Freelance registration that's simple & swift

- Want to go freelance in Germany? Register for free and get your Finanzamt tax ID with no fuss.

- Guided sign-up in English – 100% online, with clear & jargon-free explanations.

- Open a business account stacked with tools to manage invoicing, expenses and bookkeeping.

4.8

Become a freelancer in 3 easy steps

How to register as a Freiberufler with the Finanzamt.

Fill out the online form

Simply enter your details into a clear, easy-to-follow form. We'll securely forward your tax registration to the Finanzamt for you.

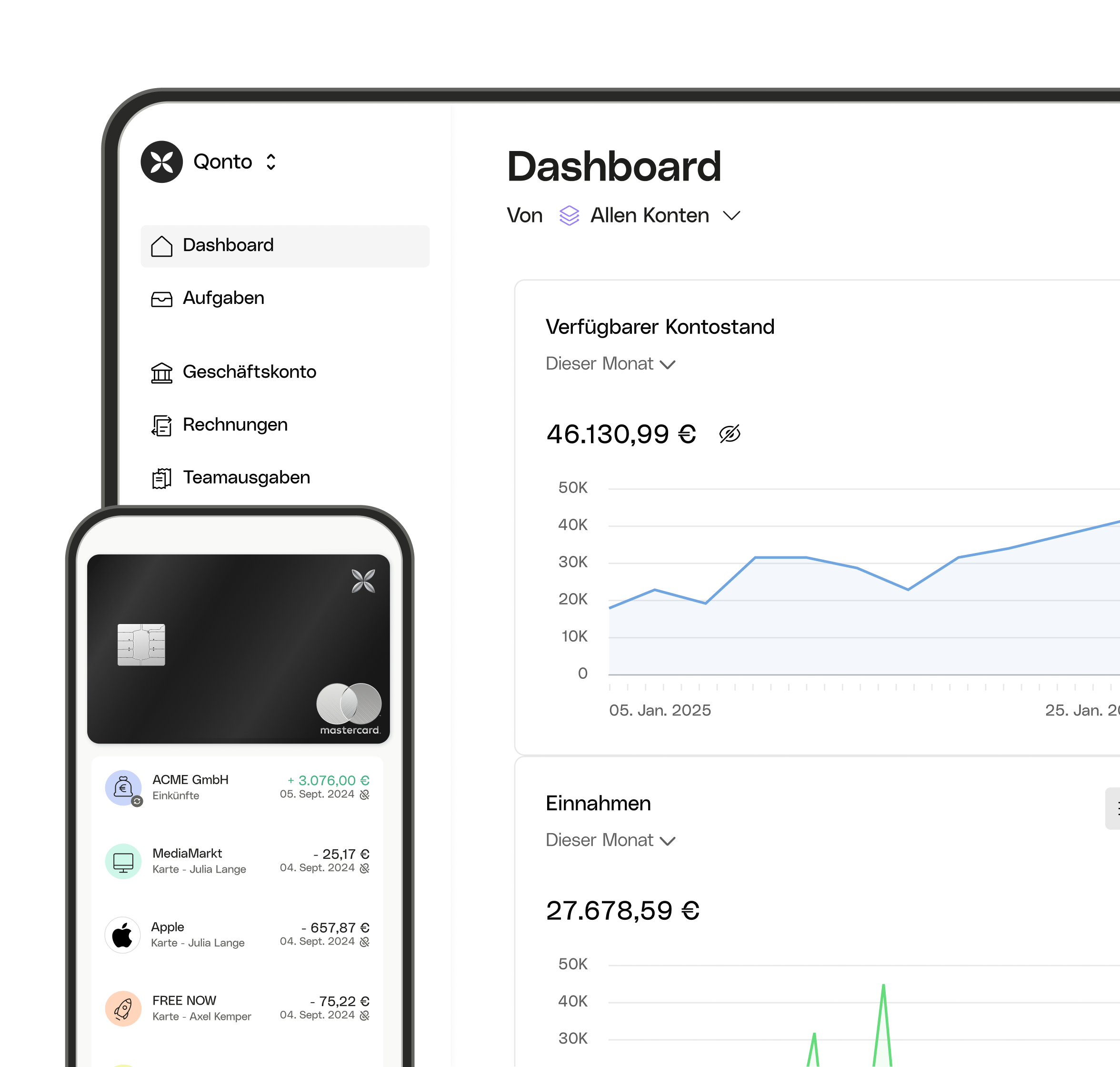

Open a business account

Try Qonto's business account for free for 30 days - no strings attached. Banking, accounting and invoicing in one intuitive app.

Get your tax ID

You'll receive your tax ID by mail in around 4-8 weeks. Once it arrives, your account's active and you're free to freelance!

Fill out the online form

Simply enter your details into a clear, easy-to-follow form. We'll securely forward your tax registration to the Finanzamt for you.

Open a business account

Try Qonto's business account for free for 30 days - no strings attached. Banking, accounting and invoicing in one intuitive app.

Get your tax ID

You'll receive your tax ID by mail in around 4-8 weeks. Once it arrives, your account's active and you're free to freelance!

Fill out the online form

Simply enter your details into a clear, easy-to-follow form. We'll securely forward your tax registration to the Finanzamt for you.

Open a business account

Try Qonto's business account for free for 30 days - no strings attached. Banking, accounting and invoicing in one intuitive app.

Get your tax ID

You'll receive your tax ID by mail in around 4-8 weeks. Once it arrives, your account's active and you're free to freelance!

Free

Guided registration with the tax office (Finanzamt)

Free

- Simplified online tax ID forms

- Explanations in clear English

- No need to sign up with ELSTER

- Free trial of our business account

Test for free

Business account & money management tools

Test for free

- Manage business money separately

- Make & receive fast, easy payments

- Create & send invoices from the app

- Cut the time spent on finance admin

Registering as a freelancer in Germany - what you need to know

Why a business account is a game changer

- Boost efficiency: Enjoy seamless invoicing, receipt handling, & expense management.

- Clarify finances: Keep personal & business funds separate, and keep control.

- Get a professional edge: Gain client & partner trust with a dedicated business account.

A smart business account, built for freelancers

What our customers say about Qonto

What our customers say about Qonto

Simple online freelance registration. The way it should be.

Register as a freelancer and get your business off the ground with a Qonto business account.