documents in real-time. Preferably, use a tool that’s easy for your investors and their lawyers to access: something simple like Google Drive, Dropbox, or some other more dedicated tools. Keep in mind a lot of legal firms are prohibited from using Google Drive for security reasons. As for the more dedicated tools, they can be costly and may not necessarily offer the functionality that your startup business needs from a Data Room.

We decided to use Dropbox here at Qonto. Here’s an example of the folder hierarchy we used in our Data Room when we went for our Series D funding:

4) Keep the process seamless

Put together a user’s guide to your Data Room for your investors so you can avoid fielding unnecessary questions and keep communication running smoothly. It should cover the rules for access and ought to cover the following points:

5) Protect your data

When fundraising, you have to share sensitive strategic information with investors. Make sure the safety and confidentiality of your documents is assured by choosing a safe Data Room and having all potential investors sign an NDA (Non-Disclosure Agreement).

It’s always in your best interest to have all your legal documents safe and organized, particularly when the time comes to raise another round of funds. Knowing exactly where to find all your pertinent paperwork will save you time, but most importantly it will give you and your investors peace of mind that you’ve got things handled. It’s vital that your investors trust you and your process. Never forget - as long as an agreement isn’t signed, it’s not final.

Coming soon in the third and final instalment of articles on Qonto’s fundraising process, we’ll focus on the work of the Finance Team in a funding round: we’ll examine documents such as the business plan and Data Pack that investors want to see and how to best present them. Watch this space for hints and tips on crunching numbers and displaying data.