Qonto’s 8 tips for a winning fundraising strategy

Fundraising is a learning curve and Qonto has learned plenty.

Five successful funding rounds in under 6 years have taught us many of the dos and don’ts of seeking investment. We believe that good knowledge is even better when it’s shared, which is why we’d like to disclose with you some of the tactics and documents that helped us secure the funding that will drive our long-term growth.

Having just raised €486 million in our Series D round, we want to delve into the mechanics of our fundraising strategy. Watch this space for upcoming articles examining the crucial work our Finance and Legal teams put into the process. First, in this article, Qonto co-founder and CEO Alexandre Prot presents 8 takeaways for a winning fundraising strategy. It worked for us, and we hope it might also work for you.

1. Treat each Round differently...

From Seed Round to Series D, Qonto has learned with each step: even if the outcomes were all positive, our internal management has become sharper at every checkpoint in the journey. The focus of each Round evolves. For Qonto that meant:

- Seed Round (2016) - the emphasis was very much on the team’s capabilities and the prior experience of the founders.

- Series A (2017) - investors’ focus shifted to the first version of the product and our ability to drive adoption, gain initial traction and generate first revenues.

- Series B (2018) - the big question was: how fast were we growing and could we still grow in France, our first and only market at that point?

- Series C (2019) - attention turned to unit economics and our ability to expand and scale in other markets.

- Series D (2021) - we needed to show how fast we could scale across Europe while maintaining a solid business model and how far we can develop our business banking offer.

For the first few Rounds, there are very few questions about profitability. What matters to investors in the initial rounds is client-base growth. You shouldn’t be looking at profitability too early or you risk slowing down your growth. Instead, we really focused on our volume of clients and making sure those clients keep coming back to our product, that they love and recommend it and, ultimately, are happy to pay for it.

2...but treat fundraising as one, ongoing process

Each Round may be different, but fundraising must be seen as one, ongoing process; it’s important to see the bigger picture early on and have an eye on future Rounds. When we built our Series C in 2019, we had in mind that the investment would cover 2 years of growth; we had already indicated to investors that we’d launch the Series D two years after the Series C. By keeping to that schedule, not only were we able to stay focused on it, we also showed that we stick to the plans we make. This is key to building trust with investors.

Similarly, we were telling investors 2, 3 and even 4 years ago that we would expand to other European markets like Italy, Germany and Spain. The investors would have flagged that information somewhere in their notes. Fast forward to today, and Qonto is present in those other countries. It proves we say what we do and we do what we say, and that doesn’t go unnoticed by investors. It’s an ongoing journey and you build trust organically over time.

3. Do you need a financial establishment as an advisor?

Most companies would have an investment bank as an advisor because banks can help with the documentation side of the process, such as the business plan and the pitch deck, as well as managing both the process and investor relations (see more in takeaway 8). Also, banks have the contacts and the leads for putting you in touch with investors.

In our case - and in all of our funding rounds - we decided to take care of this internally. We were confident we had the capability and the recognition, and that we were market-ready. What steered our thinking was that we knew we would be able to cultivate better relationships with investors if we dealt with them directly.

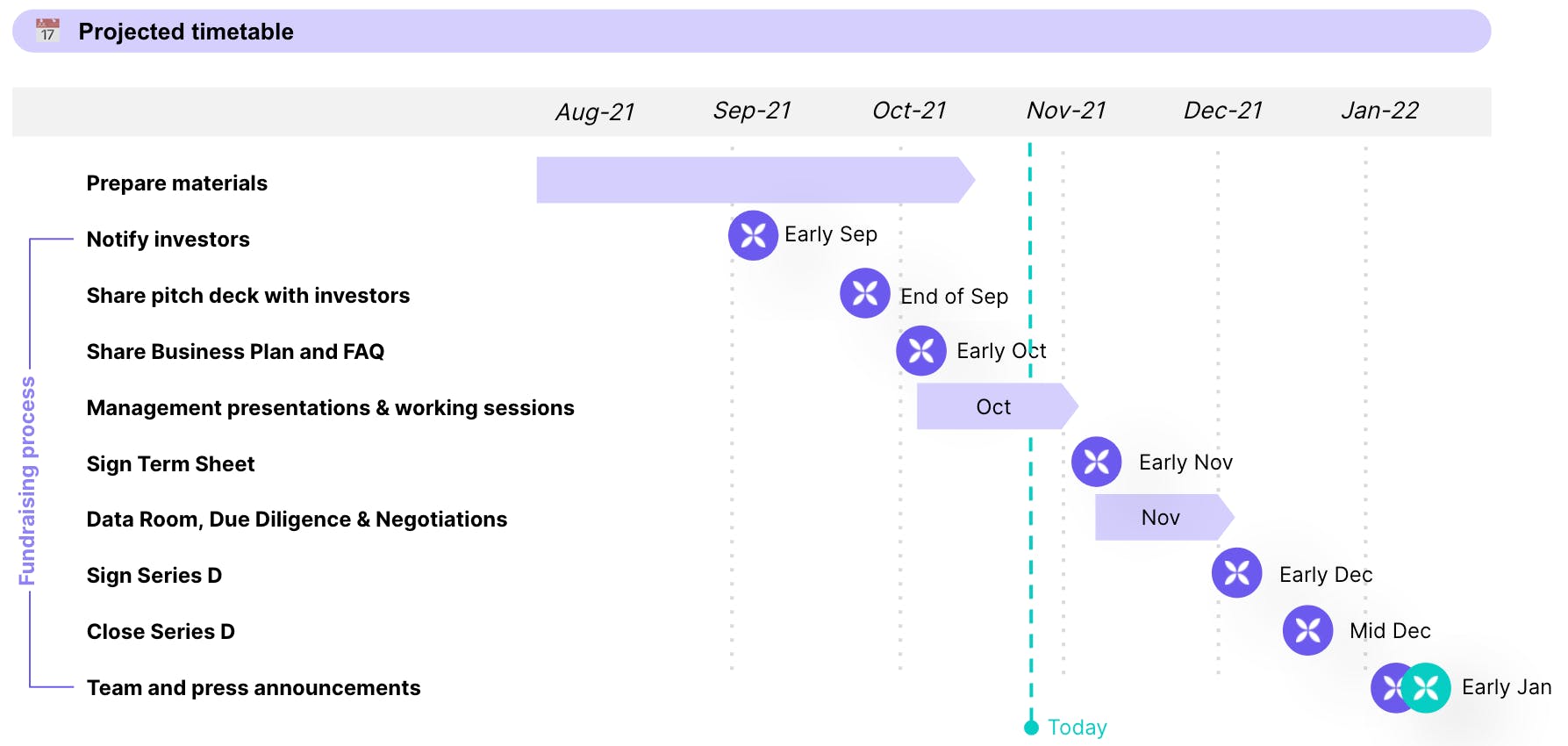

4. Establish an efficient timeline

By the time we reached the planning stage for the Series D, we’d become very familiar with the timeline we’d need to follow and knew the process would take us one quarter. We wanted to make sure that each resource was deployed in a timely sequence to make the process as fluid as possible, both internally and externally. To have an efficient process in Q4, 2021, we activated the Finance and Legal teams and the Chief of Staff in Q3. This meant we were totally ready by the end of September and were able to close everything by mid-December.

Below is the timeline that allowed us to achieve this:

5. Timing is everything: raise only when you’re ready

One of the biggest traps to fall into is fundraising when you’re not ready. The process should be followed on your own company’s terms and only when you are absolutely all set.

To be fully prepared, you’ll need the right material, documentation and data (see takeaway 8), as well as the internal bandwidth to support both the fundraising effort and the day-to-day running of your business.

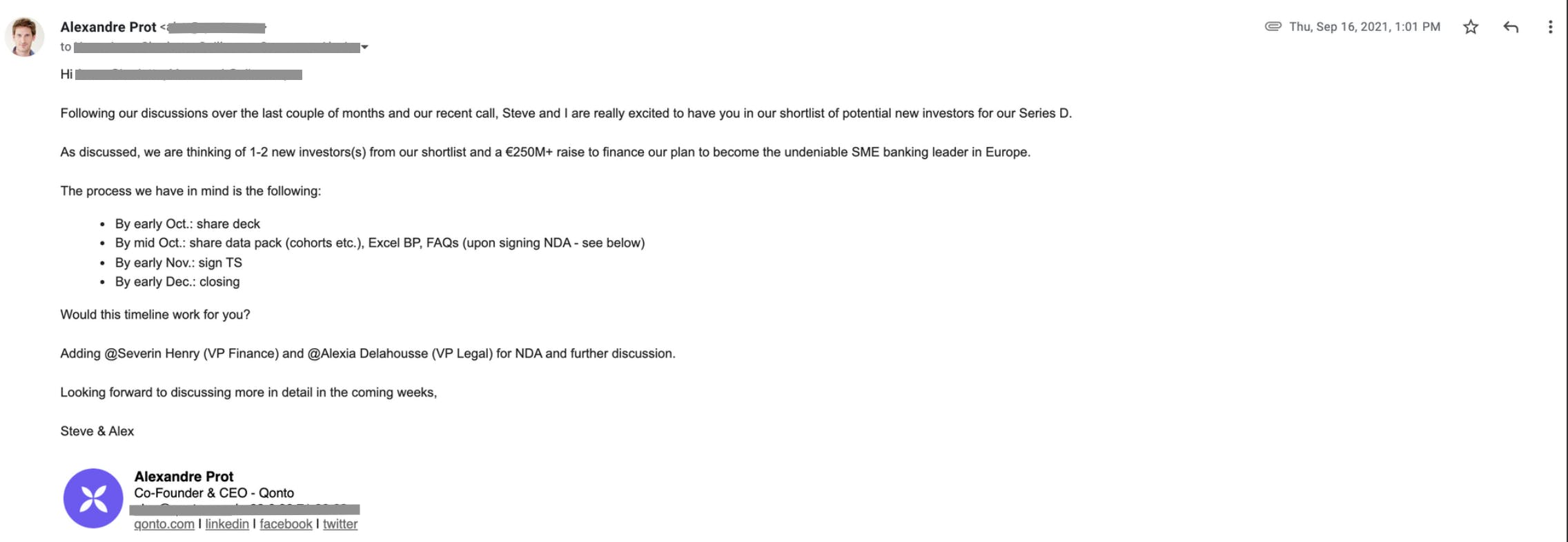

If an investor gets in touch saying they want to invest next week, that should not be the trigger for a funding round. It’s fine to say you’re not quite ready yet. Investors will appreciate the transparency and the fact you stick to your guns. Then, when you’re ready, you can reach back out (the email below is an example of Qonto getting back in touch with interested investors when the time was right.)

It also helps to wait until multiple investors are interested, as it gives you more bargaining power (see takeaway 7).

If raising too early jeopardizes your chances of securing investment, raising too late threatens the long-term survival of your business by exhausting your reserves.

Therefore, timing is crucial.

6. Make the most of conferences and trade shows

Banking conferences are held throughout the year and are a great opportunity to get your project seen by VCs who can really push your plans forward.

Last year, we attended tech conferences organised by banks like Goldman Sachs and JP Morgan, which were virtual events in the current Covid context. We had 15 minutes to present Qonto (see the 16-slide presentation for the JP Morgan event below), then 15 minutes of moderated questions, as well as some 1-to-1 sessions. You get to meet various people over the course of these conferences, you explain to them where you stand, update them on your expansion plans, you stay in touch and foster your relationship over time.

7. Quantity of investors matters

Competition helps. The Venture Capital market is a market like any other and competition is a very healthy sign for a fundraising company. If there’s only one investor taking part, there’s no way to leverage competition and get the best deal possible.

Qonto welcomed 10 new investors in the Series D. Many of them are investors who could have invested independently but it was fantastic for us to have so many involved in the process: we were able to benefit not only in terms of money, but also in terms of the breadth of expertise the various investors could bring to the table.

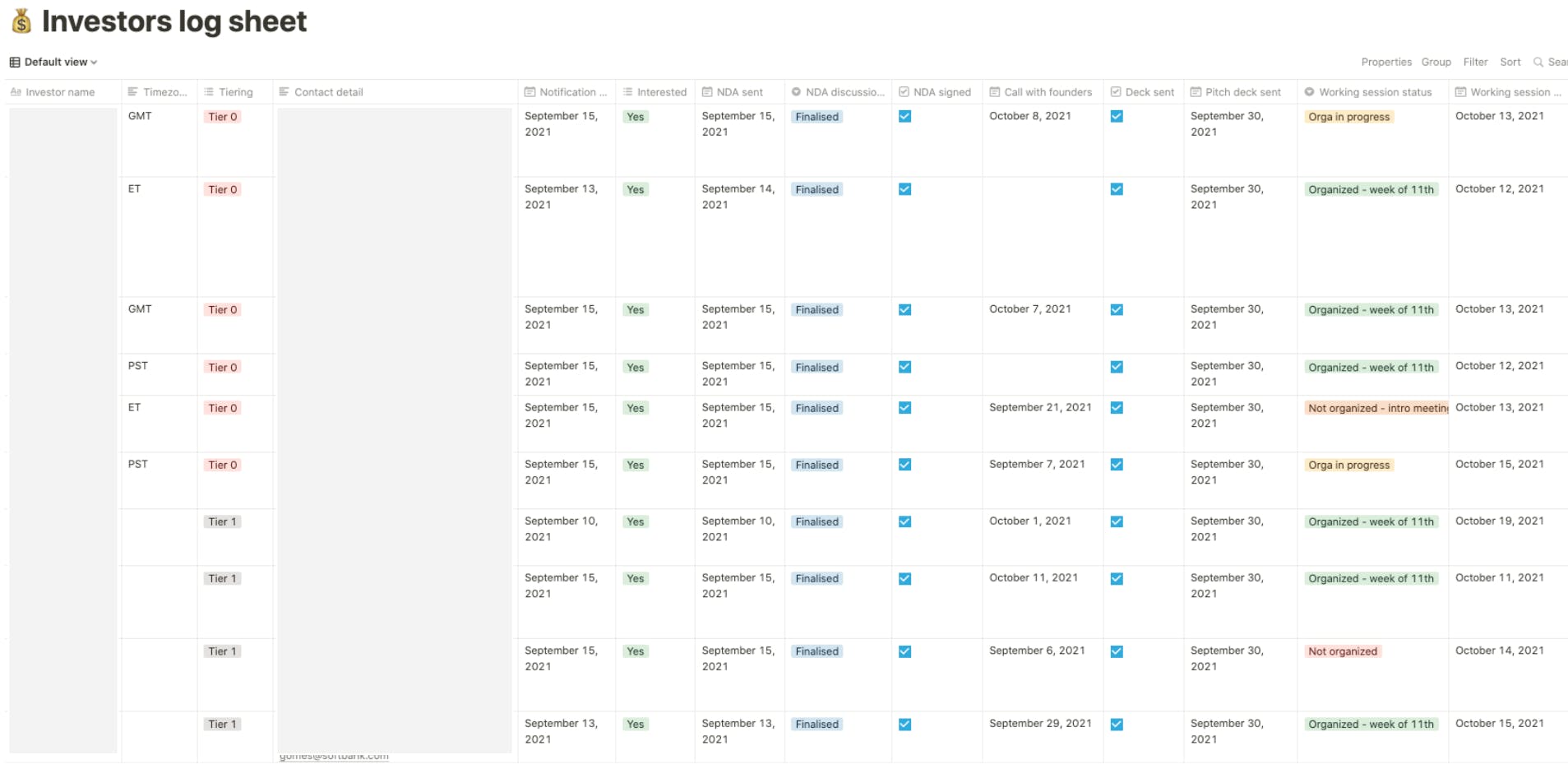

Of course, you need to be able to track all of your interested investors and all of your communications with them. This is another key part of being prepared. We structured the investor discussions in such a way that gave us excellent visibility over all the parties concerned, which you can see here:

8. Be transparent, structured and data-driven with your documents

For our Series D, we armed ourselves with five key documents to show potential investors:

- a 57-slide pitch deck created on Google slides (see below);

- a legal Data Room (read more about that in our upcoming article);

- a financial Data Pack on Excel, containing key data on the business, country breakdowns, cohort breakdowns etc;

- a very detailed business plan on Excel;

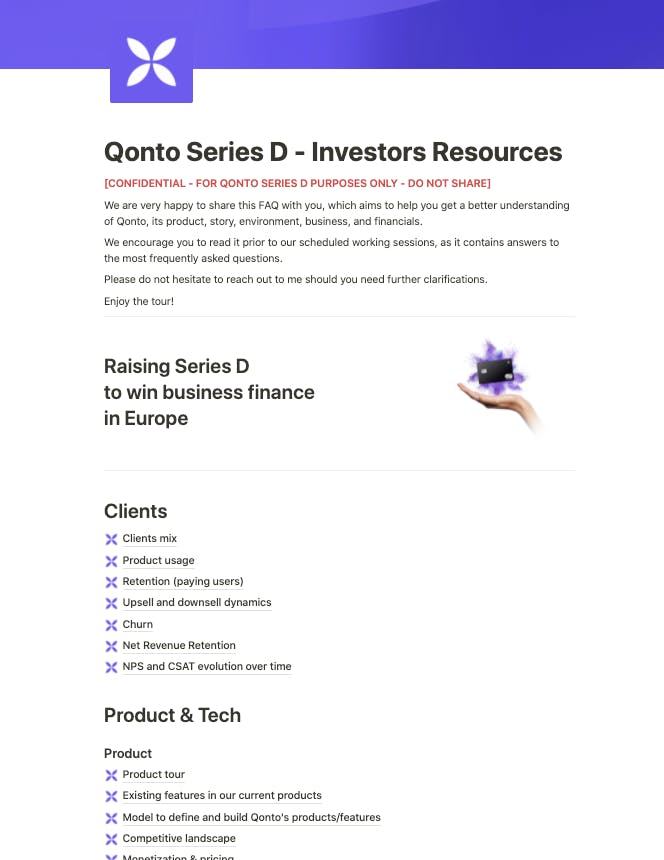

- a comprehensive FAQ document.

For the FAQs, we built a mini-website that leveraged Notion (see below). In it, we address issues such as our hiring process, how we keep the team engaged and motivated, how we’ll know when to expand to new markets, how we deal with fraud and how we choose our partners. It proved very useful in demonstrating that we are prepared and proactive. It also allowed us to put forward non-financial aspects of the company that we’re very proud of, such as our employer branding and our emphasis on diversity.

We disclosed almost everything. We had to be slightly cautious around some aspects, like our key partners and the features we’ll be launching in the near future. But transparency is paramount as it promotes trust. It shows that if you do have blind spots, you are at least aware of them and can work on resolving them.

Serious investors know the terrain inside out and will find anything you’re trying to hide. Therefore, it’s better to put all your cards on the table. Be proactive by answering investors’ questions before they even have a chance to ask them.

💡Qonto’s 8 takeaways at a glance

- Each funding round has its own specificities, with early focus on client-base growth rather than profitability.

- If each Round is different, fundraising should be seen as an ongoing process that allows relationships to blossom.

- You may want to consider whether you need a financial institution as an advisor.

- Establish an efficient timeline that clearly sets out objectives and milestones.

- Don’t raise before you’re ready, even if investors declare their interest. But don’t raise too late. Timing is paramount in a funding round.

- Develop your investor network at banking and tech conferences organized throughout the year.

- Get as many investors on board as you can to increase your bargaining power and broaden the expertise available to you.

- Be meticulous and data-driven with your documentation and always be fully transparent with potential investors.

In our next installment of articles on our fundraising strategy, we dive into the legal aspects of fundraising. Our Legal team will reveal the challenges of choosing the right external advisors and building long-term partnerships that boost your fundraising power when the time comes.

On the same topic, also read: Teamwork, prep and focus: how Qonto set a Series D funding record.