Raising funds: the perspective of Qonto’s Finance team

In previous articles in this series, we looked at Qonto’s general fundraising strategy and focused on the funding process from the perspective of our Legal team. Here, we will take a deeper dive into the contribution of our Finance team, key stakeholders in the drive to secure investment.

We’ll examine the kind of financial data needed to convince investors and how this information should be presented. There is no official template, of course, but we’d like to share what worked for us, in the event that it might also work for you.

In this article, Qonto’s VP Finance, Séverin Henry, details the output his team leveraged to make our fundraising effort a success.

As is the case in all aspects of a fundraising round, it’s all about meticulous preparation and leaving nothing to chance.

The Pitch Deck

The pitch deck is your key selling document, the shop window to your company and, as such, demands both style and substance: a good pitch deck is watertight in its breakdown of the numbers and facts; a great pitch deck gets investors excited. To make ours as visually appealing as possible, we made the most of our internal Design team to prepare attractive slides (see Qonto’s pitch deck overview below).

In terms of content, it should make explicit:

- Your company vision

- Addressable market: how big is your business opportunity?

- Your value proposition, strategy and positioning

- Your product roadmap

- Your ambition and future plan

- Your company’s financials

The pitch deck should be concise and absolutely crystal clear. You need to be prepared to go through it over and over again until your company story flows seamlessly and you know it by heart. It is important to keep iterating and revising until the story feels perfect. This should be reflected in your equity story, which is a concise summary of your pitch deck that should be linked directly to the overall story and that ought to be prepared well in advance.

An equity story lists all the compelling reasons why investors should invest in your company and should fit onto one slide. It will typically show the market opportunity, your past successes and milestones, your core competencies and differentiators compared to the rest of the market, your strategy and ambition. You should really own this piece as this will determine how you tell your story to investors.

You should adapt the content of your pitch deck to the stage of investment you’re seeking: at a seed or early funding round, the pitch deck is more about the vision; for later stage investment, it should resemble an information memorandum, with more detailed data and information.

The Business Plan

Your business plan translates the cohesive vision for the company into an actionable plan with concrete objectives and milestones. It’s a roadmap to help you achieve the business goals you have set for yourself, and helps the management - and investors - understand how you’ll reach those goals.

Ultimately, the business plan should give a projection of your 3 main financial statements: Profit and Loss statement, Cash Flow statement and Balance Sheet. These should be derived from operational metrics - the business KPIs that help investors build an informed view on how your revenue will grow.

It’s important to demonstrate how your business model generates (and will generate) revenue and profits. Also, the historical data in your business plan should mirror exactly your audited financial statements and, ideally, your internal Business Intelligence (BI) data. If there are any discrepancies, you need to be able to explain them.

Delivering on your promises is key to building trust with investors during the process. It is therefore very important to make sure you reach the numbers you forecast in the business plan during the 2-3 months of your fundraising process. You can typically include a small buffer in your business plan to make sure that all your forecasts and targets are met.

The business plan can be presented on an Excel or Google Sheet. In Qonto’s case, we used Excel as Google Sheet was not powerful enough for the quantity of data in our model.

The Data Pack

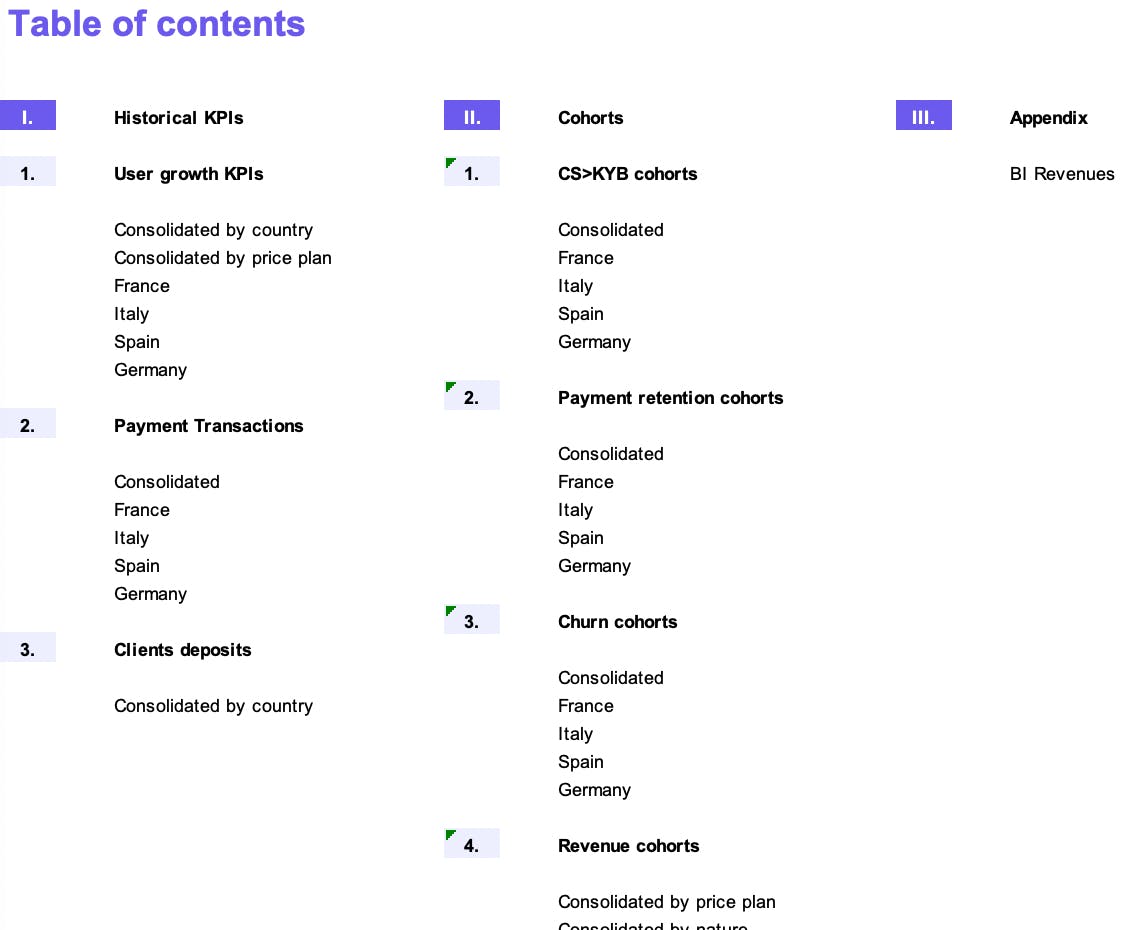

Investors will want to see detailed operation and financial information that will enable them to understand the dynamics of your business. This is where your Data Pack will come in handy.

You can share data that is relevant to your business and sector. For Qonto, that meant (see image below):

- Historical operational KPIs (client base growth, transactions, deposits etc.)

- Detailed cohort data (onboarding funnel conversion, payment retention, churn, revenue, ARPU, transactions, deposits, upgrades/downgrades...)

You should give the highest possible level of granularity (for example, by price plan, by product and by country, etc.). Also, don’t try to conceal data that suggests poor performance because you will most likely get found out. Instead, come armed with explanations and solutions for any problems you’ve identified.

Some data may be difficult to reconcile: even if, in theory, the sum of all your prior cohorts should match all your monthly data, the reality generally throws up inconsistencies. This means it’s well worth investing your time clearing any reconciliation issues before you launch your fundraising process.

You can present your Data Pack in an Excel or Google Sheet, while it’s also worth considering specialist data visualization tools such as Tableau.

FAQs

We decided we wanted to give investors upfront information that painted a picture of Qonto as a company, details that describe our culture and values rather than strictly cold, hard numbers. It’s not usual practice for fundraising companies, but it is a very useful way of pre-empting questions that investors will ask and reducing the number of follow-up questions you will have to answer.

You should choose the information that is most relevant to your company. When we were developing our FAQ list, we asked ourselves: ‘If I’d never heard of Qonto, what would I like to find out and how would I like to be told its story?’

We based our FAQs on the following pillars:

- Client base

- Product and Tech

- Growth and European Expansion

- Unit Economics

- Financial Information

- Team and Values

- Operations

- Regulatory, Risk and Compliance

We presented these FAQs on a Notion page (see below), which was more attractive from a navigation and formatting perspective. Alternatives would be a Google Doc, Word doc or PDF.

Q&As

During their Due Diligence phase and once they have digested the documentation made available to them, investors will usually ask additional questions to ensure they have an exact understanding of the business, its dynamics, and challenges. While different investors will want to emphasize different topics, their areas of interest are usually similar and will cover areas such as:

- Total addressable market and the evolution of market share

- Growth trends and future growth potential

- Scalability of the business model and unit economics

- Prospects for international expansion

It’s a good idea to answer investors’ questions in written form first, rather than orally. This way, you can easily re-use the same answers for other investors who come back with similar questions. It will also make the follow-up call more time-efficient; raising funds is a disruptive process for your company and so the process needs to be streamlined wherever possible.

Our approach was the following:

- We collected questions from investors in advance of a call (no questions = no call)

- We answered promptly in written form ahead of the call (we gave an answer within 24 hours)

- Use the call to clarify written answers (to the extent possible)

And finally, follow your own fundraising rhythm

As mentioned above, fundraising burns through a lot of internal bandwidth and it’s important to set your own pace in order to satisfy both the day-to-day running of the company as well as relationships with investors.

Don’t be afraid, therefore, to be clear on deadlines and ensure that they are respected. If you have to chase an investor up, chase them up! Sticking to your timetable is a sign of your efficiency and this, ultimately, is what you will be judged on.