Company creation made fast and simple

Register as self-employed for free, in plain English

Want to be your own boss? Get up and running fast as a freelancer (Freiberufler) or sole trader (Gewerbetreibende).

Free

Guided registration with the tax office (Finanzamt)

Free

- Simplified online tax ID forms

- Explanations in clear English

- No need to sign up with ELSTER

- Free trial of our business account

Test for free

Business account & money management tools

Test for free

- Manage business money separately

- Make & receive fast, easy payments

- Create & send invoices from the app

- Cut the time spent on finance admin

Qonto's business account plans

Basic

From

€9

/month (excl. VAT)

Included in the Basic plan

- 1 account with German IBAN

- 30 transfers or direct debits per month

- 1 business Mastercard

- Unlimited invoices

Smart

From

€19

/month (excl. VAT)

Included in the Smart plan

- 1 account & 1 sub-account with German IBAN

- 60 transfers or direct debits per month

- 1 business Mastercard

- Unlimited invoices

- Accountant access

Premium

From

€39

/month (excl. VAT)

Included in the Premium plan

- 1 account and 4 sub-accounts with German IBAN

- 100 transfers or direct debits per month

- 1 business Mastercard

- Unlimited invoices

- Accountant access

- Unlimited team members

Four easy steps to self-employment

Fill out the online form

Complete all the information the tax office (Finanzamt) need - with straightforward guidance available in English.

Open a business account

Open a Qonto business account online and test all features for 30 days for free and without obligation.

Upload your tax ID

The tax office will send you your tax ID number by post - usually within 4-8 weeks.

You're in business!

With your account activated, you're free to start your self-employment journey.

Fill out the online form

Complete all the information the tax office (Finanzamt) need - with straightforward guidance available in English.

Open a business account

Open a Qonto business account online and test all features for 30 days for free and without obligation.

Upload your tax ID

The tax office will send you your tax ID number by post - usually within 4-8 weeks.

You're in business!

With your account activated, you're free to start your self-employment journey.

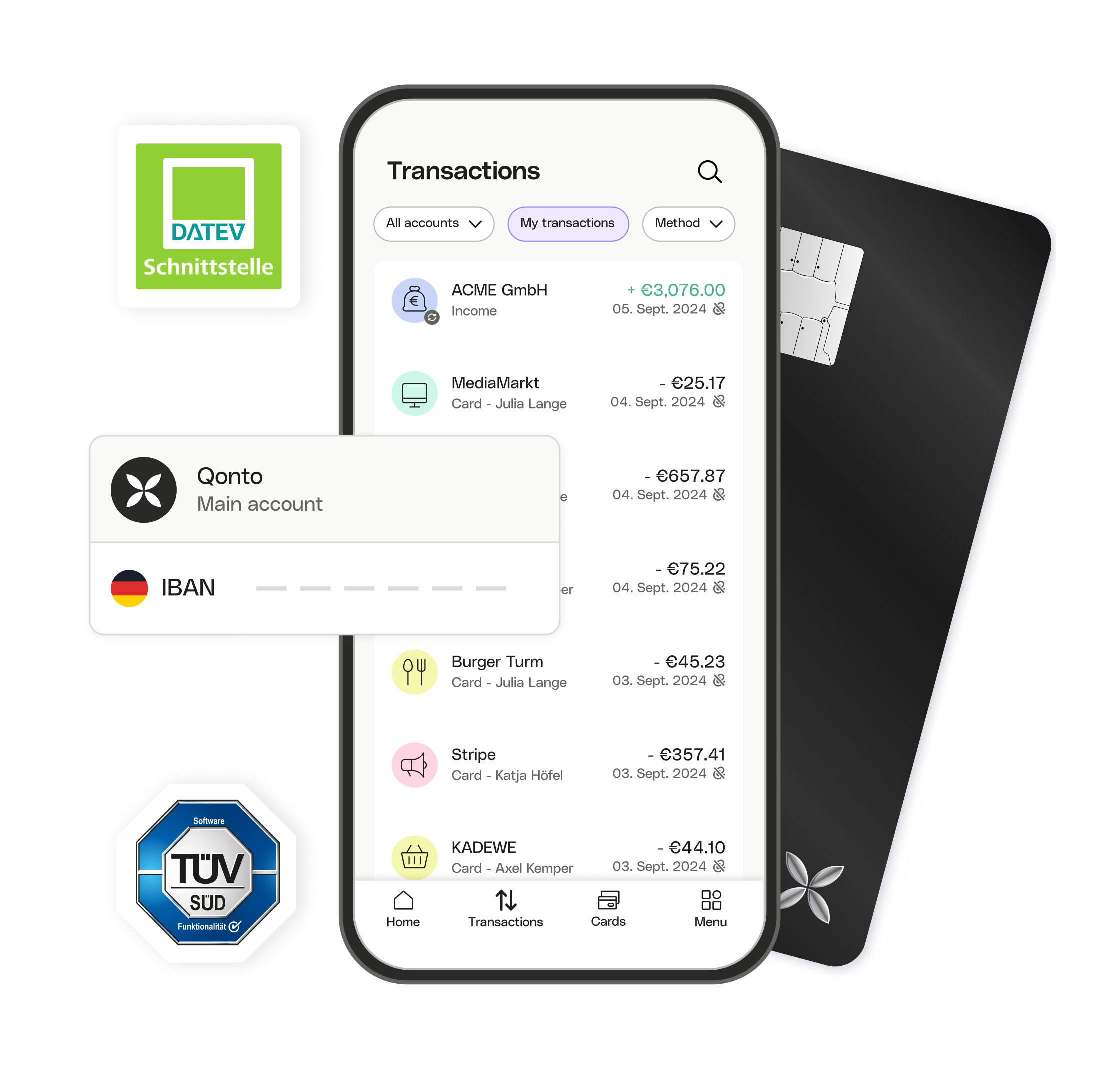

All your business finances in just one platform

A business account you’ll love using

Opening your account is fast, simple and 100% online

All accounts come with a German IBAN and free Mastercard included

Virtual and physical cards allow you to handle expenses easily

A real-time overview of all transactions gives you full account visibility

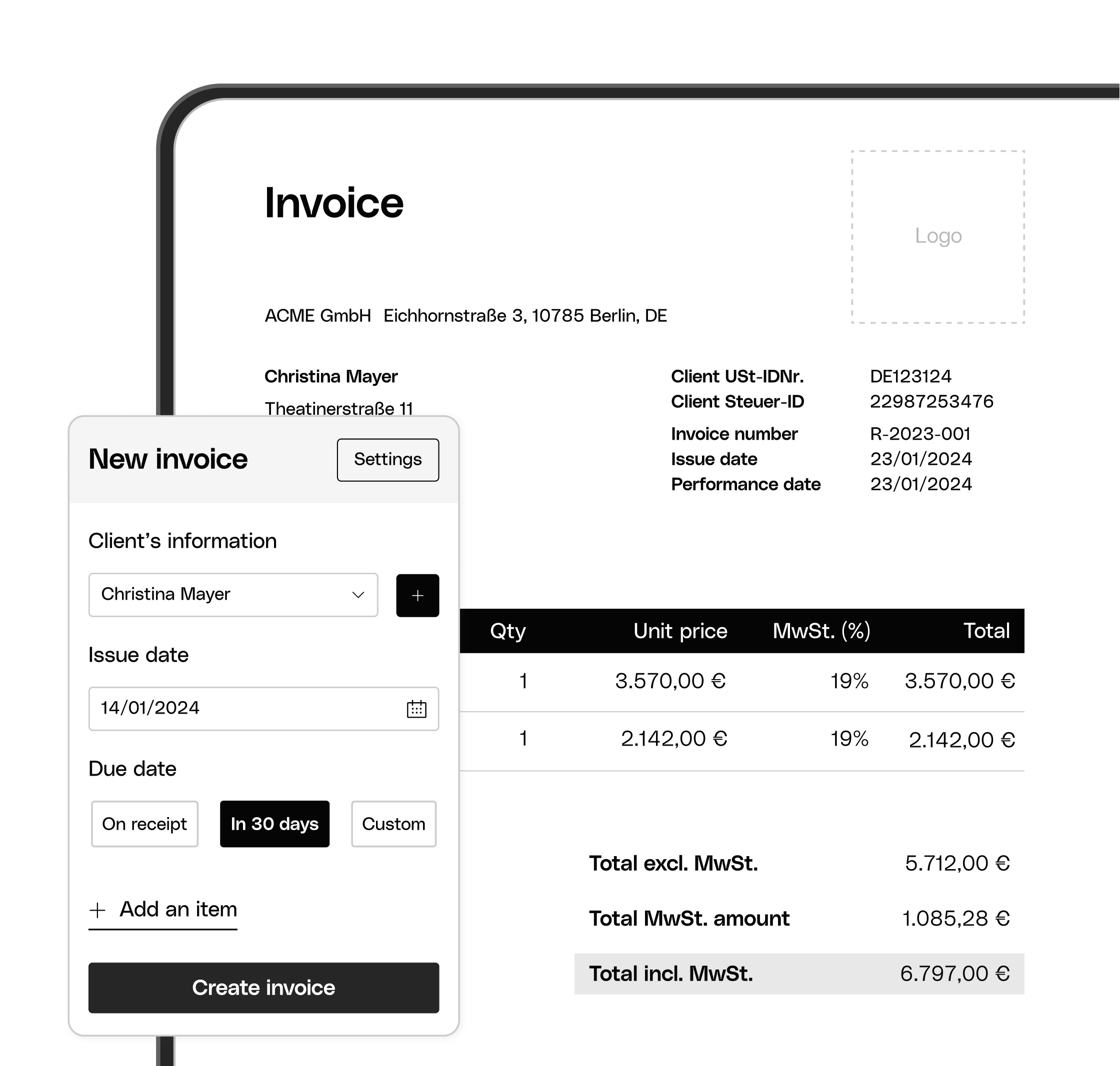

All your invoicing, in one place

Create quotes and cost estimates directly in the Qonto app

Convert them into billable invoices in one click

Embed payment links to help clients pay you faster

Centrally manage and track all invoices

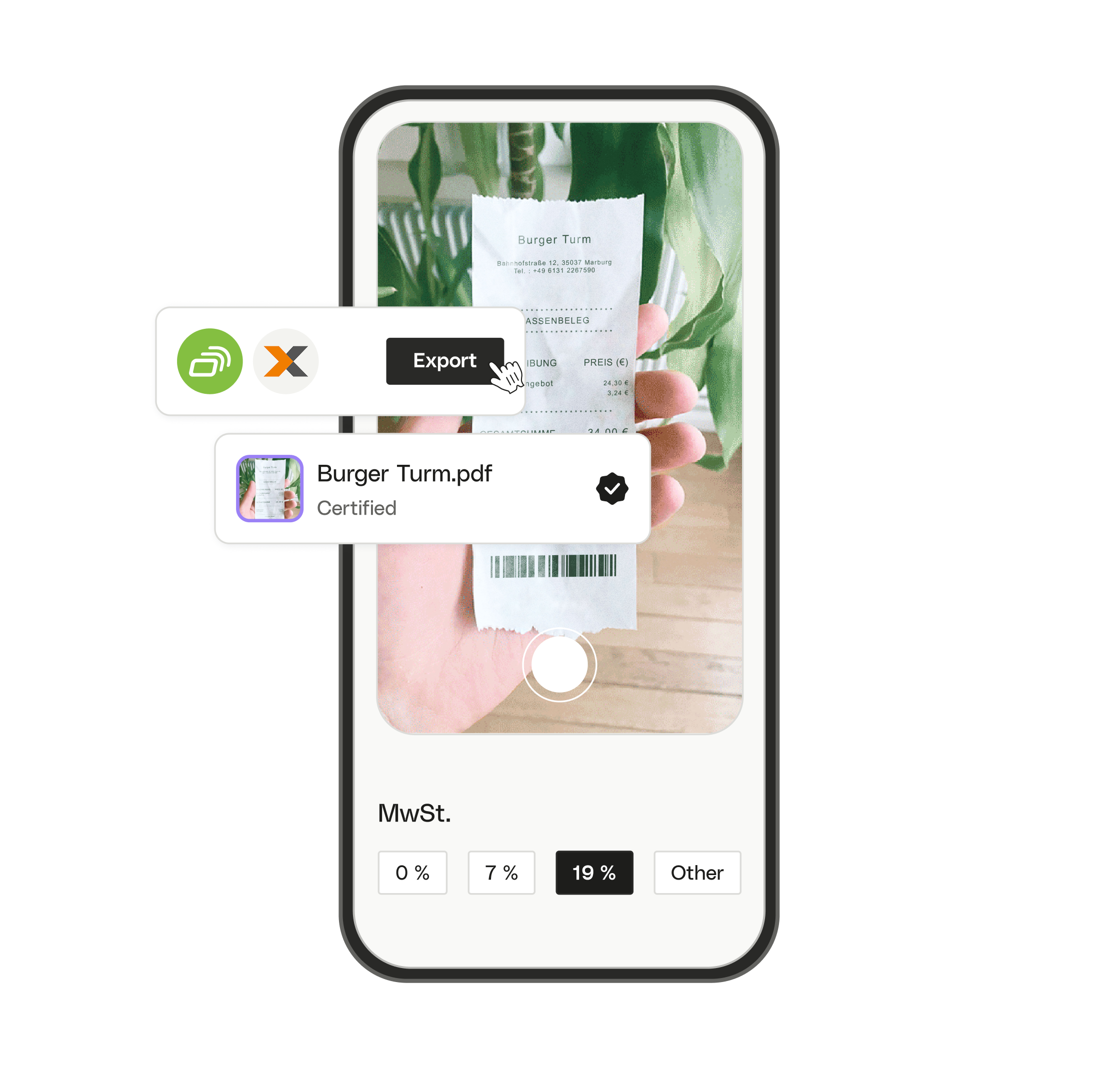

Simplify the paperwork whenever you spend

Just scan and upload receipts via your app on mobile

Qonto automatically matches receipts to their corresponding transactions

Archive all receipts in full compliance with GoBD

Prepare your accounting in just a few clicks

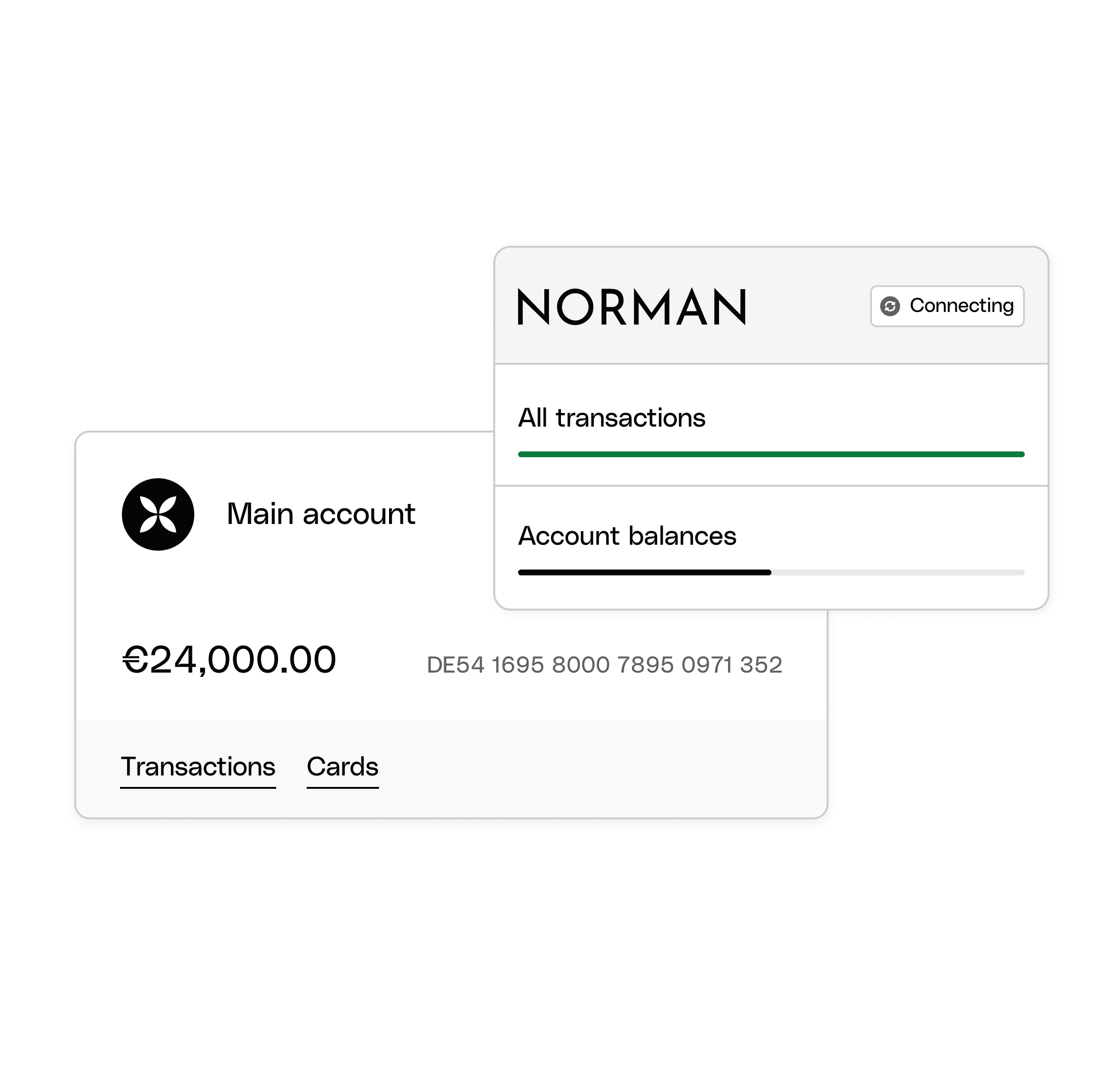

Automate filing your tax returns

With our NORMAN integration, your tax returns will be filled out automatically

Create income tax, profit and loss and VAT statements quickly and easily

Qonto will automatically recognize your income and expenses

Payments can be transmitted directly from your Qonto account

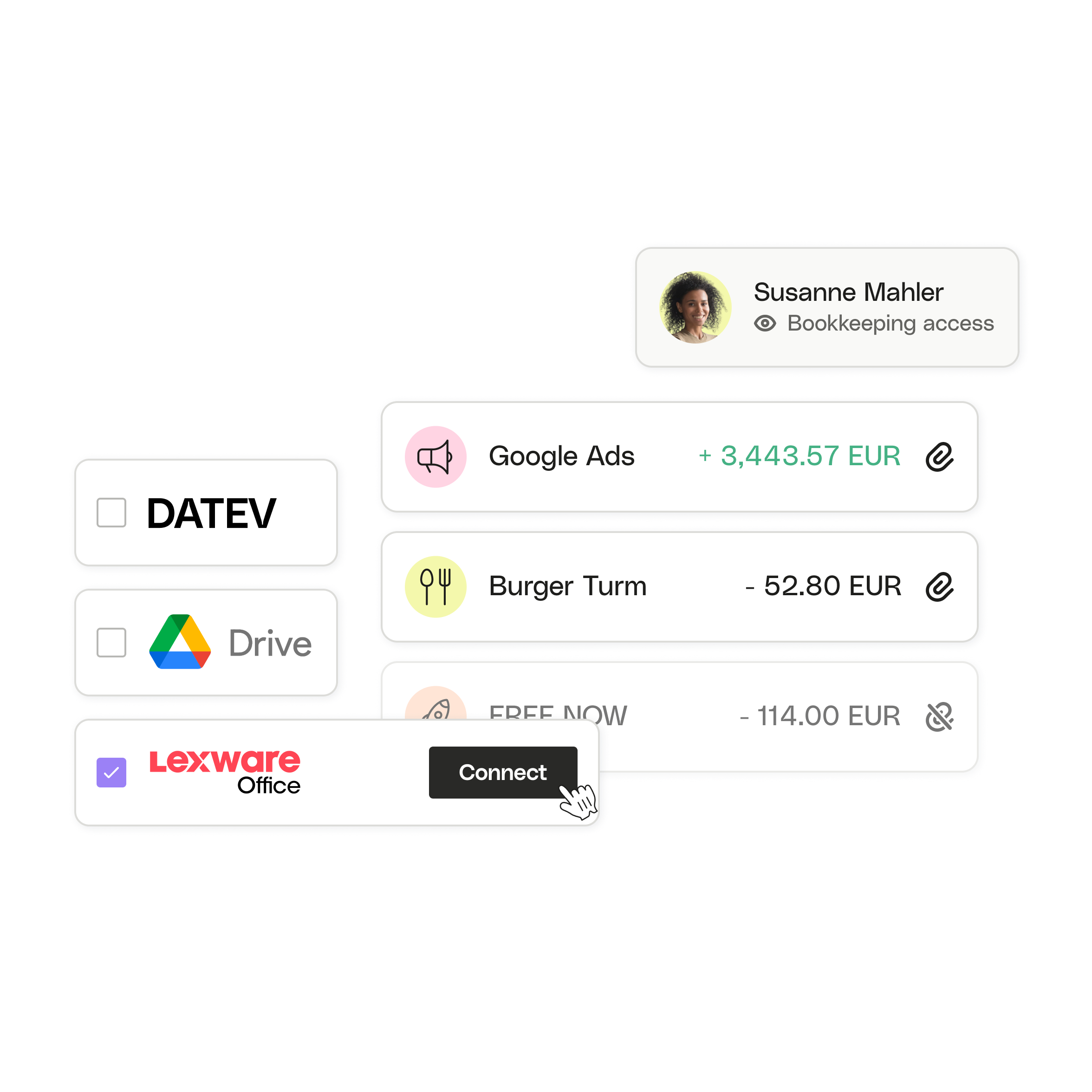

Automations that do jobs for you

Direct connections to DATEV, sevdesk, and Lexware (available from the Smart Plan)

Automatic transfer of all bookkeeping data

No more manual data entry needed

Smoother collaboration with your tax office

Understanding self-employment in Germany

Ready to be your own boss?

Register as self-employed with the German tax office.

Our customers say it best

Our customers say it best