Open your new business account with Qonto

- Secure, online and with no hidden fees.

- Open your account in 10 minutes. You’ll be ready to register in the Handelsregister within 72 hours.

- Get top professional legal advice from Firma.de

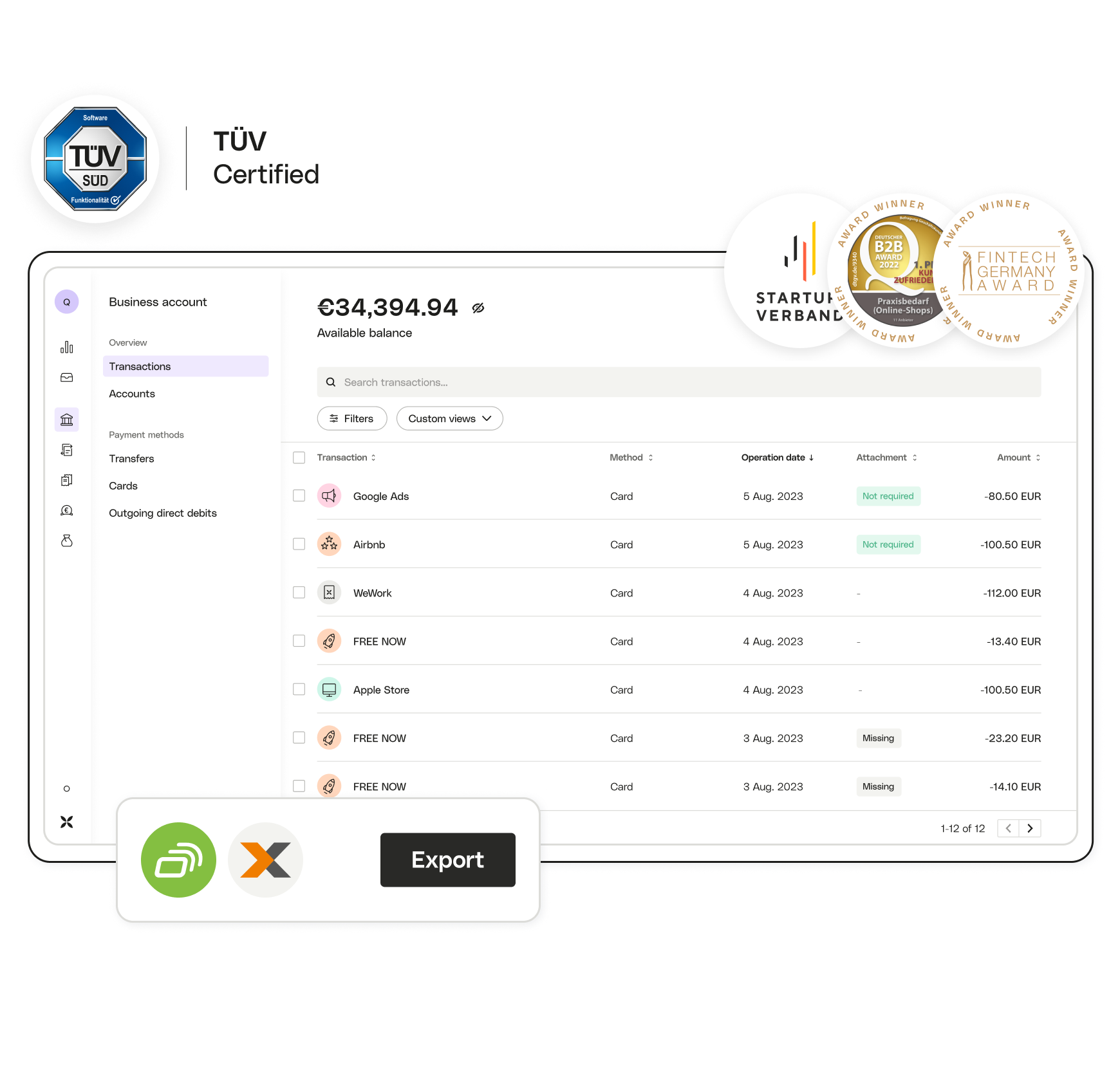

The award-winning account for new business founders

- Get a German IBAN in a just few clicks. Make managing day-to-day finances simple.

- Free payment cards included in all our plans. Set your own payment limits.

- Pay for what you need. Whichever way you grow. From just €9/month.

- Customer service by phone or email. We’ll get your questions answered within 15 minutes.

Basic

Starting from

€11

/month (excl. VAT)

+ 69€ one-off deposit fee

Get your business started: an account with built-in invoicing tools for simple day-to-day finances.

Billed monthly

Smart

Starting from

€23

/month (excl. VAT)

+ 69€ one-off deposit fee

Advanced business banking, invoicing and bookkeeping tools, and direct accountant access.

Billed monthly

Essential

Starting from

€59

/month (excl. VAT)

+ 69€ one-off deposit fee

The complete finance management package for company co-founders.

Billed monthly

Company creation: which legal form should I choose?

Your finances are in safe hands

Qonto is an independent payment institution with its own core banking system. We guarantee the security of your business account.

Your funds are secure

A regulated institution

Cyber-secure. At all times.

Any questions about how to set up your business?

- Get customized advice at every step of the process.

- Set up your company safely, quickly & 100% online.

- Tap into a wealth of expertise and experience.

- Your initial consultation is absolutely free.

Open your business account in 3 quick steps

Submit your information

Securely upload your incorporating documents and list any shareholders. We can validate your request within 24 hours.

Deposit your share capital

Transfer your share capital to your account using a temporary IBAN. We’ll verify your deposit and issue an account statement for your notary within 24 hours.

Finalize your company's registration

Your company will be registered in the German Handelsregister commercial register. Just upload your Handelsregisterauszug certificate to the Qonto app and your account is now active.

Submit your information

Securely upload your incorporating documents and list any shareholders. We can validate your request within 24 hours.

Deposit your share capital

Transfer your share capital to your account using a temporary IBAN. We’ll verify your deposit and issue an account statement for your notary within 24 hours.

Finalize your company's registration

Your company will be registered in the German Handelsregister commercial register. Just upload your Handelsregisterauszug certificate to the Qonto app and your account is now active.

Submit your information

Securely upload your incorporating documents and list any shareholders. We can validate your request within 24 hours.

Deposit your share capital

Transfer your share capital to your account using a temporary IBAN. We’ll verify your deposit and issue an account statement for your notary within 24 hours.

Finalize your company's registration

Your company will be registered in the German Handelsregister commercial register. Just upload your Handelsregisterauszug certificate to the Qonto app and your account is now active.

Your questions on company creation

Ready for Qonto?

Want to set up your GmbH or UG quickly and with little fuss?

Open your business account online now with Qonto.