FREELANCERS 8 mins

Here’s our latest selection of articles on running your business effectively with minimal fuss.

Last update: November 21, 2025

Here’s our latest selection of articles on running your business effectively with minimal fuss.

Last update: February 02, 2026

FREELANCERS 8 mins

FREELANCERS 6 mins

TRENDS AND NEWS 8 mins

BUSINESS CREATORS 11 mins

SMES 11 mins

Here are all our essential tips for getting your business project off the ground.

BUSINESS CREATION 7 mins

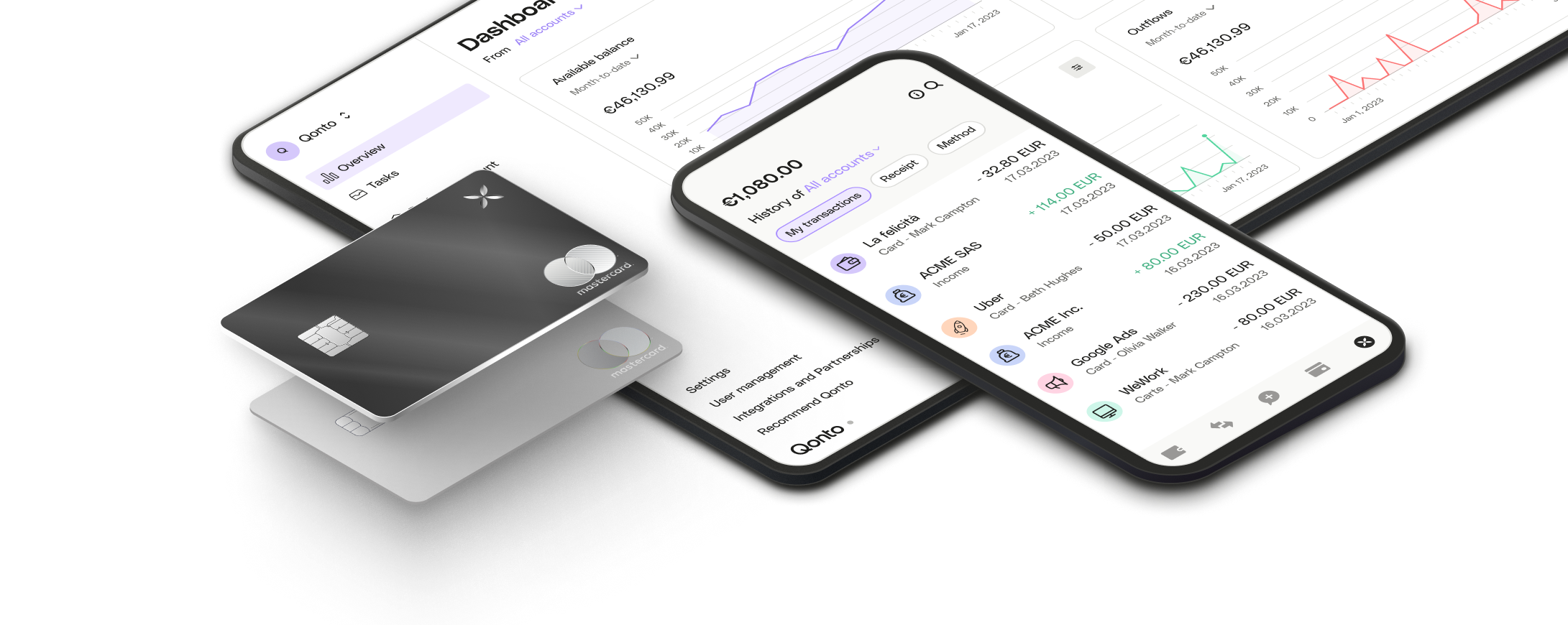

QONTO BUSINESS ACCOUNT 8 mins

Whether it's to examine the specific needs of your business, or to go over the benefits of Qonto's tools and features, we're here for you.

30-day free trial.