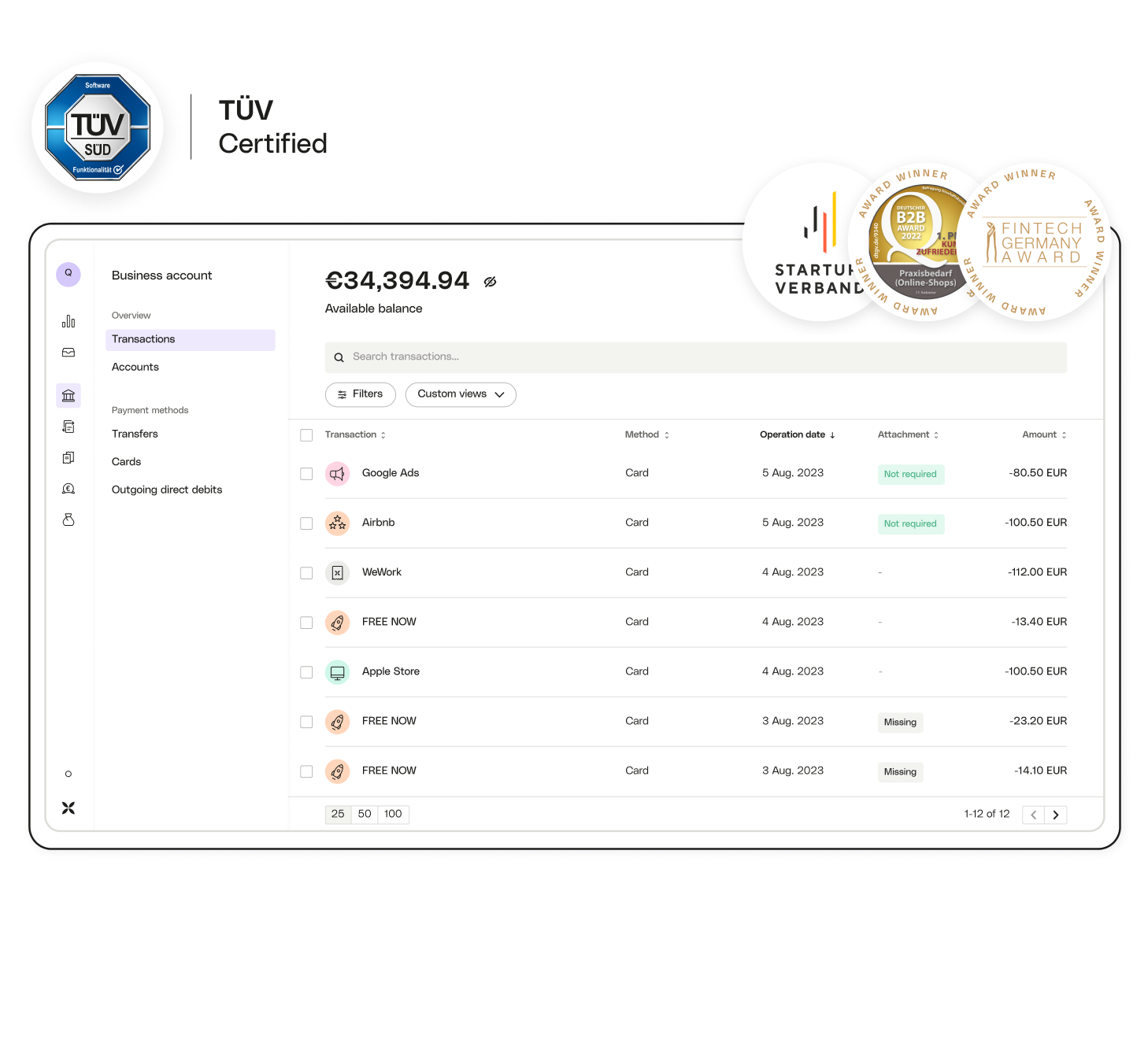

The all-in-one business account for your startup

Open an online account for your startup in just 10 minutes. Get access to bookkeeping and invoicing tools, best-in-class customer service, flexible payment methods, and an intuitive app for real-time cash flow control. Anytime. Anywhere.

An award-winning product

- Finance management made easy: track your sales in real-time, completely online

- Sub-accounts with German IBANs: manage your cash flow in just a few clicks

- Flexible plans starting at €9/month: pay for what you need- whichever way you grow

- No hidden fees: fair, transparent pricing with no obligations

Finance management at your fingertips

A secure, intuitive app

German IBAN

Multi-layered security

Fast Bank Transfers

Paperless admin

Digital bookkeeping

- Less paper, more work. Scan and store GoBD-compliant receipts directly on your app

- Categorize expenses using customizeable tags

- With Integrations and Partnerships, synch your key account information with tools like FastBill, Slack, Zapier, and more

- Give your accountant dedicated read-only access to your account data

Your money is safe with us

- Deposit protection: Your deposits are protected according to the applicable rules and regulations.

- Regulated financial institution: Qonto operates under the joint supervision of BaFin and the ACPR (French Prudential Supervision and Resolution Authority).

- Always up to standard: our security protocol is regularly audited by external specialists to make sure your account is safe

Fully customizable cards

- Physical or virtual, in-store or online… even make contactless payments quickly and securely with Apple Pay and Google Pay.

- Create as many cards as you need for your team - while staying in control of spending. Set payment limits and track expenses in real-time from your app.

- One, Plus, or X Card: spend up to €200,000 and enjoy greater peace of mind with premium insurance and exclusive perks

Qonto: with you every step of the way

Company creation

Open a Qonto account for your startup online and deposit your share capital in just a few clicks. Have a question? We’re available 7 days a week via chat, phone or email.

Admin setup

Save time with paperless bookkeeping tools and by connecting your favorite tools to your Qonto account.

Ongoing growth

Set yourself up to scale. Organize cash flow with sub-accounts, set payment limits on cards and transfers, and manage your customer invoices using our integrated invoicing tool.

Company creation

Open a Qonto account for your startup online and deposit your share capital in just a few clicks. Have a question? We’re available 7 days a week via chat, phone or email.

Admin setup

Save time with paperless bookkeeping tools and by connecting your favorite tools to your Qonto account.

Ongoing growth

Set yourself up to scale. Organize cash flow with sub-accounts, set payment limits on cards and transfers, and manage your customer invoices using our integrated invoicing tool.

Creating a company? Choose the right legal form

Check out our business account comparator

Pay as you grow

Essential

Starting from

€49

/month (excl. VAT)

Simplified banking for teams, with built-in spend management, bookkeeping and cash flow tools.

1-month free trial

Business

Starting from

€99

/month (excl. VAT)

An integrated finance management solution that adapts to your workflows, with exclusive support.

1-month free trial

Enterprise

Starting from

€199

/month (excl. VAT)

The ultimate finance workspace for teams, with the highest limits and exclusive support.

1-month free trial

Add-ons

Take your plan further

Customize your business account with finance Add-ons to meet your company’s unique needs.