Companies don’t need to wait until the law on electronic invoices changes before switching to paperless billing. Digitizing invoices has several advantages for companies and those benefits are available right now.

Save time managing supplier invoices

Between receiving and paying an invoice, the processing of supplier invoices carries a cost in both time and money.

By digitizing and streamlining the invoice management process, you can get a quick return on investment.

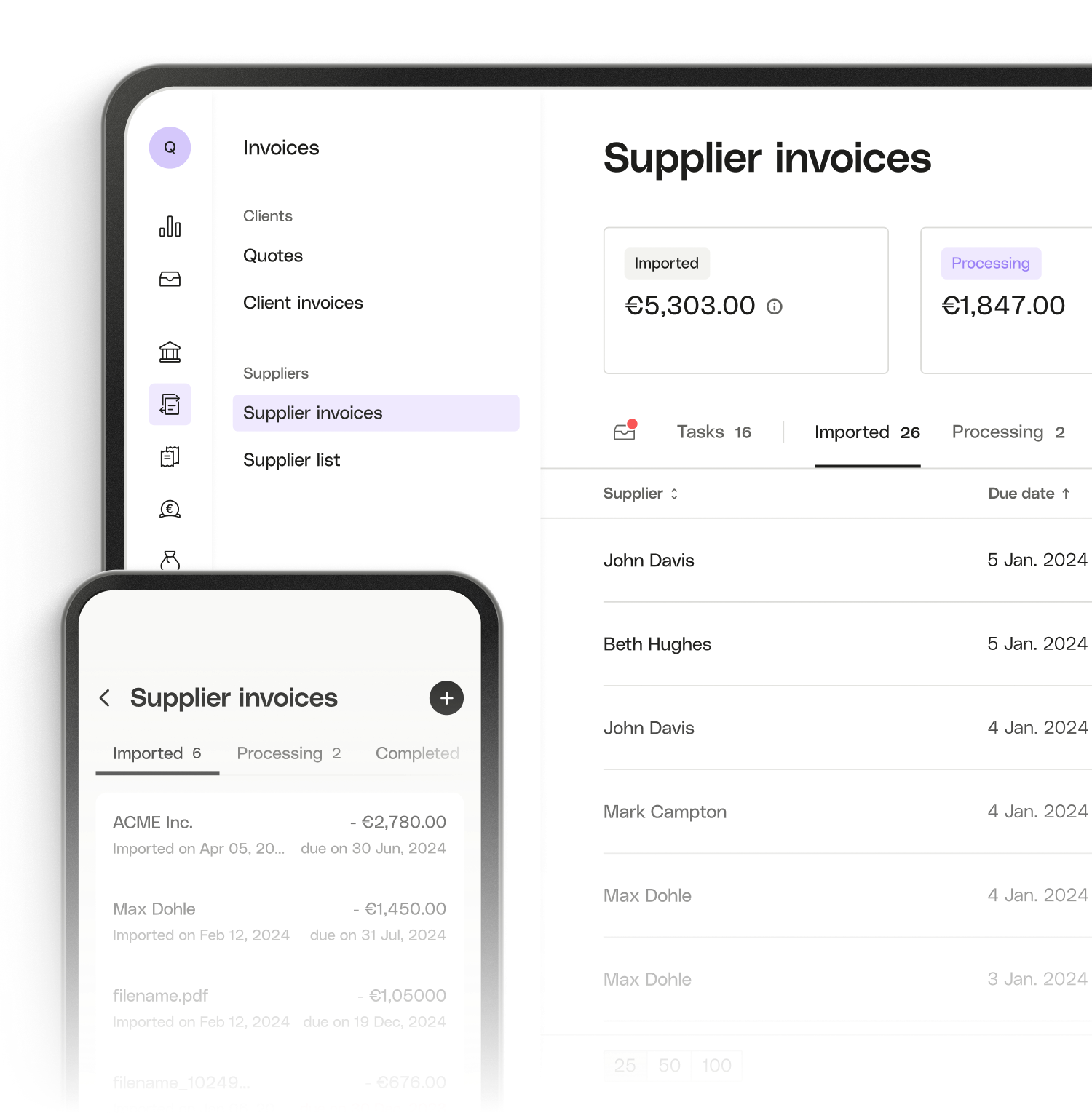

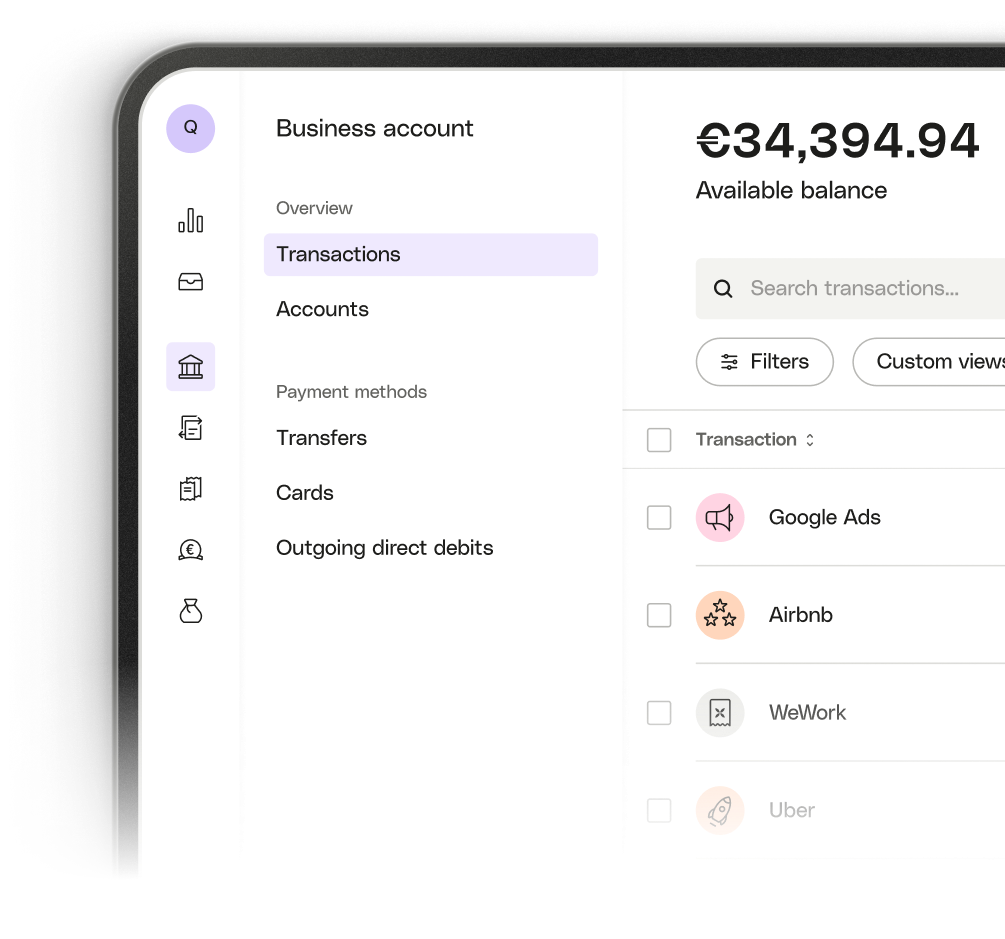

Qonto provides an efficient solution for centralizing and digitizing your supplier invoices into one simple and intuitive interface. It can:

- digitize invoices based on a simple photo;

- automatically detect VAT and supplier data;

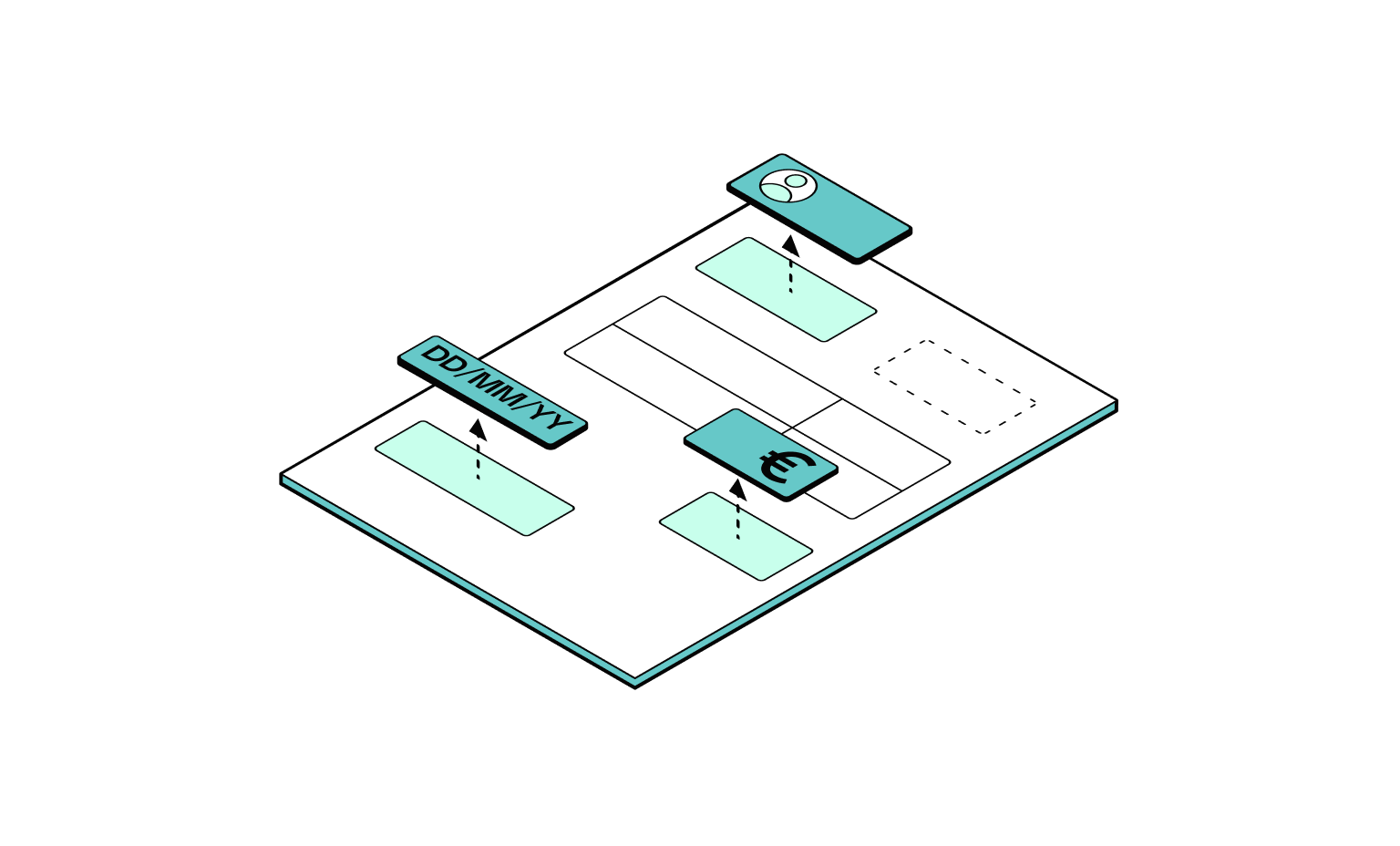

- prepare payments thanks to our intelligent tool that detects essential data (IBAN, due date and amount);

- give you real-time visibility over invoices that require payment or any other action on your part.

In addition to making the management of your business easier, a digitized invoice solution strengthens your relationships with suppliers.

Become legally compliant today

As previously mentioned,

mandatory electronic invoicing will come into effect after July 1, 2024 for invoices issued by your suppliers.

Switching to digitization today has multiple advantages:

- getting you familiar with the process ahead of time;

- updating your procedures;

- making sure your software is adapted;

- going paperless and reducing your impact on the environment.

Reduce the risk of fraud

Fighting VAT fraud is one of the government’s main reasons for introducing new regulations on electronic billing.

Additionally, electronic invoices reduce the number of attempts of payment fraud that regularly impact companies.

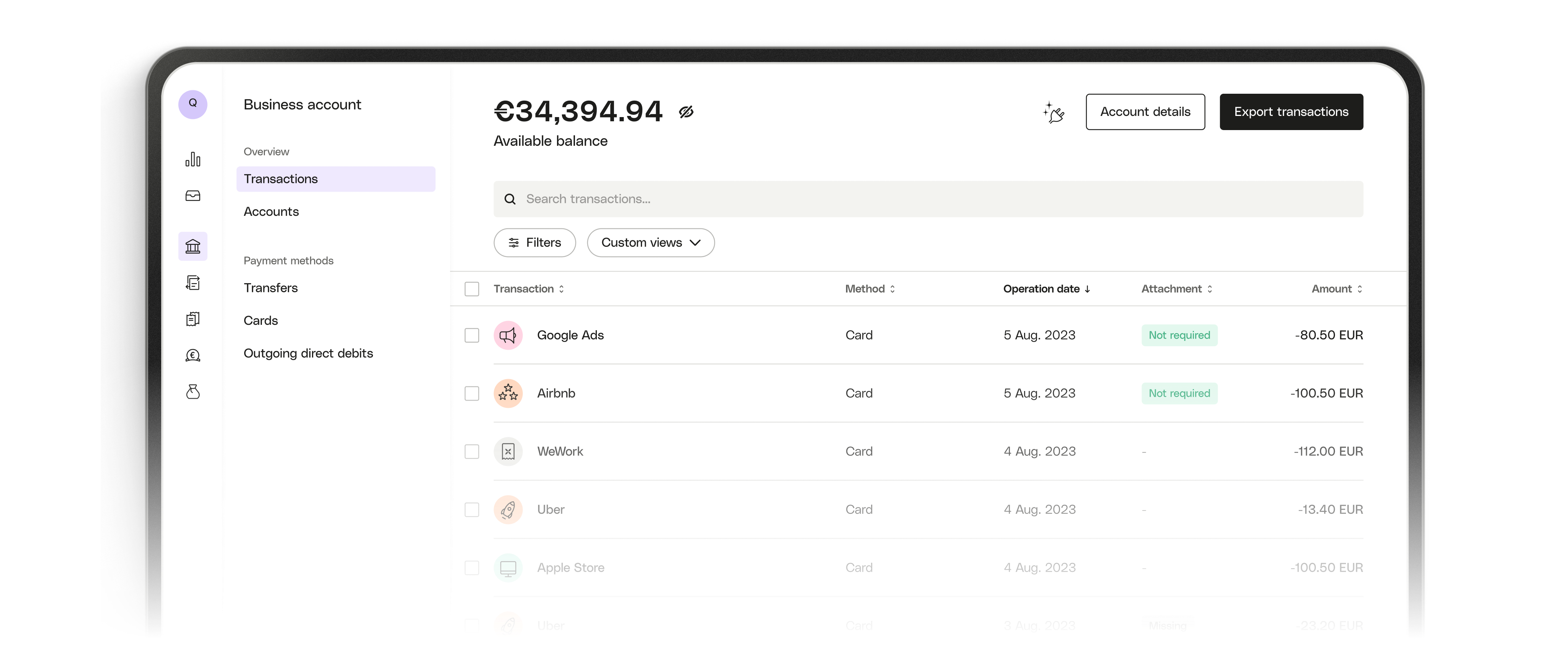

With Qonto, you have a centralized tool for your invoices that allows you to structure your team more effectively:

- it controls access permissions;

- it allows for a smooth approval process.

Make your accountant’s job easier

Entering supplier invoices is a time-consuming task with low added value. With electronic invoicing, manual data entry work will gradually disappear and, with it, should the risk of errors.

Thanks to the digitization of supplier invoices, your supplier accounting department will be able to focus on more strategic tasks such as:

- implementing a digital transformation process;

- monitoring for irregularities;

- conducting in-depth cost and spending analyses.