Fast-track your expense reports

Manage your expense reports 4x faster and focus on the tasks that bring true added value to your business.

Win back time

- Say goodbye to manual data entry and error-ridden spreadsheets.

- Stop chasing after missing receipts. Centralize them in a single app.

- No juggling between different tools. Track all expenses accurately on Qonto.

- Stand out from other employers with faster reimbursements.

Why choose our online solution?

4x faster

Free

Simple

Free up your teams

- No more wasted time preparing an expense report on paper or Excel.

- No more piled up receipts. A simple photo will do the trick.

- No more hold-ups on reimbursements. Employees get their money back in under 2 days on average.

- No more cost counting after a trip. Employees can submit expense reports on the mobile app, on the go.

How do you manage your expense reports on Qonto?

Ready to win back time on your expense reports? Qonto will help

lighten your workload.

Set permissions for your employees

Read-only access allows staff to request reimbursement without touching company financial data.

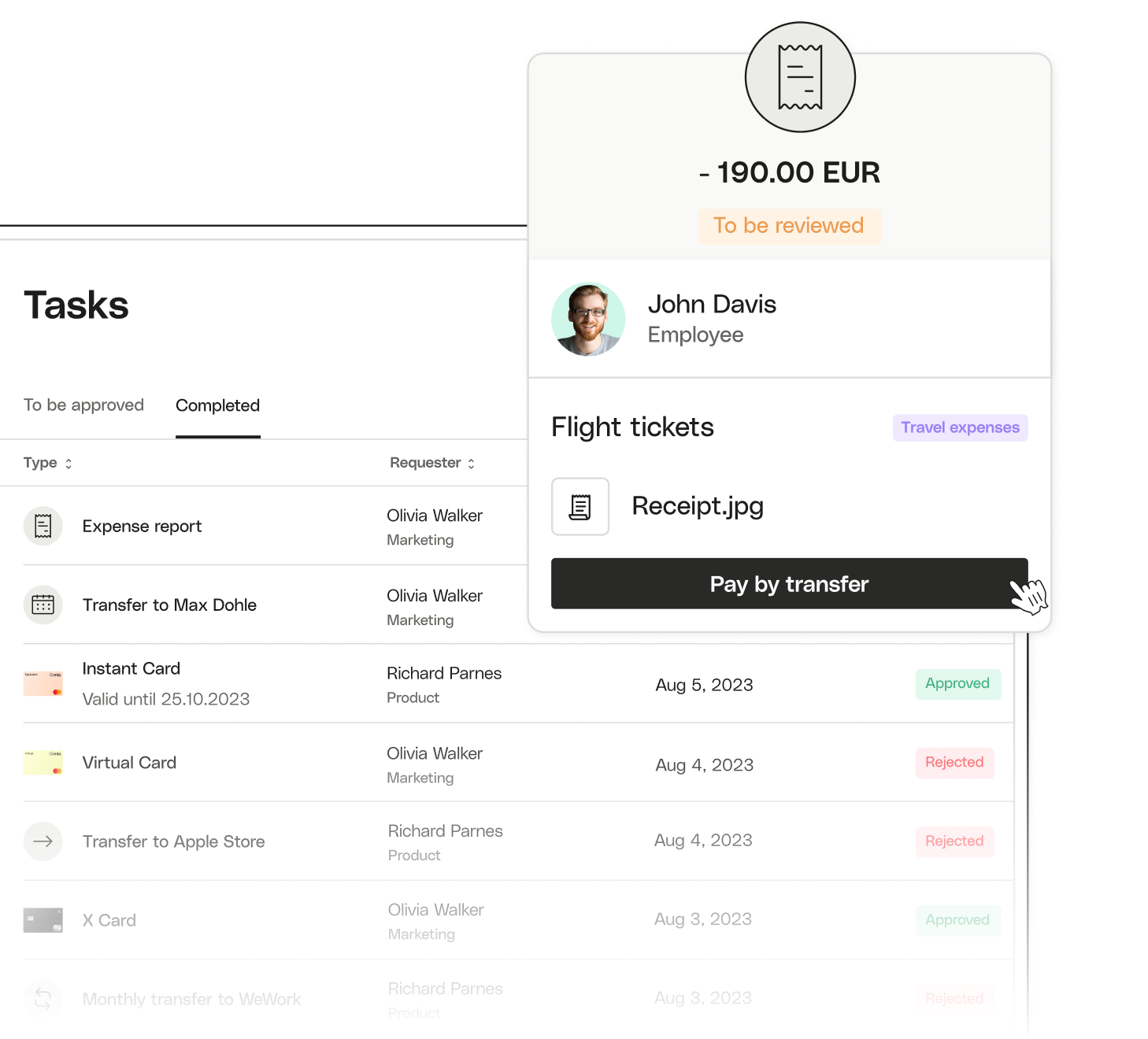

Create approval workflows

Multi-layered validation steps keep you in charge of payment requests.

Approve submitted expenses

Easily view expense reports awaiting approval via the Requests tab.

Instantly reimburse your teams

Instant transfers to employees’ IBANs the moment their expenses are approved.

Set permissions for your employees

Read-only access allows staff to request reimbursement without touching company financial data.

Create approval workflows

Multi-layered validation steps keep you in charge of payment requests.

Approve submitted expenses

Easily view expense reports awaiting approval via the Requests tab.

Instantly reimburse your teams

Instant transfers to employees’ IBANs the moment their expenses are approved.

Custom approval workflows

- Keep control with multi-layer approvals based on the amount and requestor.

- Create bespoke expense sign-off workflows, tailored to your company’s policy.

- Save time where it counts, with custom, one-layer approvals for low-cost requests.

Make life easier for your accountant

- Synchronize your transactions with over 80 accounting tools.

- Group your invoices according to expense type using custom labels.

- Import your invoices and we'll match them to the right transactions.

- Grant read-only access to your accountant.

Benefits for every employee

Finance manager

Accountant

Employee

They win back time with Qonto

They win back time with Qonto

Want to manage your expenses even faster?

Mastercard Business cards

Roles and access

Business travel management