If you’ve started up a new company in Germany, you have an important task ahead of you for tax purposes: preparing your opening balance sheet. You need to do this once you start making business transactions and at the beginning of each subsequent financial year. Once prepared, you then send it to your local tax office. The rules for this are set out in the Handelsgesetzbuch (German Commercial Code).

Creating an opening balance sheet: structure, content, tips

Opening balance sheet at a glance

- Companies subject to accounting requirements must prepare opening balance sheets

- This includes all assets and liabilities of a company

- It is notarized and submitted to the tax office

- The legal basis is § 242 HGB

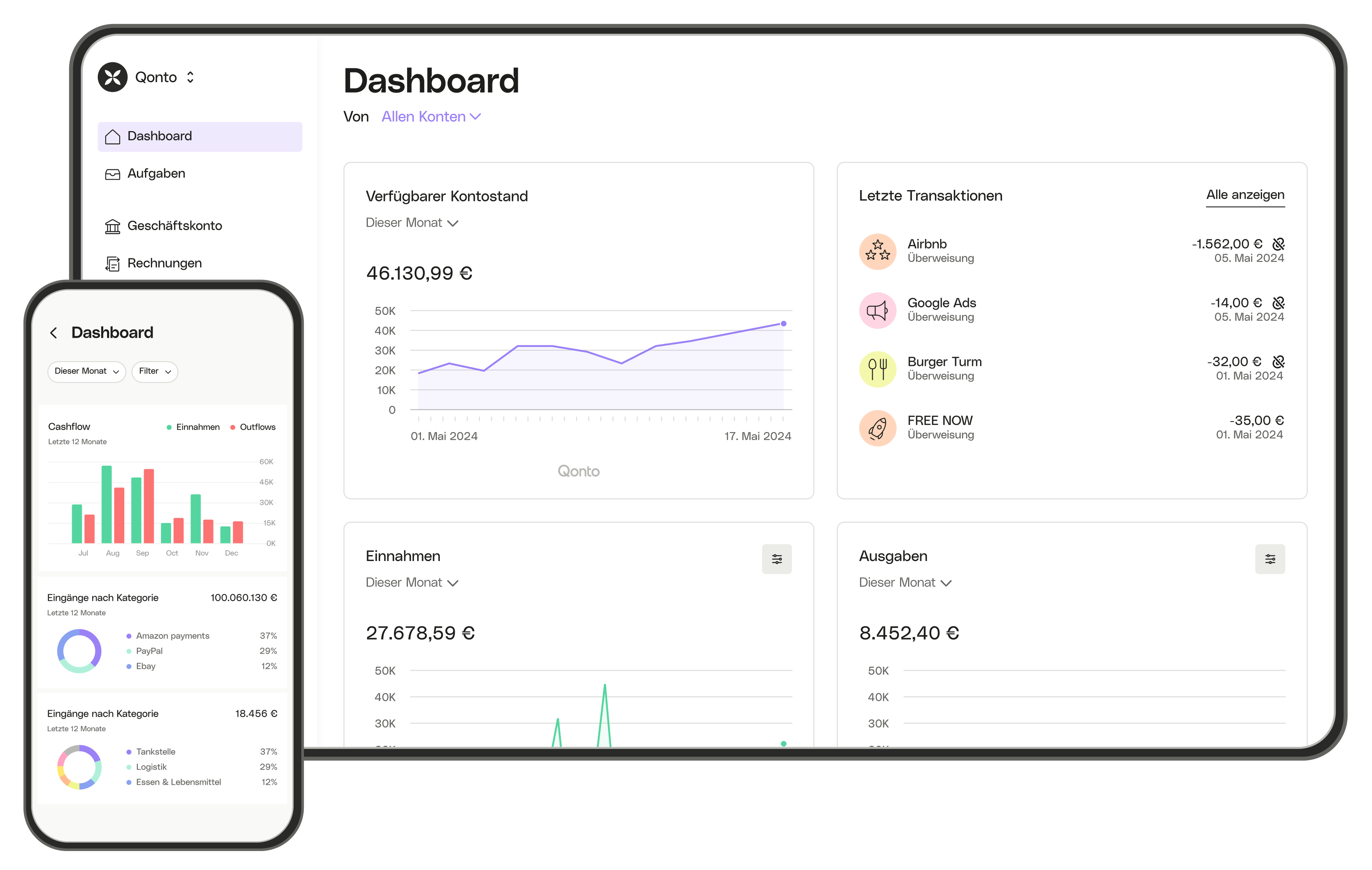

Individual cards, budgets, and full control. Get a free consultation.

4.4 on Capterra

What is an opening balance sheet?

Your opening balance sheet will list all of your company assets and liabilities. In accordance with Section 242of the Handelsgesetzbuch (HGB), if your company is required to submit a balance sheet, it must be done when you have founded your company and at the beginning of the financial year. You’ll also need to prepare one if any of these situations arises:

- Sales of companies

- Mergers

- Change of legal form

- Change of shareholders

Your opening balance sheet is your basis for proper accounting. A record of all your business-related transactions, it also serves as a comparison with your closing balance sheet. This together with your income statement will form your company’s annual financial statements at the end of the fiscal year.

Balance sheet identity: Your opening and closing balance sheets

The general rule goes like this: your previous year’s closing sheet must be identical to your opening balance sheet in the new year.

Are you required to prepare an opening balance sheet?

If your company is registered in the Handelsregister (Commercial Register) you are obliged to keep double-entry accounts (matching your assets and liabilities) and prepare balance sheets. The following company types required are listed below:

- Sole proprietorships such as registered traders (e. K) and small traders

- partnerships such as general partnerships (OHG) or limited partnerships (KG)

- Corporations such as the stock corporation (AG), the limited liability company (GmbH) and its sub-form the limited liability company (UG)

Sole proprietorships with less than €600,000 in sales in back to back fiscal years and an annual net profit below €60,000 do not have to prepare balance sheets. Freelancers may submit an income statement to the tax office and this will exempt them from the balance sheet obligation.

When is your opening balance sheet due?

So that you can compare it with the closing balance sheet, your opening balance sheet needs to be ready at the time you would normally prepare annual financial statements. Prepare your annual financial statements (in accordance with Section 264 HGB)within the first three months after the end of the fiscal year if the calendar year corresponds. In this case, you would need to prepare your sheet by March 31 of the next year.

Deadlines for startups

While there are no statutory regulations for opening balance sheets for startups, the three and six month deadlines are common:

- Medium-sized and large companies are granted a deadline of 3 months

- Smaller companies and sole proprietorships are granted a period of 6 months

If you fail to comply with these deadlines, you could face legal consequences. To avoid this, the date you need to keep in mind is the date you commence business activities. This is especially true if you establish your company in a multi-stage process–in these cases, you may commence business activities before your company is entered in the commercial register.

Gmbh and UG (haftungsbeschränkt) in formation

Your GmbH or UG will exist ‘in formation’ until you have attended the notary appointment and entered it into the commercial register. From this point on, you must record all of your business transactions in the opening balance sheet. You choose the cut-off date, given that it corresponds with your start of business operations.

Are you looking for a business account that adapts to your needs? Penta offers you the all-inclusive package.

Structure and contents of an opening balance sheet

The content and structure of your opening balance sheet will be the same as your corresponding closing balance sheet.

- Name of the company

- Place and date of incorporation

- Names of the managing directors

Once you’ve filled in the appropriate information, have the balance sheet signed by yourself and any other managing directors of your company.

Create an opening balance in 5 steps

Step 1: Set the opening balance sheet date

Complete this step by selecting the date at which your company makes its first business transaction. Remember, this may be before you enter your company into the commercial register.

Step 2: Preparation according to assets and liabilities

Assets owned under your company name must be listed in full. Divide your opening balance sheet into assets and liabilities.

- Land

- Machinery

- Transport vehicles

- Office equipment

- Technical equipment (computers, printers, smartphones, etc.)

- Licenses

Your current assets are ones used in the short-term, such as office supplies (pens, paper etc) and any raw materials.

- Equity

- Accruals

- Liabilities

Step 3: Posting to your opening balance sheet account

This is the account which contains all of your opening balances and posting records. Enter any liabilities as debits and all assets as credits.

Step 4: Further information in the opening balance sheet

When you have entered the figures into your opening balance sheet, they are supplemented with the above mentioned information on your assets and liabilities and must then be signed by management and notarised.

Step 5: Submission to the tax office

Now you’re ready to submit your opening balance sheet by mail to the tax office. This will be within either three or six months of the fiscal year, depending on the size of your company. If you would prefer, you can send your information electronically via the tax management program ELSTER. A corresponding certificate for authentication is then required.

How much does it cost to prepare an opening balance?

You can of course prepare your opening balance sheet yourself or with your co-founders and some assisting software. If, however, you believe your company is larger or more complex and you’re unsure how you should proceed, seek a tax consultant or similar expert for assistance.

Preparing an opening balance sheet – a conclusion

If your company is subject to accounting requirements, you will need to prepare an opening balance sheet for certain reasons. Your deadline will depend both on when you commence business activities and how large your company is. Exceeding these deadlines can result in serious consequences.