When starting your startup, securing funding probably sounds like the least exciting part of business formation. Developing your idea, setting out your goals, and getting clients are all more thrilling parts which help you embark on your journey towards running a successful business—securing funding is the obstacle you have to clear before doing any of this.

4 ways to get funding for your new business

1. Determine what you need

The first crucial step on your path to securing funding is to reasonably determine how much you will actually need. This isn’t a time to be too ambitious or let your excitement carry you away on how much you hope you can achieve in your venture. When determining how much funding you require, take a sober approach to what you need or risk failure and becoming disheartened.

Don’t quit your day job (yet)

There’s a good chance your most reliable source of income is your current job. You can divide up a portion of your monthly paycheque and put it towards your startup fund until you feel confident you have enough to leave. It’s also a good idea to begin your startup as a side-hustle, working part-time on both jobs. This way you can get a feel for the startup life without entirely depending on it just yet.

Approach friends and family

This won’t be possible for everyone, and it may be very difficult for others. Asking for donations from friends and family means more than asking for them to trust in your venture—it means asking for them to follow through on that trust. Family members may tell you early on they’ll be happy to help you out but when it comes to handing over the cash they suddenly become reluctant.

- Business plan: The more thoroughly laid out your business plan is, the better someone is going to feel about giving you money, because it’s clear you’ve planned ahead—this isn’t just a whim

- Be reasonable with what you ask for: This goes for both asking for too much and too little. You may be initially tempted to ask for a small amount so as to not scare off who you’re asking, but asking for too little could have you needing donations are second time, which shows a lacking of planning to your donors

- Expect their input later on: Your donors not only have put their money into your business, but if they are family and friends, they care about your financial success. Don’t shun them when they ask you how things are going or reject any suggestions they give to help you out

2. Secure venture capital from investors

Obtaining venture capital requires much more planning ahead than seeking funding from family and friends. This is because while donors will choose whether or not to invest in your company by providing feedback or simply checking in, venture capital investors will play an active role, perhaps sitting on your board of directors and making decisions affecting the future of your business. Selecting potential venture capital investors requires a thorough investigation of each person who is going to be involved in your business.

What is venture capital?

First, what exactly is venture capital investing?

Venture capital vs angel funding

If angel investing is possible, you may want to consider this over venture capital. An angel investor works like a donor from your family, providing money at the early stages of your company but in this case the investor is paying for ownership equity. This means that if your company is liquidated, a percentage of your shares will go to the investors.

Securing venture capital

If you’ve decided you want to go about securing venture capital, the first thing you’ll need is a very clear business plan. This is not only to convince the investor, but also for your own sake. The better laid out your business plan is, the clearer you are making the terms of involvement to the venture capitalist, meaning later on you’re less likely to be surprised by the interference of the investor.

- Where have they invested before?

- What kind of involvement do they typically offer to companies?

- Are they interested in new companies or well-established ones?

- What kind of qualifications do they have?

- Do they specialise in your industry or more generally?

- For how long do they wish to be involved with your venture?

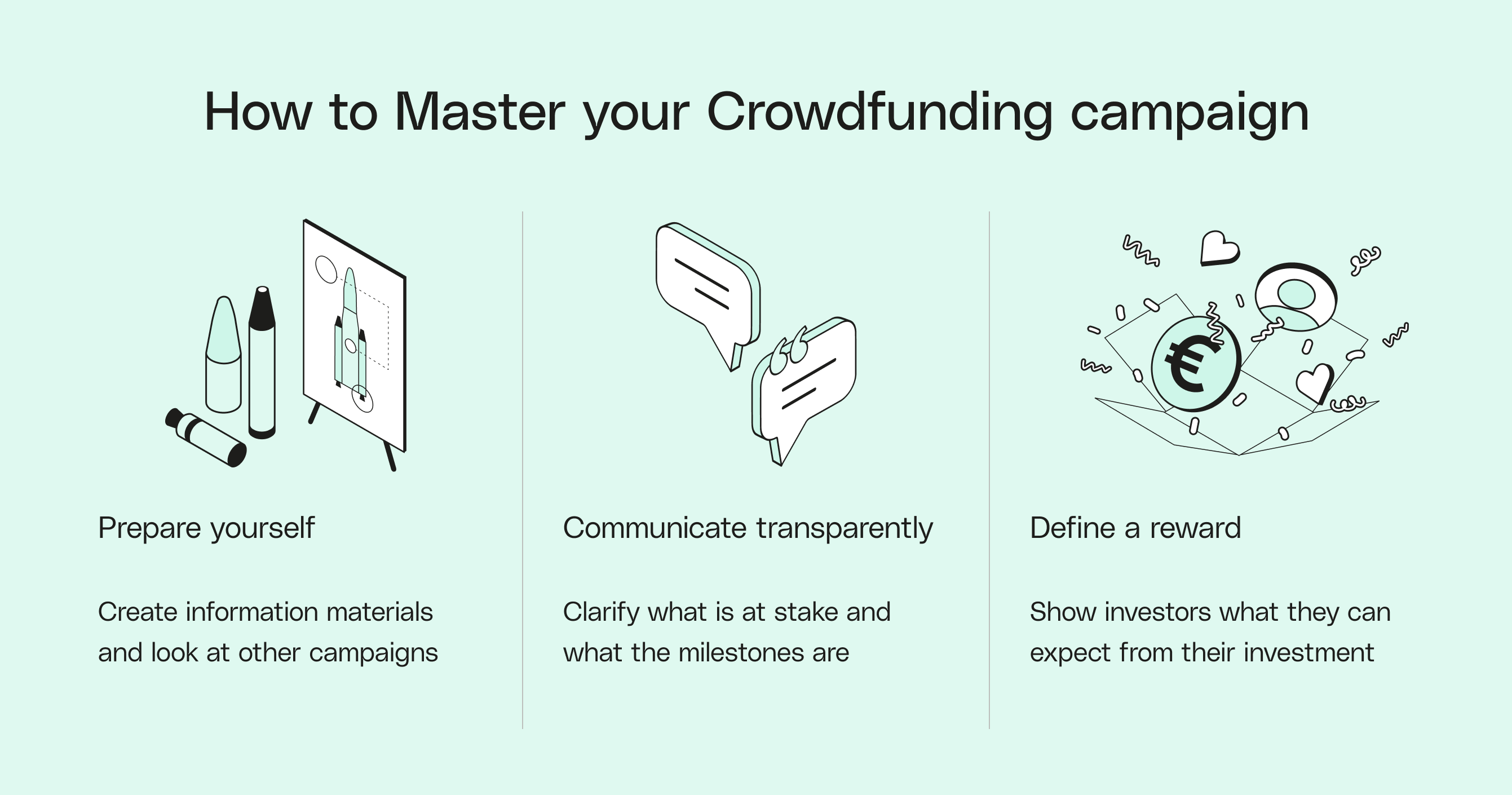

3. Use crowdfunding methods

Crowdfunding can be wonderful for business owners—if it’s possible. It’s probably the most difficult form of funding to secure because you’re essentially asking for a large pool of investors who want almost nothing in return. Crowdfunding is more like donation. Score’s survey found crowdfunding at the lowest percentage for ways entrepreneurs secured funding, at 0.8%

That said, there are different methods of crowdfunding which you can implement. Read about the options below to help decide which one fits your situation best.

- Donation crowdfunding: difficult for entrepreneurs without a public following or particularly compelling idea and business plan, crowdfunding is popular for non-profit organisations doing humanitarian work. Donors are more likely to get behind something with no financial return if they believe they are doing something good.

- Equity crowdfunding: angel investing with more investors giving smaller donations, with equity crowdfunding you are selling shares to each investor so they would be paid back after the company’s liquidation or if they wish to sell their shares at some point.

- Debt crowdfunding: with debt crowdfunding, you are borrowing money from individuals instead of taking out a loan from the bank. This may be best if you wish to have more control over your pay back terms than you would with a bank.

- Rewards crowdfunding: favoured by youtubers, Instagram influencers, and other public content creators, rewards crowdfunding offers return on investment in the form of merchandise, recognition on the channel or page, extra content, and anything else the audience may find enticing and worth their donation .

Crowdfunding and health insurance

4. Investigate small business loans and funding programmes

Depending on where you live, small business loans can be a good and safe way to begin your entrepreneurial venture. They differ from venture capital investors and crowdfunding methods because the terms are set out clearly by financial and governmental institutions, meaning the payback conditions are clear to everyone who takes out a loan and are only granted to those who will be able to afford it.

Looking for fast, easier, and fair funding for your startup? Qonto offers you lending options that suit your needs.

In Germany, there are several types of business loans and grants for the hopeful small business owner:

- Direct grants: non-repayable cash payments, direct grants are designed to offset the costs of setting up your business. The size of the grant is usually determined by the size of your business and location within Germany. Read up on the GRW cash grant here.

- Public loans: publicly-subsidised programs offered by banks, public loans have low-interest rates. They come in the form of both national public loans and federal state public loans.

- Public guarantees: a German government scheme, public guarantees are intended to encourage banks to offer loans to companies. The bank will act as a guarantor for small business owners with insufficient loan collateral and will promise to repay the lender if the owner is unable to. They cover up to 80% of the loan amount.

- Equity capital: lastly, some public sources will provide equity capital to small businesses and in 2016 over 900 million euros was provided to small businesses this way. Some providers include High-Tech Gründerfonds (HTGF), Coparion, and Mittelständische Beteiligungsgesellschaften.

What to consider in business financing

While all of these methods provide opportunities for you to fund your venture and start your business on a strong financial foundation, each one comes with risks and things to consider. Below are some of the top things to consider in each of the ways to get funding for your business:

Determine what you need

- Avoid being too ambitious

- Keep your job and consider starting your business as a side hustle

- Approach family and friends with a clear business plan and expect their input

Secure venture capital from investors

- Thoroughly research investors and venture capital firms

- Lay out your terms and business plan clearly to each investor

- Expect to lose some control over your business decisions

Use crowdfunding methods

- Consider all crowdfunding methods

- Use whatever public following you have to help gain funding

- Offer incentives for crowdfunders

Investigate small business loans and funding programmes

- Look at all the business loans on offer in your country of business

- Consider how they differ from venture capital investing and crowdfunding methods

- Present a clear business plan to any government backed or public funding institution

Financing your business may not be the part of running a business you look forward to, but it can ease the process to learn that there are many options for financing available. Spending time to do the research and decide which methods work best for you will enable you to approach it and pick the best financing option for you and your business. Hopefully this blog post has demonstrated the many ways to get funding for your business.

- Keep your day job until you can comfortably quit, and approach family and friends for donations

- Consider the differences and possibilities between venture capital and angel investing

- Research venture capital firms and interview investors

- Look at all the different types of crowdfunding to decide which is best for you

- Examine the funding programmes and loan offers in your place of business