Get a business loan online with Qonto

Apply for your business loan quickly and 100% online through our partners. Get funding between €500 and €1 million paid directly to your Qonto account.

Access up to €50,000 immediately, which you can repay in three instalments to cover your invoices.

Custom loans for your business

Custom loans for your business

- Fund long-term projects up to €1 million.

- Submit your loan application 100% online and get a response in 48 hours.

- Our partners are customer-focused, digital, and specialized in business financing.

Fuel your business growth

Up to €1 million

Flexible funding for medium to long-term projects.

Tailored for you

Our specialized partners craft financing plans for your business needs.

Fast & direct

Apply for loans on Qonto and receive them directly in your account.

Financing partners to help you thrive

Financing type

Amount

Repayment period

Interest rate

Payout time

Required time in business

Company location

Accepted legal forms

Legal requirements

Special conditions

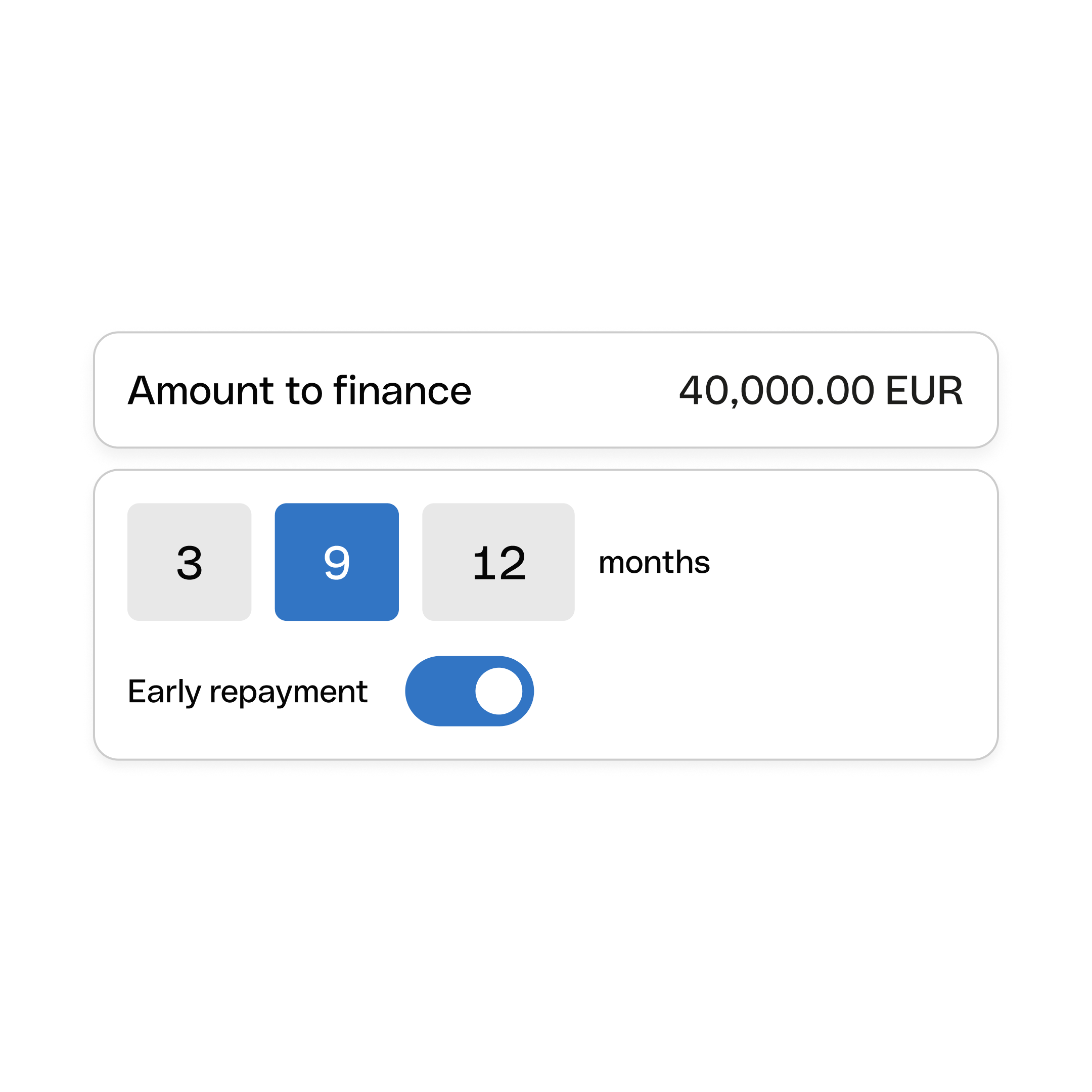

Invoice financing: buy now, pay later

Get up to €50,000 in your account to finance your invoices — repay flexibly in 3, 9, or 12 instalments from 0.62% monthly. The app shows repayments and remaining balance; limit and eligibility checked monthly.

Grow faster with healthier cash flow

Secure business credit with Qonto

Deposit protection

Your deposits are fully protected in accordance with current regulations.

Regulated financial institution

Qonto is regulated by both BaFin and ACPR, so you're always in safe hands.

Human support in English

Our team answers your questions in English and German, seven days a week by phone, email, and chat.

Credit & financing, covered

Credit & financing, covered

- Open your business account with a German IBAN in just a few clicks.

- Track your cash flow in real time, anytime, anywhere.

- Pay with physical or virtual Mastercard cards.

- Make Instant SEPA and international SWIFT transfers in 30+ currencies.

Frequently asked questions about business financing

*Pay later is a financing offer from Qonto (Qonto SA). Borrow up to €50,000 for your invoices, with no down payment and with a monthly nominal rate starting from 0.64%. Repay the invoice amount plus interest (tax included) in three, nine, or twelve equal instalments, to be debited automatically from your Qonto account starting one month after your purchase. Eligibility is re-assessed on a monthly basis; you can check if you’re eligible by clicking on Pay later in the Financing section. Activating the Pay later feature is risk-free and non-binding. Signing the Pay later contract does not oblige you to use it, and there are no charges for non-use. More information is available in our Help Center.

**Qonto does not recommend any particular partner, nor does it guarantee or grant financing. Choose a partner based on your needs, their eligibility criteria and your ability to repay. Qonto is not responsible for any losses you may incur as a result of taking out a loan and plays no role in the underwriting process or the evaluation of your applications. Nothing on this page or in the Financing section should be construed as financing or investment advice.