Just as adventurers don't embark on journeys without charting their course, successful business owners don't launch ventures without a solid financial plan. Your business plan is your map, and a solid business foundation is your destination.

Your business plan isn't just a document - it's a comprehensive financial planning tool that maps your path to sustainable growth and robust financial health.

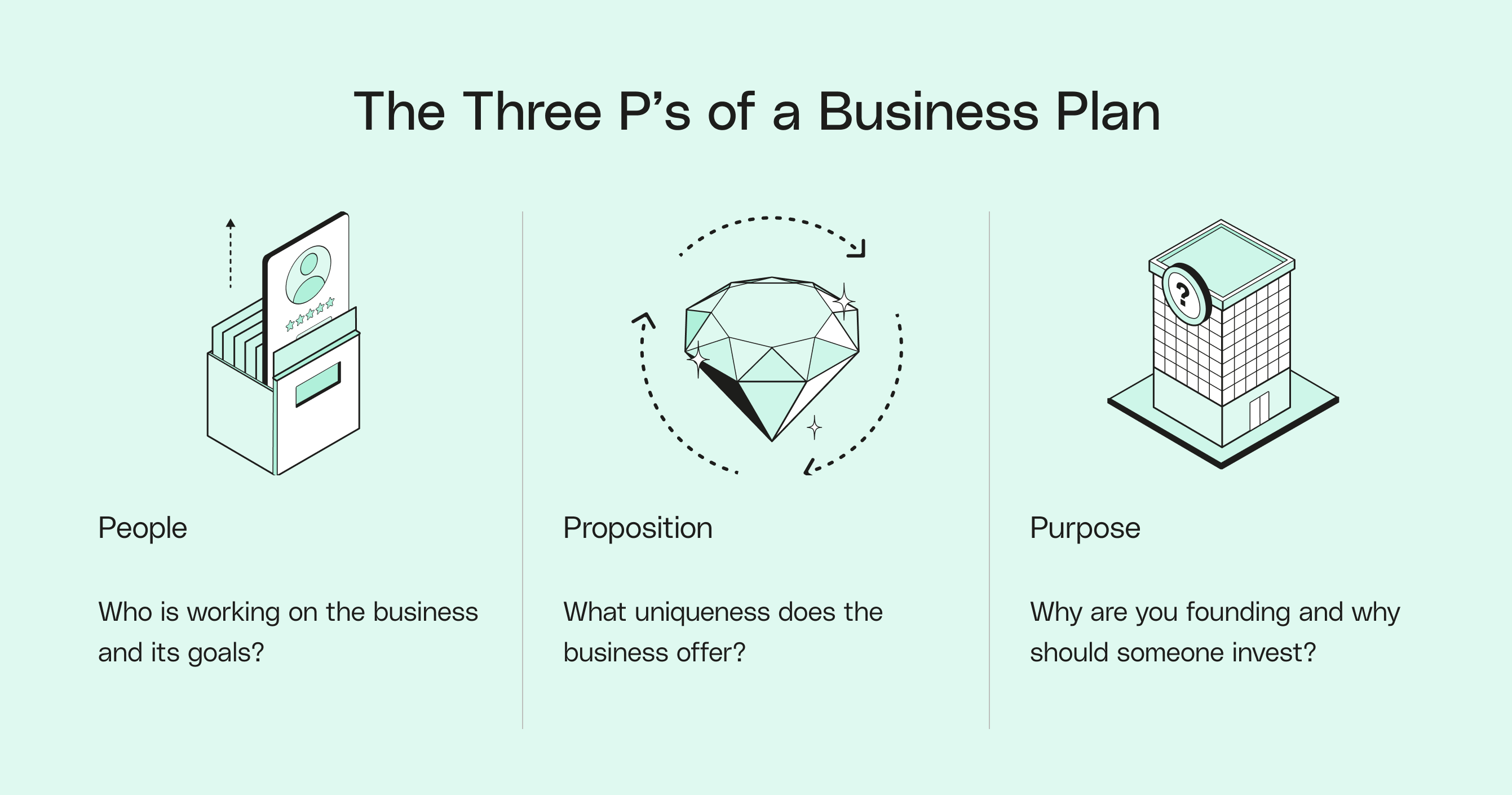

Creating a business plan has many components. You’ll need to decide what kind suits your goals, before laying out the steps required to reach completion.

To guide you through this adventure, we’ve put together a guide on how to write a business plan successfully, for you to consult so you can chart your path confidently. Read on to fully understand what a business plan is and why you should create one, which type is right for you, and how to put it together step by step.